Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Click and enlarge to view please options for req 3 are ( Earlier savings or later saving ) and ( Later or sooner ) Data

Click and enlarge to view please

Click and enlarge to view please

options for req 3 are (Earlier savings or later saving ) and (Later or sooner)

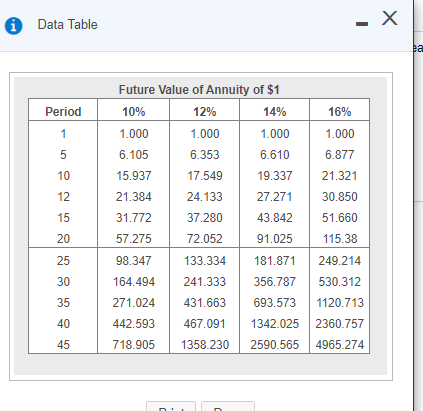

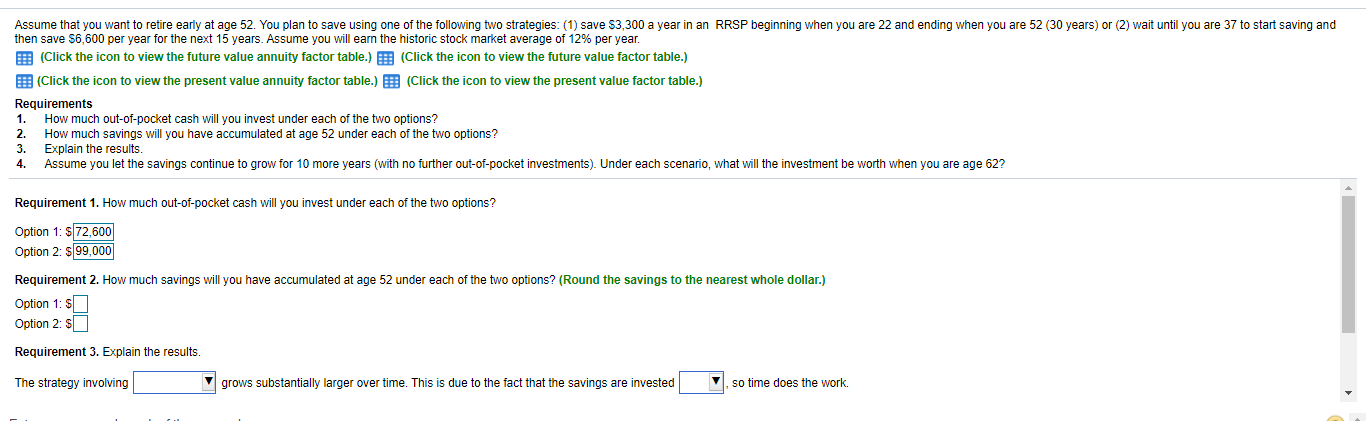

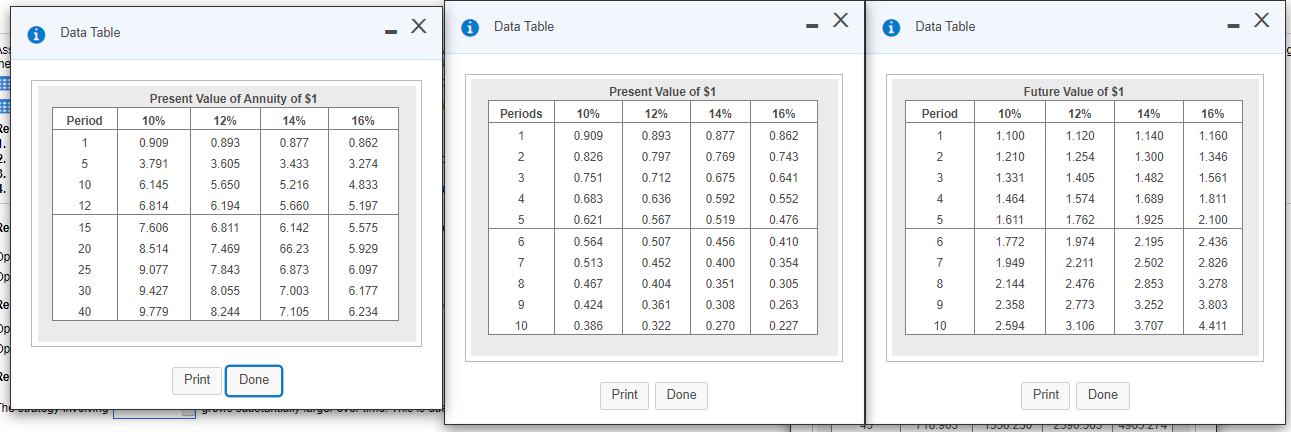

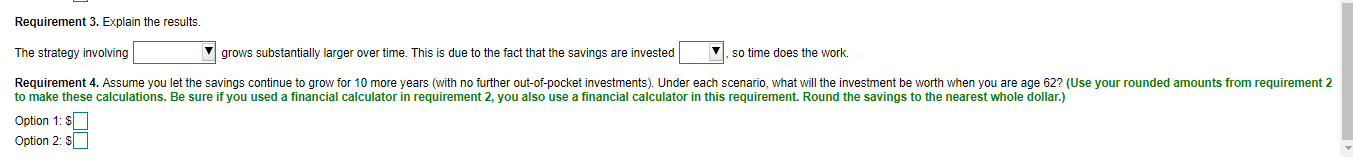

Data Table -X X ba 16% Period 1 Future Value of Annuity of $1 10% 12% 14% 1.000 1.000 1.000 6.105 6.353 6.610 5 1.000 6.877 21.321 30.850 10 15.937 17.549 19.337 12 21.384 27.271 15 24.133 37.280 72.052 43.842 31.772 57.275 51.660 20 91.025 115.38 25 98.347 133.334 181.871 249.214 30 164.494 271.024 442.593 241.333 431.663 530.312 1120.713 35 356.787 693.573 1342.025 2590.565 40 467.091 2360.757 45 718.905 1358.230 4965.274 Assume that you want to retire early at age 52. You plan to save using one of the following two strategies: (1) save $3,300 a year in an RRSP beginning when you are 22 and ending when you are 52 (30 years) or (2) wait until you are 37 to start saving and then save $6,600 per year for the next 15 years. Assume you will earn the historic stock market average of 12% per year. E (Click the icon to view the future value annuity factor table.) E (Click the icon to view the future value factor table.) E (Click the icon to view the present value annuity factor table.) B (Click the icon to view the present value factor table.) Requirements 1. How much out-of-pocket cash will you invest under each of the two options? 2. How much savings will you have accumulated at age 52 under each of the two options? 3. Explain the results. 4. Assume you let the savings continue to grow for 10 more years with no further out-of-pocket investments). Under each scenario, what will the investment be worth when you are age 62? Requirement 1. How much out-of-pocket cash will you invest under each of the two options? Option 1: $72,600 Option 2: $ 99,000 Requirement 2. How