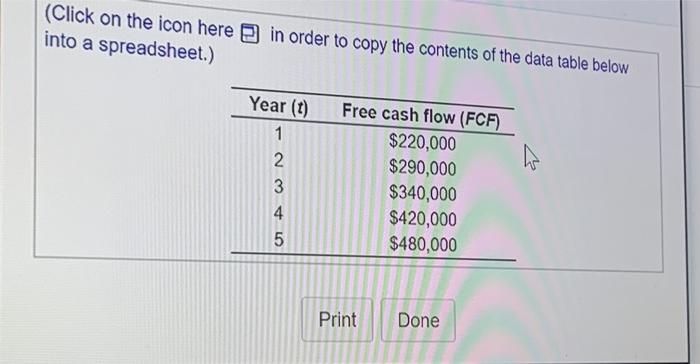

Question: (Click on the icon here e in order to copy the contents of the data table below into a spreadsheet.) Year t) ho 1 2

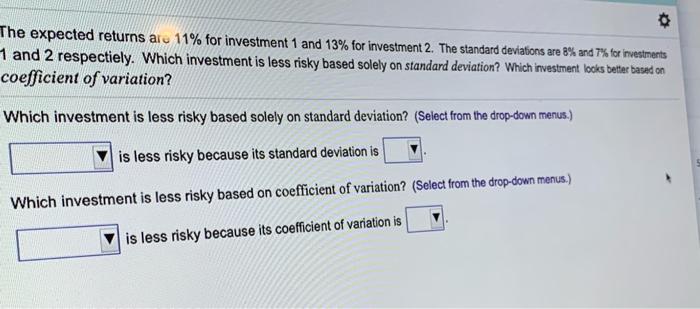

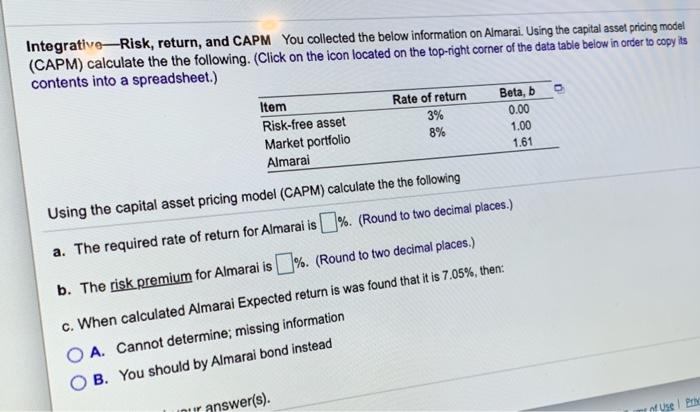

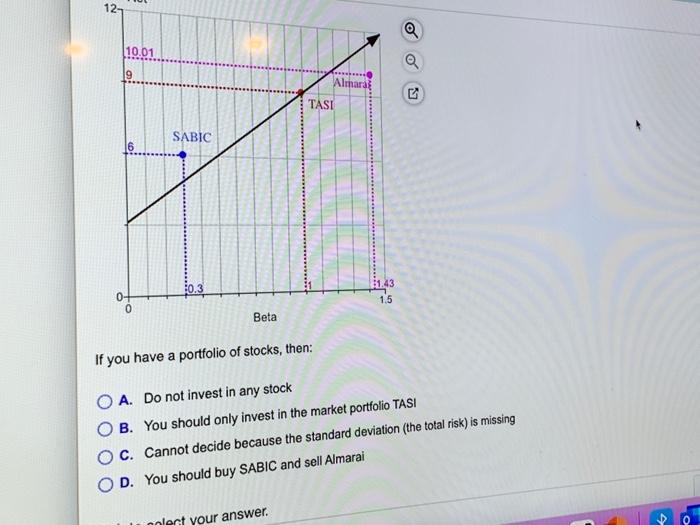

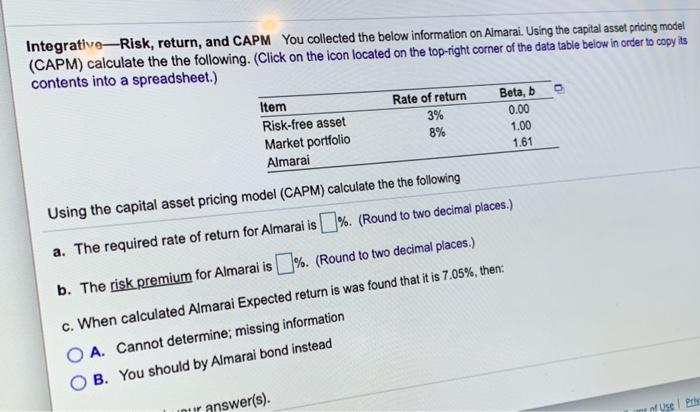

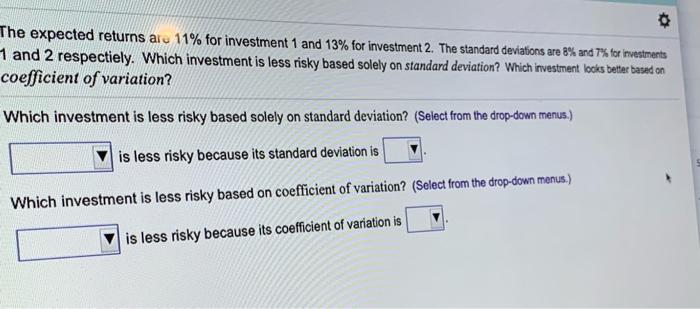

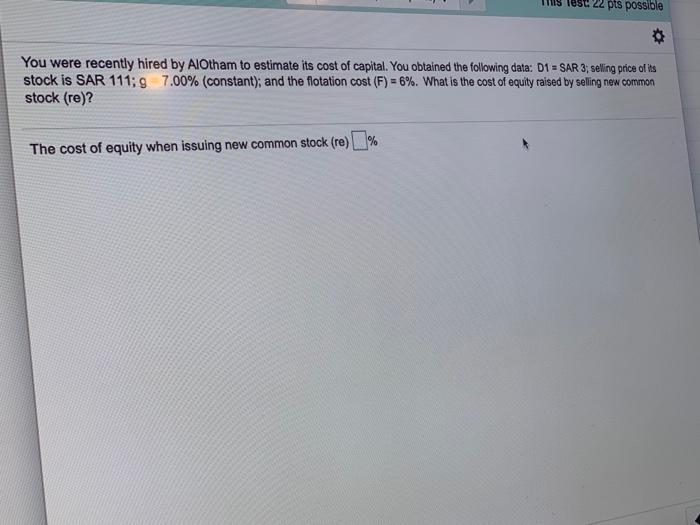

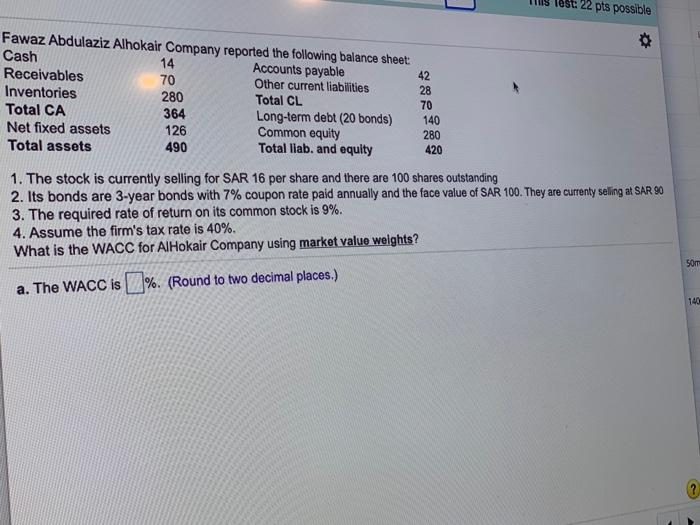

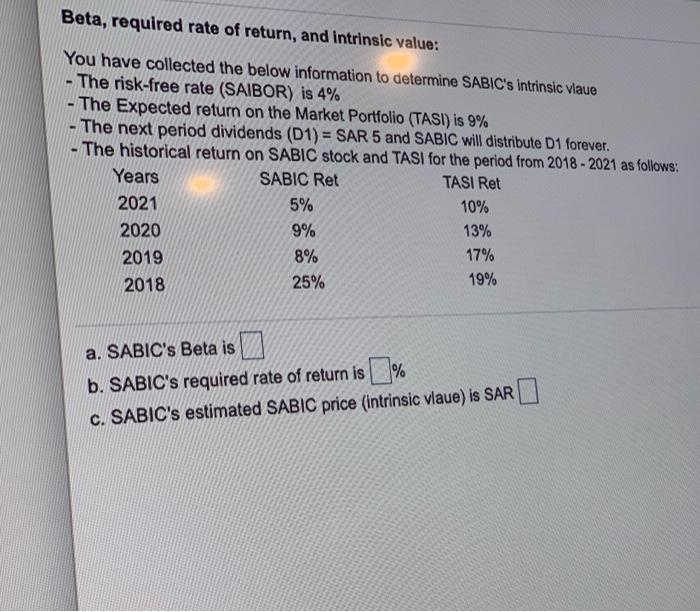

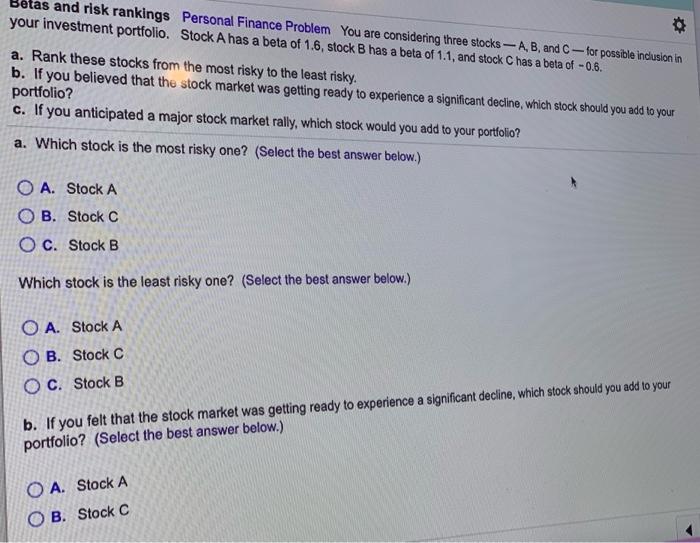

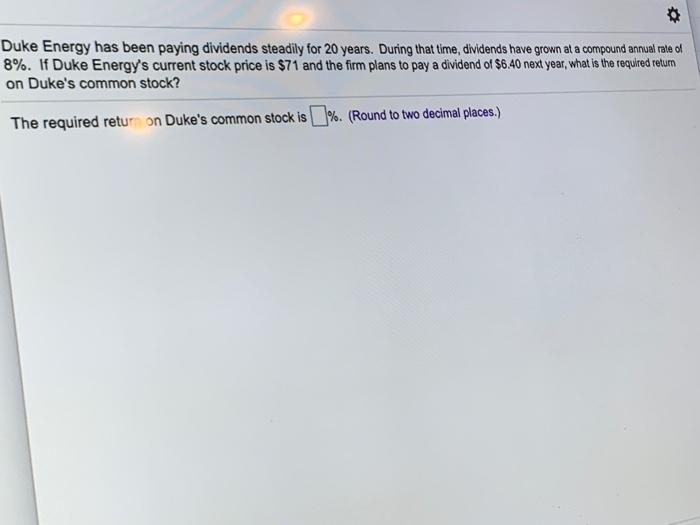

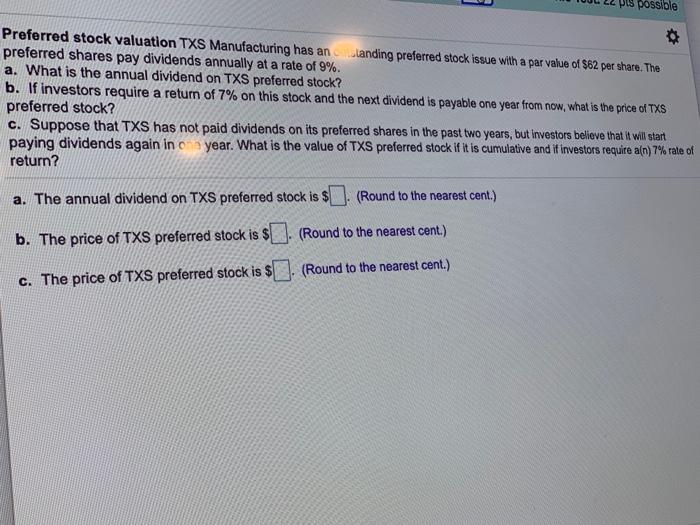

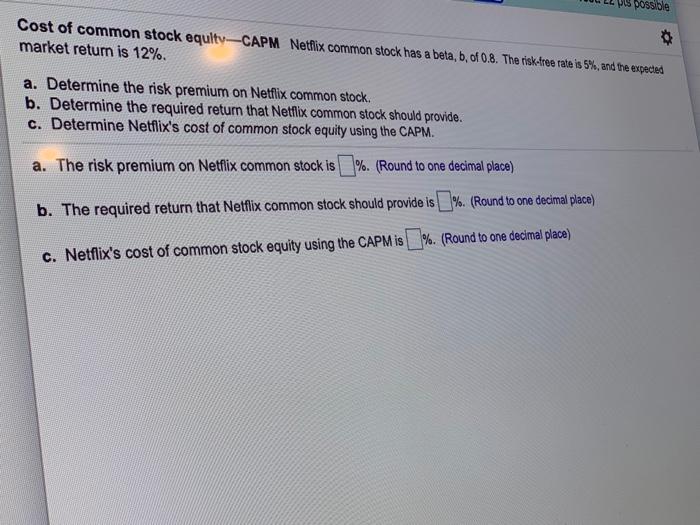

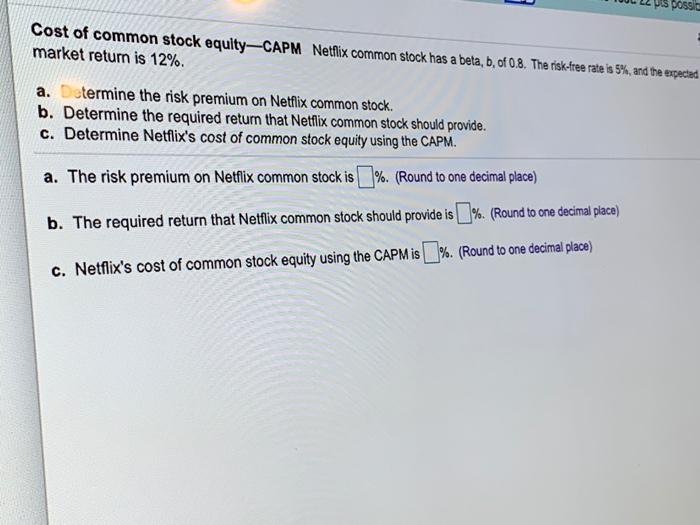

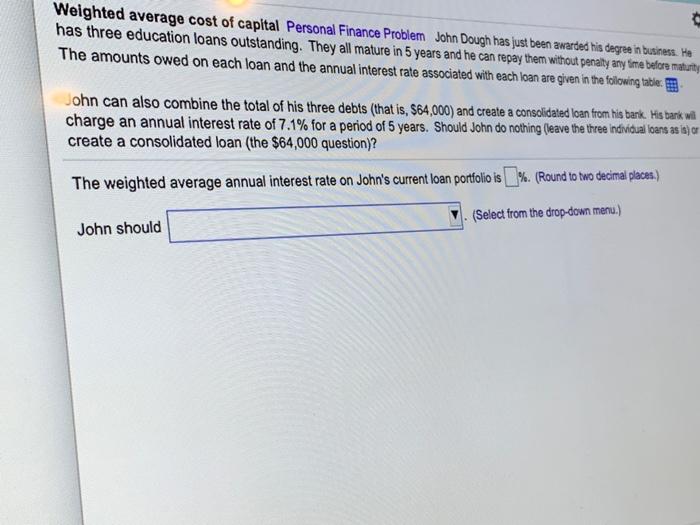

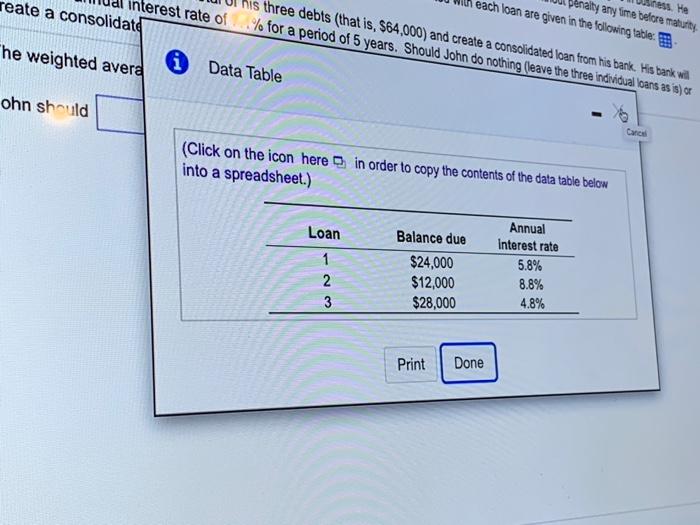

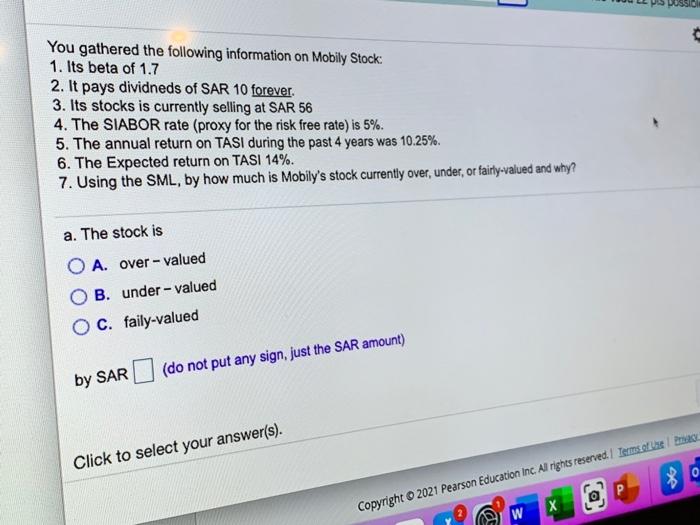

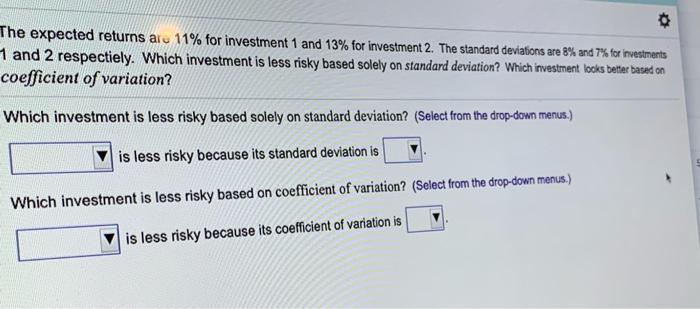

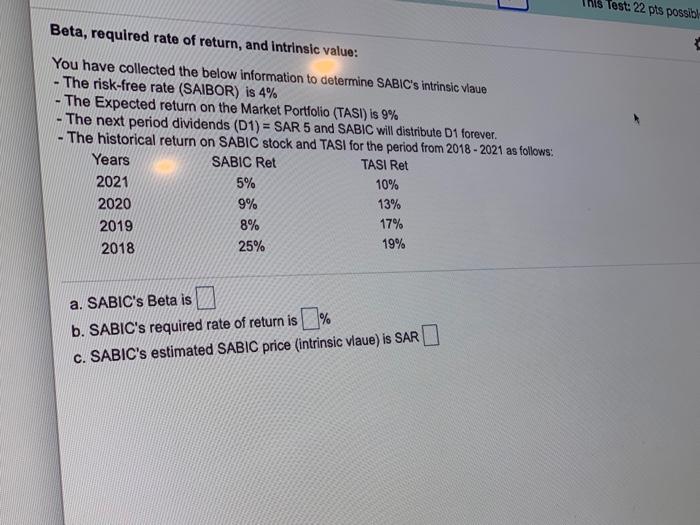

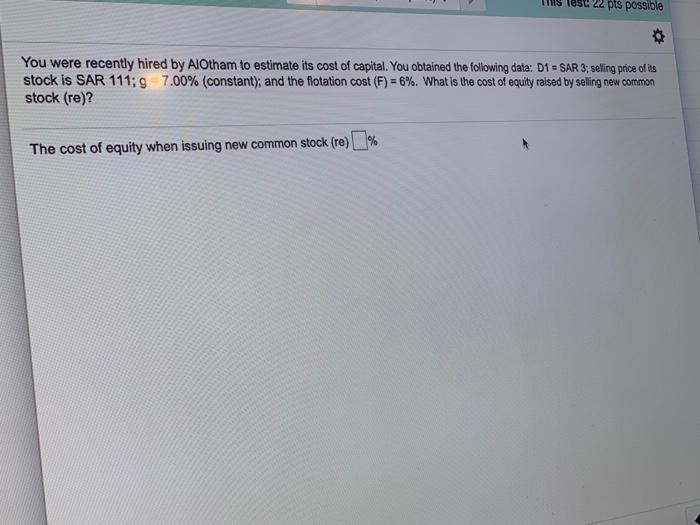

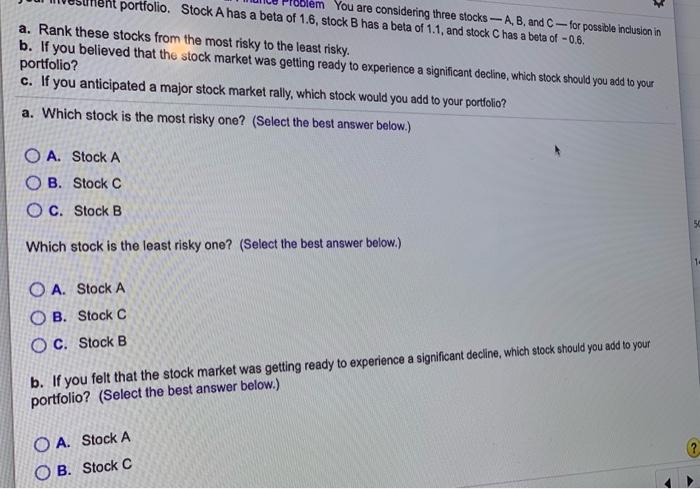

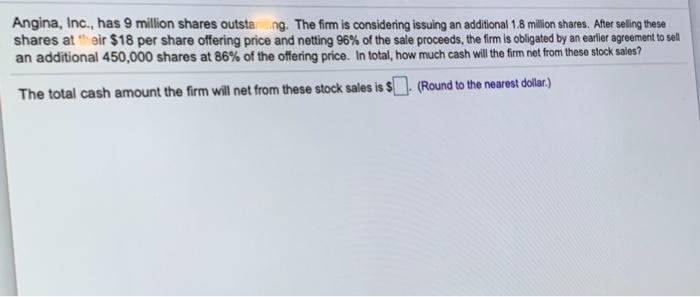

