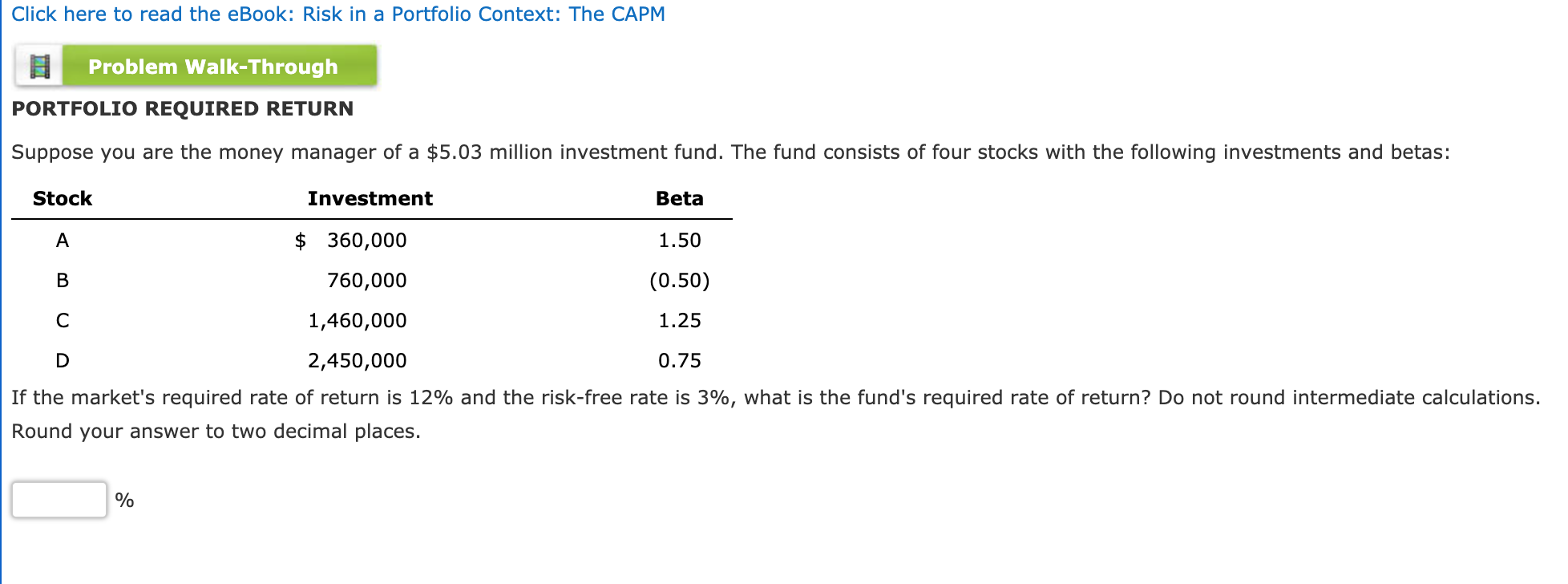

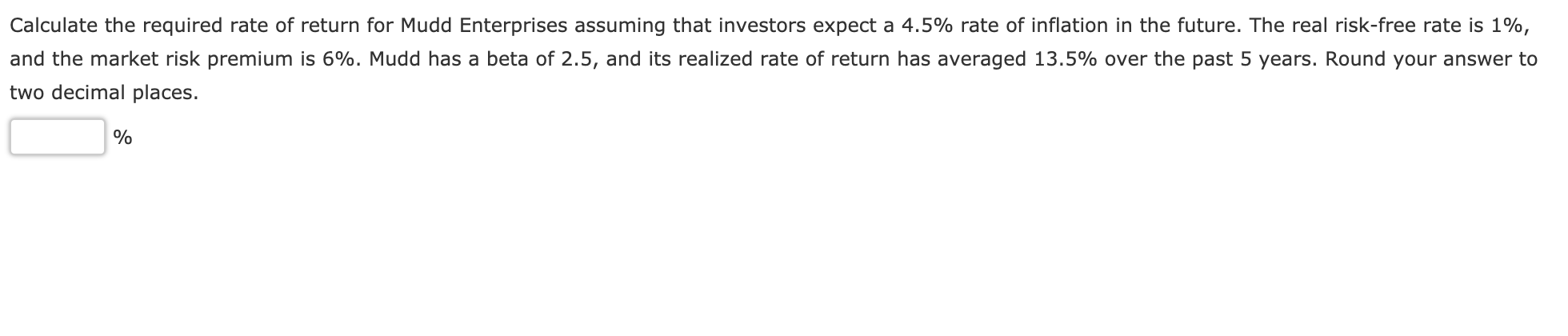

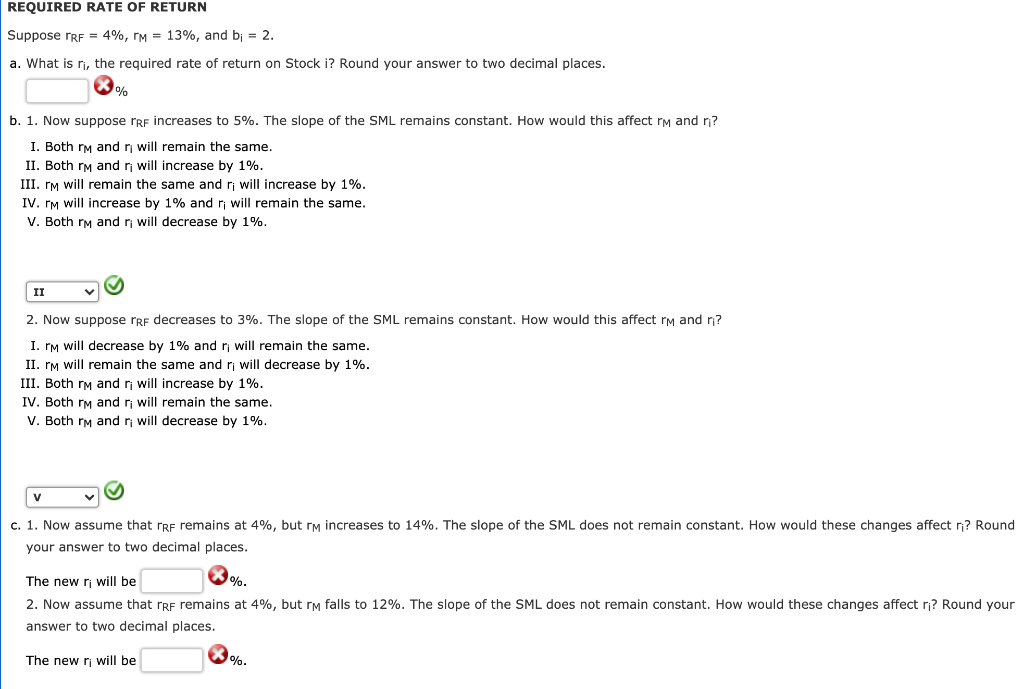

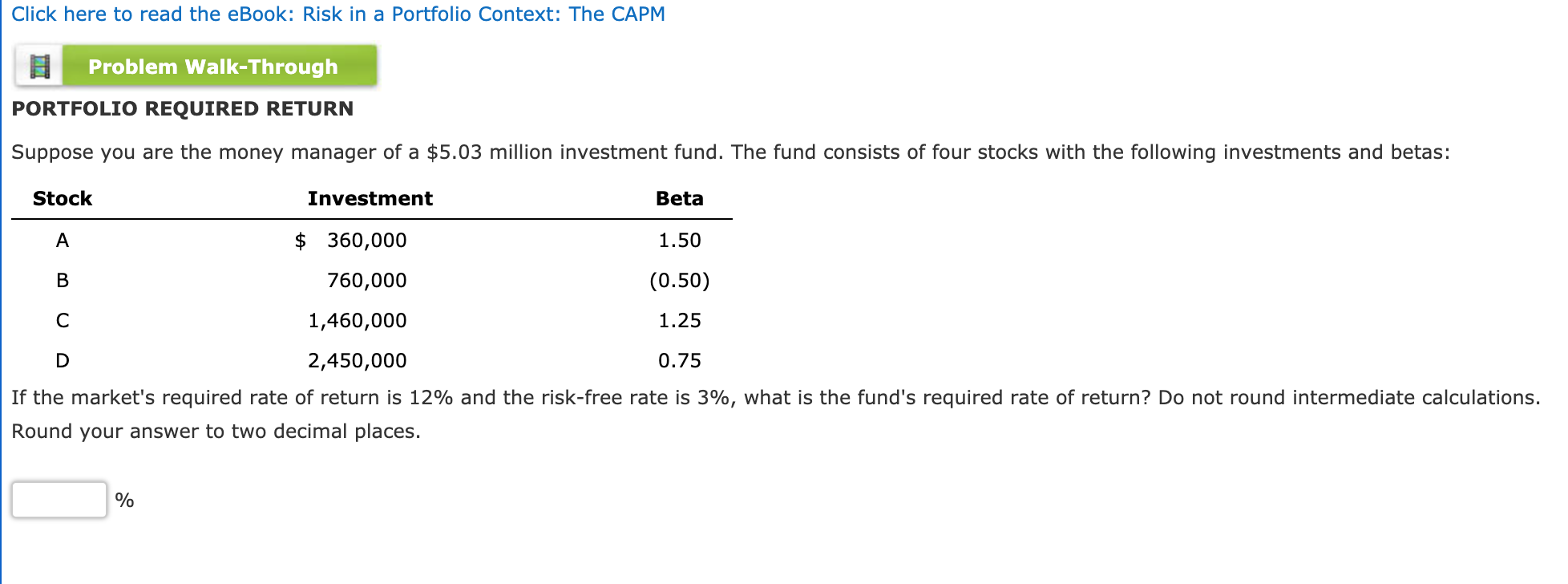

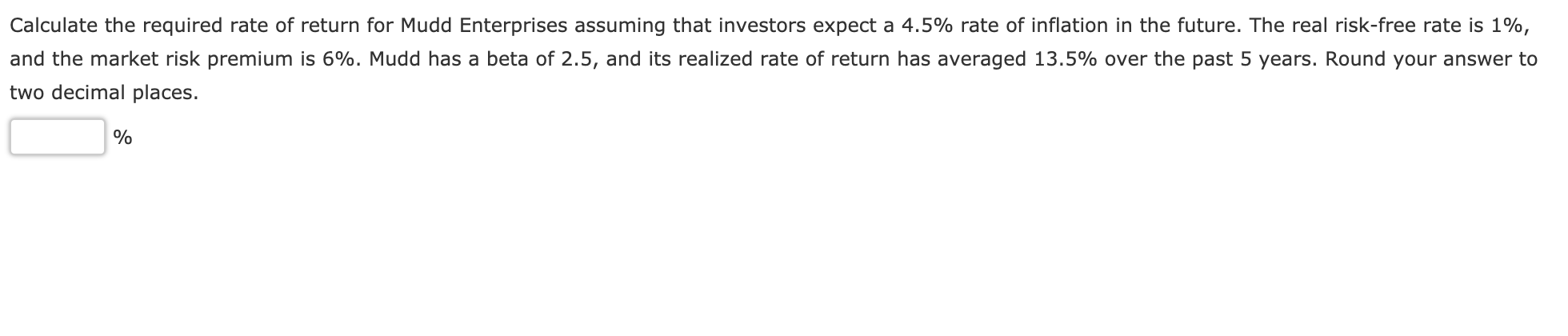

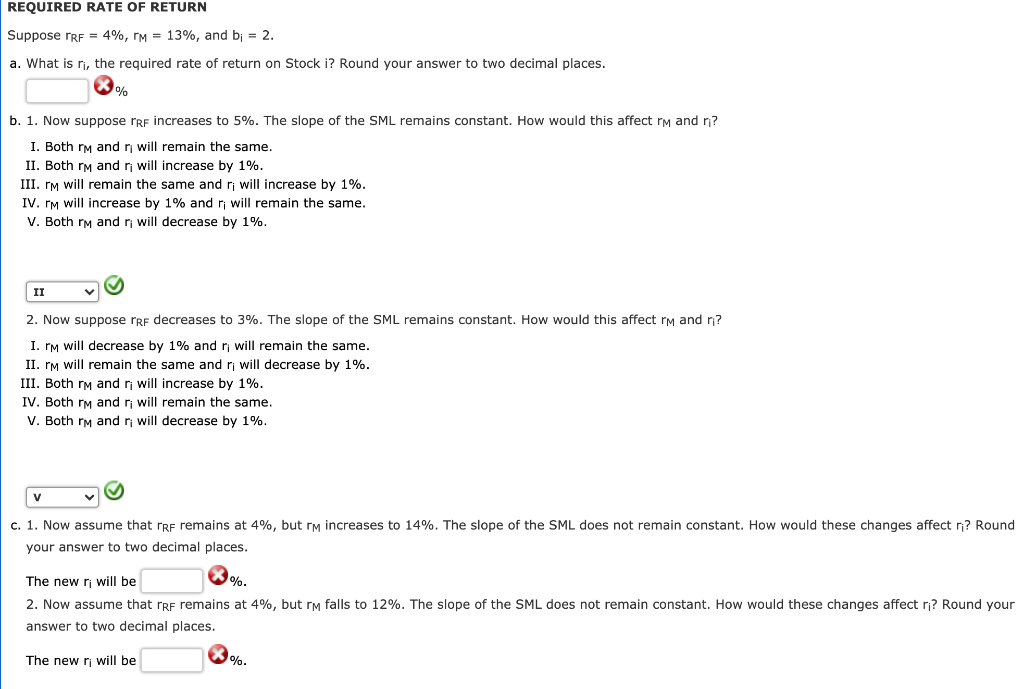

Click here to read the eBook: Risk in a Portfolio Context: The CAPM Problem Walk-Through PORTFOLIO REQUIRED RETURN Suppose you are the money manager of a $5.03 million investment fund. The fund consists of four stocks with the following investments and betas: Stock Investment Beta A $ 360,000 1.50 B 760,000 (0.50) C 1,460,000 1.25 D 2,450,000 