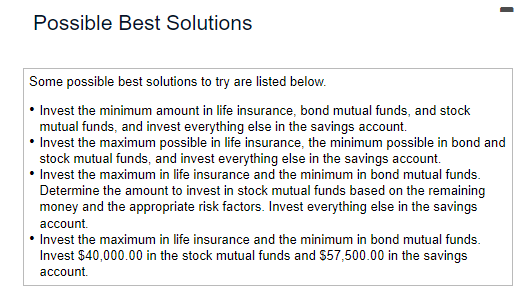

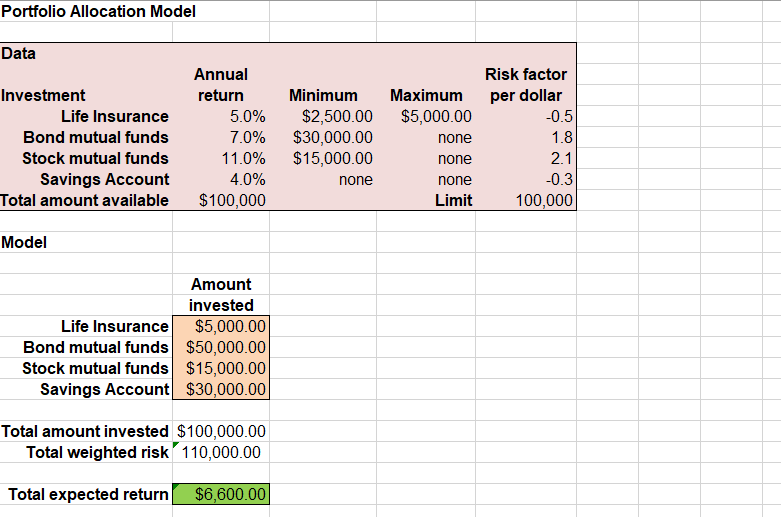

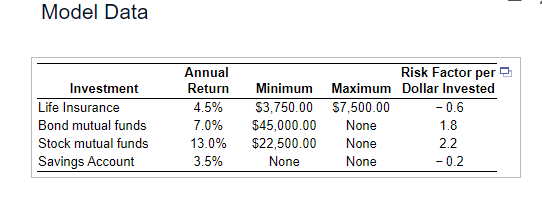

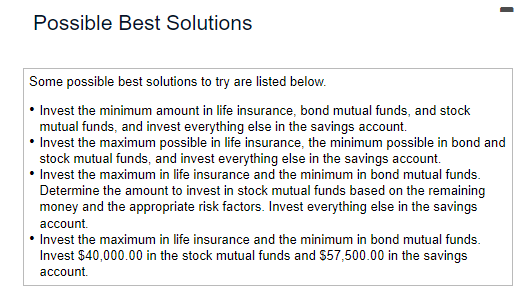

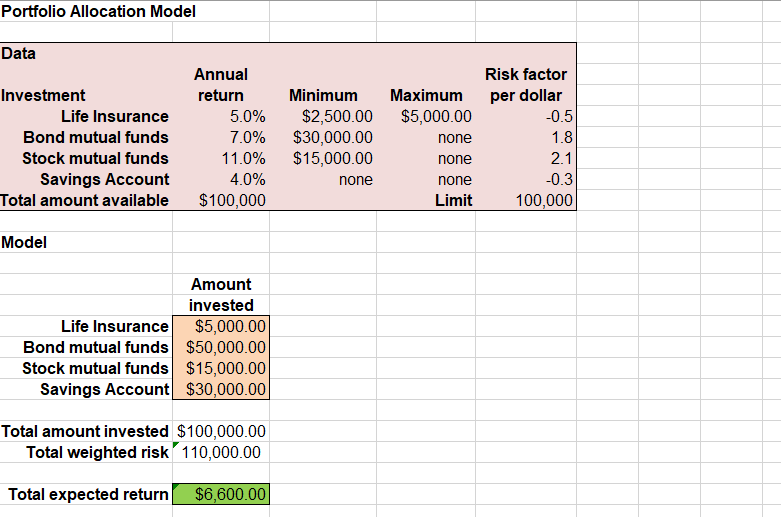

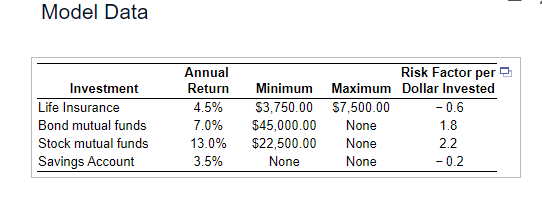

Click here to view the portfolio allocation model. Click here to view the returns, minimums, maximums, and risk factors. Click here to view some possible best solutions. (Round to the nearest cent as needed.) Possible Best Solutions Some possible best solutions to try are listed below. - Invest the minimum amount in life insurance, bond mutual funds, and stock mutual funds, and invest everything else in the savings account. - Invest the maximum possible in life insurance, the minimum possible in bond and stock mutual funds, and invest everything else in the savings account. - Invest the maximum in life insurance and the minimum in bond mutual funds. Determine the amount to invest in stock mutual funds based on the remaining money and the appropriate risk factors. Invest everything else in the savings account. - Invest the maximum in life insurance and the minimum in bond mutual funds. Invest $40,000.00 in the stock mutual funds and $57,500.00 in the savings account. Portfolio Allocation Model Model Total amount invested $100,000.00 Total weighted risk 110,000.00 Total expected return $6,600.00 Model Data Click here to view the portfolio allocation model. Click here to view the returns, minimums, maximums, and risk factors. Click here to view some possible best solutions. (Round to the nearest cent as needed.) Possible Best Solutions Some possible best solutions to try are listed below. - Invest the minimum amount in life insurance, bond mutual funds, and stock mutual funds, and invest everything else in the savings account. - Invest the maximum possible in life insurance, the minimum possible in bond and stock mutual funds, and invest everything else in the savings account. - Invest the maximum in life insurance and the minimum in bond mutual funds. Determine the amount to invest in stock mutual funds based on the remaining money and the appropriate risk factors. Invest everything else in the savings account. - Invest the maximum in life insurance and the minimum in bond mutual funds. Invest $40,000.00 in the stock mutual funds and $57,500.00 in the savings account. Portfolio Allocation Model Model Total amount invested $100,000.00 Total weighted risk 110,000.00 Total expected return $6,600.00 Model Data