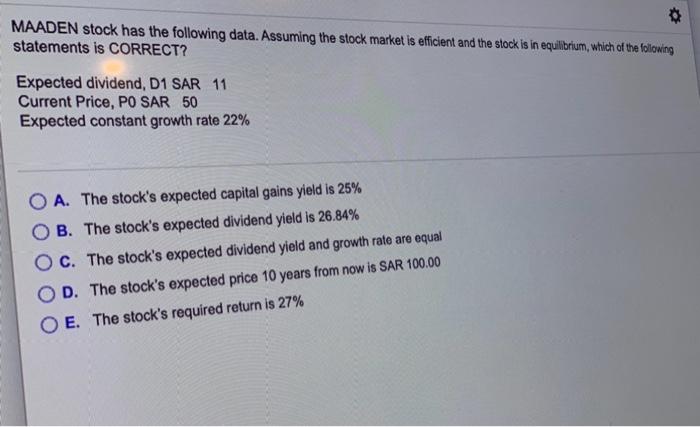

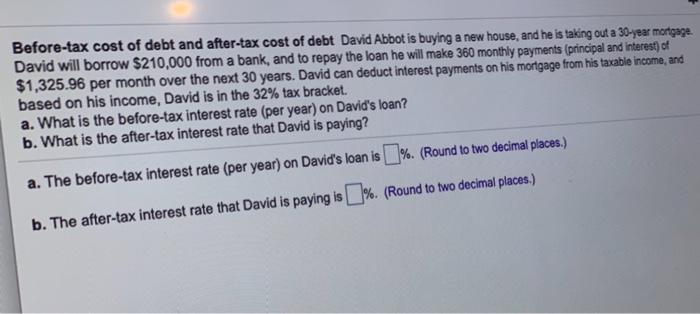

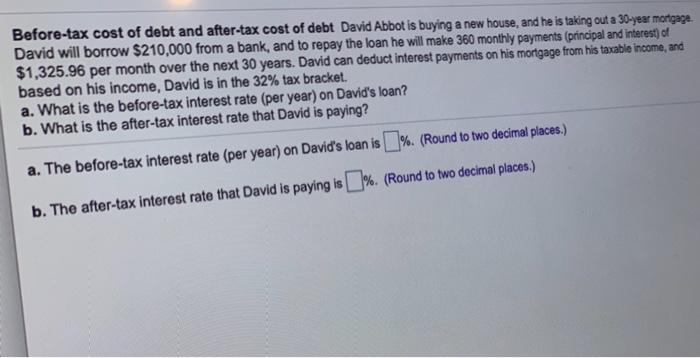

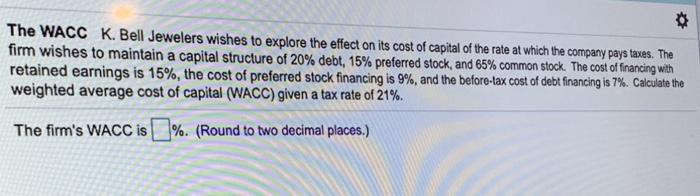

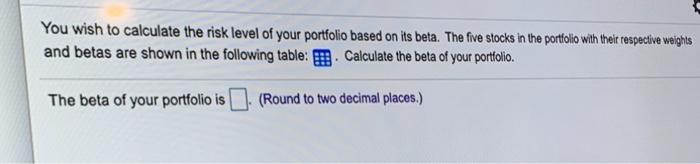

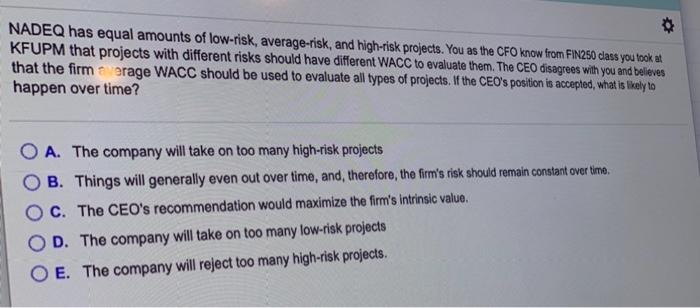

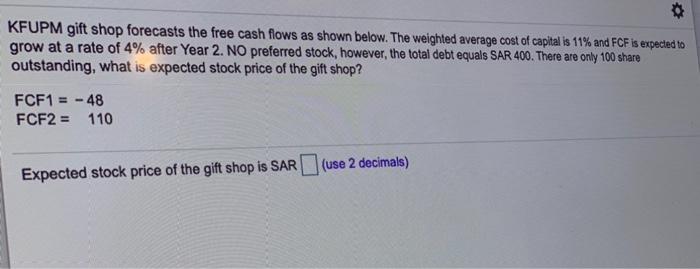

(Click on the icon here e in order to copy the contents of the data table below into a spreadsheet.) Year t) ho 1 2 3 4 5 Free cash flow (FCF) $220,000 $290,000 $340,000 $420,000 $480,000 Print Done The expected returns are 11% for investment 1 and 13% for investment 2. The standard deviations are 8% and 7% for investments 1 and 2 respectiely. Which investment is less risky based solely on standard deviation? Which investment looks better based on coefficient of variation? Which investment is less risky based solely on standard deviation? (Select from the drop-down menus.) is less risky because its standard deviation is Which investment is less risky based on coefficient of variation? (Select from the drop-down menus.) is less risky because its coefficient of variation