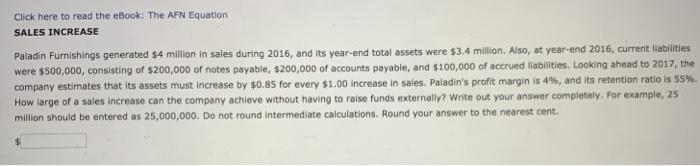

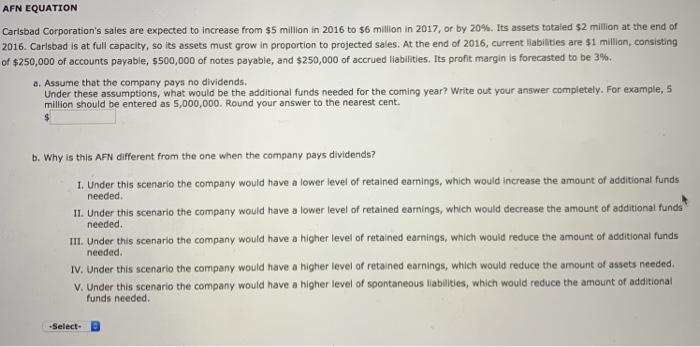

Click here to read the eBook: The AFN Equation SALES INCREASE Paladin Furnishings generated S4 million in sales during 2016, and its year-end total assets were $3.4 million. Also, at year-end 2016, current liabilities were $500,000, consisting of s200,000 of notes payable, $200,000 of accounts payable, and $100,000 of accrued liabilities. Looking ahead to 2017, the company estimates that its assets must increase by $0.85 for every $1.00 increase in sales. Paladin's profit margin is 4%, and its retention ratio is 55%. How large of a sales increase can the company achieve without having to raise funds externally? Write out your answer completely. For example, 25 million should be entered as 25,000,000. Do not round intermediate calculations. Round your answer to the nearest cent. AFN EQUATION Carlsbad Corporation's sales are expected to increase from $5 million in 2016 to $6 million in 2017, or by 20%. Its assets totaled $2 million at the end of 2016. Carlsbad is at full capacity, so its assets must grow in proportion to projected sales. At the end of 2016, current fiabilities are $1 million, consisting of $250,000 of accounts payable, $500,000 of notes payable, and $250,000 of accrued liabilities. Its profit margin is forecasted to be 3%. a. Assume that the company pays no dividends. Under these assumptions, what would be the additional funds needed for the coming year? Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answer to the nearest cent. b. Why is this AFN different from the one when the company pays dividends? 1. Under this scenario the company would have a lower level of retained earnings, which would increase the amount of additional funds needed 11. Under this scenario the company would have a lower level of retained earnings, which would decrease the amount of additional funds needed m. Under this scenario the company would have a higher level of retained earnings, which would reduce the amount of additional funds needed IV. Under this scenario the company would have a higher level of retained earnings, which would reduce the amount of assets needed V. Under this scenario the company would have a higher level of spontaneous liabilities, which would reduce the amount of additional funds needed. -Select