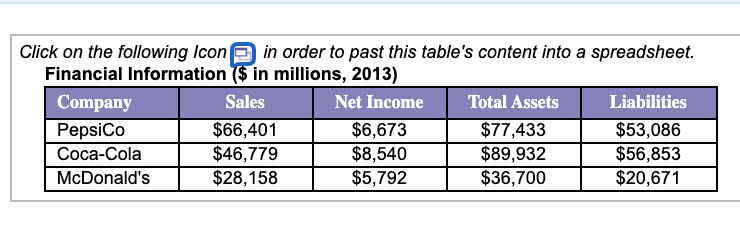

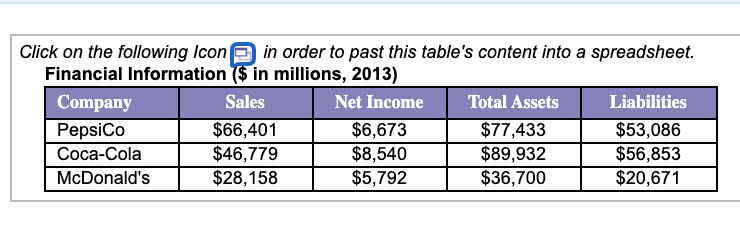

Click on the following Icon in order to past this table's content into a spreadsheet. Financial Information ($ in millions, 2013) Company Sales Net Income Total Assets Liabilities PepsiCo $66,401 $6,673 $77,433 $53,086 Coca-Cola $46,779 $8,540 $89,932 $56,853 McDonald's $28,158 $5,792 $36,700 $20,671 DuPont identity. For the firms in the popup window, find the return on equity using the three components of the DuPont identity: operating efficiency, as measured by the profit margin (net income/sales); asset management efficiency, as measured by asset turnover (sales/total assets); and financial leverage, as measured by the equity multiplier (total assets/total equity). First, find the equity of each company. The equity for PepsiCo is $ 4 million. (Round to the nearest million dollars.) The equity for Coca-Cola is $ 4 million. (Round to the nearest million dollars.) The equity for McDonald's is $ 4 million. (Round to the nearest million dollars.) Next, calculate the three components of the DuPont identity. The profit margin for PepsiCo is 4%. (Round to two decimal places.) The profit margin for Coca-Cola is 4%. (Round to two decimal places.) The profit margin for McDonald's is 4%. (Round to two decimal places.) The asset turnover for PepsiCo is . (Round to four decimal places.) The asset turnover for Coca-Cola is (Round to four decimal places.) The asset turnover for McDonald's is 4. (Round to four decimal places.) The equity multiplier for PepsiCo is 4. (Round to four decimal places.) The equity multiplier for Coca-Cola is 4. (Round to four decimal places.) The equity multiplier for McDonald's is 4. (Round to four decimal places.) Last, use the three components of the DuPont identity to find the ROE. The ROE for PepsiCo is 4%. (Round to two decimal places.) The ROE for Coca-Cola is 4 %. (Round to two decimal places.) The ROE for McDonald's is 4%. (Round to two decimal places.) "While McDonald's is the most operationally efficient and Pepsi the most efficient in management, Pepsi is the best to its shareholders because it has effectively utilized a very high financial leverage strategy, using debt and not shareholder earnings to finance the profits of the firm." Is the above statement true or false? True (Select from the drop-down menu.) Click on the following Icon in order to past this table's content into a spreadsheet. Financial Information ($ in millions, 2013) Company Sales Net Income Total Assets Liabilities PepsiCo $66,401 $6,673 $77,433 $53,086 Coca-Cola $46,779 $8,540 $89,932 $56,853 McDonald's $28,158 $5,792 $36,700 $20,671 DuPont identity. For the firms in the popup window, find the return on equity using the three components of the DuPont identity: operating efficiency, as measured by the profit margin (net income/sales); asset management efficiency, as measured by asset turnover (sales/total assets); and financial leverage, as measured by the equity multiplier (total assets/total equity). First, find the equity of each company. The equity for PepsiCo is $ 4 million. (Round to the nearest million dollars.) The equity for Coca-Cola is $ 4 million. (Round to the nearest million dollars.) The equity for McDonald's is $ 4 million. (Round to the nearest million dollars.) Next, calculate the three components of the DuPont identity. The profit margin for PepsiCo is 4%. (Round to two decimal places.) The profit margin for Coca-Cola is 4%. (Round to two decimal places.) The profit margin for McDonald's is 4%. (Round to two decimal places.) The asset turnover for PepsiCo is . (Round to four decimal places.) The asset turnover for Coca-Cola is (Round to four decimal places.) The asset turnover for McDonald's is 4. (Round to four decimal places.) The equity multiplier for PepsiCo is 4. (Round to four decimal places.) The equity multiplier for Coca-Cola is 4. (Round to four decimal places.) The equity multiplier for McDonald's is 4. (Round to four decimal places.) Last, use the three components of the DuPont identity to find the ROE. The ROE for PepsiCo is 4%. (Round to two decimal places.) The ROE for Coca-Cola is 4 %. (Round to two decimal places.) The ROE for McDonald's is 4%. (Round to two decimal places.) "While McDonald's is the most operationally efficient and Pepsi the most efficient in management, Pepsi is the best to its shareholders because it has effectively utilized a very high financial leverage strategy, using debt and not shareholder earnings to finance the profits of the firm." Is the above statement true or false? True (Select from the drop-down menu.)