is Integrative-Risk, return, and CAPM You collected the below information on Almarai. Using the capital asset pricing model (CAPM) calculate the the following. (Click on the icon located on the top-right corner of the data table below in order to copy is contents into a spreadsheet.) Item Rate of return Beta, bo Risk-free asset 3% 0.00 Market portfolio 8% 1.00 1.61 Almarai Using the capital asset pricing model (CAPM) calculate the the following a. The required rate of return for Almarai is 3%. (Round to two decimal places.) b. The risk premium for Almarai is 5%. (Round to two decimal places.) c. When calculated Almarai Expected return is was found that it is 7.05%, then: O A. Cannot determine; missing information B. You should by Almarai bond instead answer(s) of Use IP The expected returns are 11% for investment 1 and 13% for investment 2. The standard deviations are 8% and 7% for investments 1 and 2 respectiely. Which investment is less risky based solely on standard deviation? Which investment looks better based on coefficient of variation? Which investment is less risky based solely on standard deviation? (Select from the drop-down menus.) is less risky because its standard deviation is Which investment is less risky based on coefficient of variation? (Select from the drop-down menus.) is less risky because its coefficient of variation is TS Tesc 22 pts possible You were recently hired by AlOtham to estimate its cost of capital. You obtained the following data: 01 = SAR 3; selling price of its stock is SAR 111;9 7.00% (constant); and the flotation cost (F) = 6%. What is the cost of equity raised by selling new common stock (re)? The cost of equity when issuing new common stock (re) [% ] st: 22 pts possible Fawaz Abdulaziz Alhokair Company reported the following balance sheet: Cash 14 Accounts payable Receivables 70 Other current liabilities Inventories 280 Total CL Total CA 364 Long-term debt (20 bonds) Net fixed assets 126 Common equity Total assets 490 Total liab. and equity 42 28 70 140 280 420 1. The stock is currently selling for SAR 16 per share and there are 100 shares