Answered step by step

Verified Expert Solution

Question

1 Approved Answer

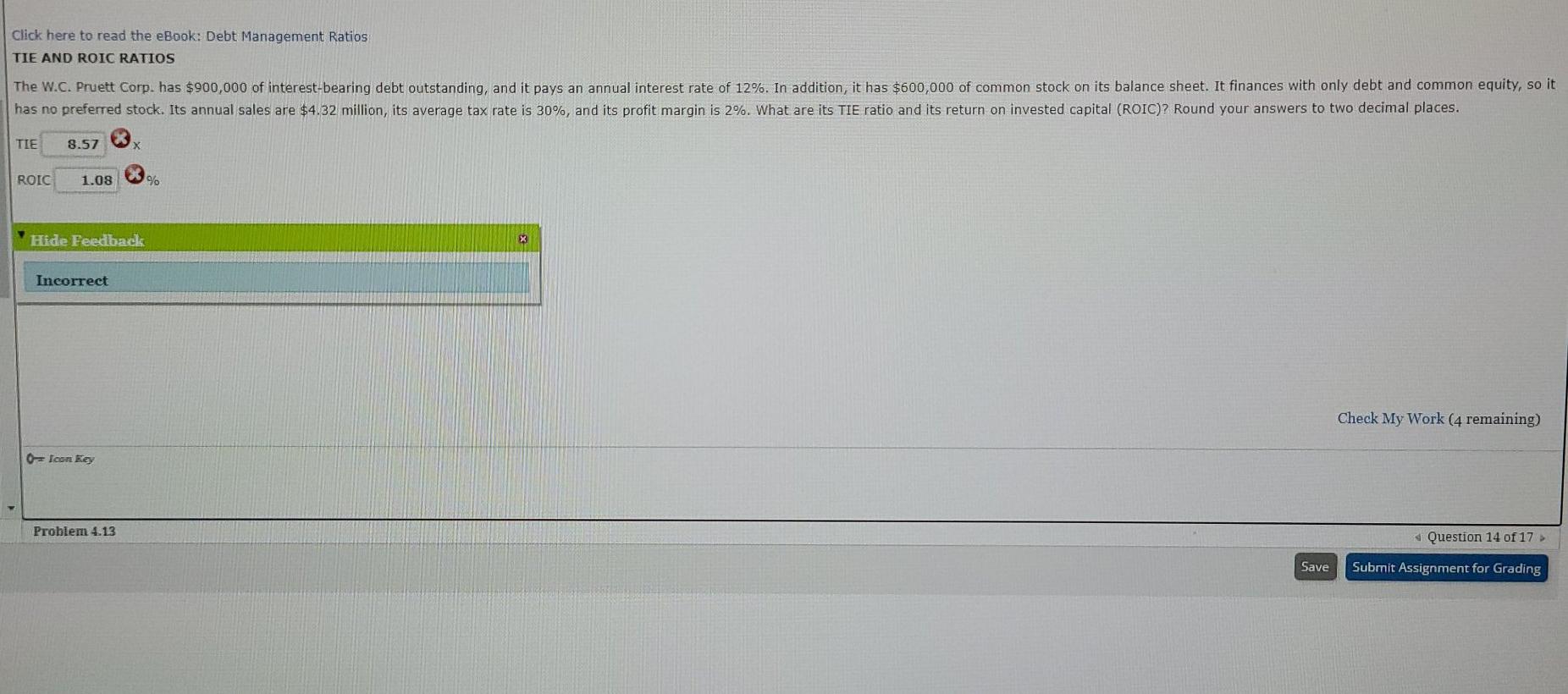

Click here to read the eBook: Debt Management Ratios TIE AND ROIC RATIOS The W.C. Pruett Corp. has $900,000 of interest-bearing debt outstanding, and it

Click here to read the eBook: Debt Management Ratios TIE AND ROIC RATIOS The W.C. Pruett Corp. has $900,000 of interest-bearing debt outstanding, and it pays an annual interest rate of 12%. In addition, it has $600,000 of common stock on its balance sheet. It finances with only debt and common equity, so it has no preferred stock. Its annual sales are $4.32 million, its average tax rate is 30%, and its profit margin is 2%. What are its TIE ratio and its return on invested capital (ROIC)? Round your answers to two decimal places. TIE 8.57 ROIC 1.08 % Hide Feedback x Incorrect Check My Work (4 remaining) 0Icon key Problem 4.13 Question 14 of 17 Save Submit Assignment for Grading

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started