much savings will you have accumulated at age 52 under each of the two options? (Round the savings to the nearest whole dollar.) Option 1: $ Option 2: $ Requirement 3. Explain the results. The strategy involving grows substantially larger over time. This is due to the fact that the savings are invested so time does the work. x - X Data Table - X Data Table Data Table s ne Present Value of $1 Future Value of $1 Periods 10% 12% 14% 16% 12% Period 14% Period 16% 16% Rel 10% 1.100 1 0.909 1 1 1.140 1.160 1 Present Value of Annuity of $1 10% 12% 14% 0.909 0.893 0.877 3.791 3.605 3.433 6.145 5.216 6.814 6.194 5.660 0.893 0.797 0.877 0.769 0.862 0.743 1.120 1.254 2 0.826 2 1.300 1.346 5 0.862 3.274 4.833 5.197 1.210 1.331 . 3 0.751 0.712 5.650 0.675 3 1.405 1.482 10 0.641 0.552 1.561 1.811 4 0.683 0.636 0.592 4 1.574 1.689 12 1.464 1.611 5 0.621 0.567 0.519 0.476 5 1.762 1.925 2.100 15 7.606 6.811 6.142 5.575 6 0.456 6 2.195 20 8.514 66.23 Op 5.929 6.097 0.507 0.452 0.410 0.354 0.564 0.513 0.467 1.772 1.949 7 2.436 2.826 0.400 7 1.974 2.211 2.476 7.469 7.843 8.055 2.502 25 9.077 6.873 DOO 8 0.404 0.351 0.305 8 2.144 2.853 3.278 30 7.003 6.177 Re 9.427 9.779 9 0.308 9 40 2.358 0.424 6.234 8.244 7.105 2.773 0.361 0.322 0.263 0.227 3.252 3.707 3.803 4.411 Do 10 0.386 0.270 10 2.594 3.106 DO Re Print Done Print Done Print Done TETETT gore TTO.JUJT TJJU.ZJU ZJU.JUJ 9900.214 Requirement 3. Explain the results. The strategy involving grows substantially larger over time. This is due to the fact that the savings are invested V so time does the work. Requirement 4. Assume you let the savings continue to grow for 10 more years with no further out-of-pocket investments). Under each scenario, what will the investment be worth when you are age 62? (Use your rounded amounts from requirement 2 to make these calculations. Be sure if you used a financial calculator in requirement 2, you also use a financial calculator in this requirement. Round the savings to the nearest whole dollar.) Option 1: Option 2:$Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started