outstanding 2. Its bonds are 3-year bonds with 7% coupon rate paid annually and the face value of SAR 100. They are currenty selling at SAR 90 3. The required rate of return on its common stock is 9%. 4. Assume the firm's tax rate is 40%. What is the WACC for Al Hokair Company using market value weights? 50m a. The WACC is %. (Round to two decimal places.) 140 Beta, required rate of return, and intrinsic value: - You have collected the below information to determine SABIC's intrinsic vlaue The risk-free rate (SAIBOR) is 4% - The Expected return on the Market Portfolio (TASI) is 9% - The next period dividends (D1) = SAR 5 and SABIC will distribute D1 forever. - The historical return on SABIC stock and TASI for the period from 2018-2021 as follows: Years SABIC Ret TASI Ret 2021 5% 10% 2020 9% 13% 2019 8% 17% 2018 25% 19% a. SABIC's Beta is b. SABIC's required rate of return is % C. SABIC's estimated SABIC price (intrinsic vlaue) is SARI Betas and risk rankings Personal Finance Problem You are considering three stocks - A, B, and C--for possible inclusion in your investment portfolio. Stock A has a beta of 1.6, stock B has a beta of 1.1, and stock C has a beta of -0.6. a. Rank these stocks from the most risky to the least risky. b. If you believed that the stock market was getting ready to experience a significant decline, which stock should you add to your portfolio? c. If you anticipated a major stock market rally, which stock would you add to your portfolio? a. Which stock is the most risky one? (Select the best answer below.) O A. Stock A B. Stock C O C. Stock B Which stock is the least risky one? (Select the best answer below.) O A. Stock A OB. Stock C O C. Stock B b. If you felt that the stock market was getting ready to experience a significant decline, which stock should you add to your portfolio? (Select the best answer below.) O A. Stock A OB. Stock C Duke Energy has been paying dividends steadily for 20 years. During that time, dividends have grown at a compound annual rate of 8%. If Duke Energy's current stock price is $71 and the firm plans to pay a dividend of $6.40 next year, what