0.75 If the market's required rate of return is 12% and the risk-free rate is 3%, what is the fund's required rate of return? Do not round intermediate calculations. Round your answer to two decimal places. % Calculate the required rate of return for Mudd Enterprises assuming that investors expect a 4.5% rate of inflation in the future. The real risk-free rate is 1%, and the market risk premium is 6%. Mudd has a beta of 2.5, and its realized rate of return has averaged 13.5% over the past 5 years. Round your answer to two decimal places. % REQUIRED RATE OF RETURN Suppose IRF = 4%, M = 13%, and b; = 2. a. What is ri, the required rate of return on Stock i? Round your answer to two decimal places. % b. 1. Now suppose rrf increases to 5%. The slope of the SML remains constant. How would this affect rm and n? I. Both rm and r will remain the same. II. Both rm and ri will increase by 1%. III. PM will remain the same and ri will increase by 1%. IV. IM will increase by 1% and i will remain the same. V. Both rm and will decrease by 1%. II 2. Now suppose tre decreases to 3%. The slope of the SML remains constant. How would this affect rm and n? I. rm will decrease by 1% and r will remain the same. II. PM will remain the same and i will decrease by 1%. III. Both rm and r will increase by 1%. IV. Both rm and i will remain the same. V. Both rm and r will decrease by 1%. v C. 1. Now assume that ref remains at 4%, but rm increases to 14%. The slope of the SML does not remain constant. How would these changes affect m? Round your answer to two decimal places. Yo. The new r will be 2. Now assume that ref remains at 4%, but im falls to 12%. The slope of the SML does not remain constant. How would these changes affect ri? Round your answer to two decimal places. The new r will be %