is the required retur on Duke's common stock? The required retur on Duke's common stock is 1%. (Round to two decimal places.) pis possible Preferred stock valuation TXS Manufacturing has an Landing preferred stock issue with a par value of $62 per share. The preferred shares pay dividends annually at a rate of 9%. a. What is the annual dividend on TXS preferred stock? b. If investors require a return of 7% on this stock and the next dividend is payable one year from now, what is the price of TXS preferred stock? c. Suppose that TXS has not paid dividends on its preferred shares in the past two years, but investors believe that it will start paying dividends again in oa year. What is the value of TXS preferred stock if it is cumulative and it investors require a[n) 7% rate of return? a. The annual dividend on TXS preferred stock is $ . (Round to the nearest cent.) b. The price of TXS preferred stock is $. (Round to the nearest cent.) (Round to the nearest cent.) c. The price of TXS preferred stock is $ is possible Cost of common stock equlty CAPM Netflix common stock has a beta, b, of 0.8. The risk-free rate is 5%, and the expected market return is 12%. a. Determine the risk premium on Netflix common stock. b. Determine the required return that Netflix common stock should provide. c. Determine Netflix's cost of common stock equity using the CAPM. a. The risk premium on Netflix common stock is 7%. (Round to one decimal place) b. The required return that Netflix common stock should provide is %. (Round to one decimal place) c. Netflix's cost of common stock equity using the CAPM is_%. (Round to one decimal place) Cost of common stock equity-CAPM Netflix common stock has a beta, b, of 0.8. The risk-free rate is 5%, and the expected market return is 12% a. Determine the risk premium on Netflix common stock. b. Determine the required return that Netflix common stock should provide. c. Determine Netflix's cost of common stock equity using the CAPM. a. The risk premium on Netflix common stock is %. (Round to one decimal place) b. The required return that Netflix common stock should provide is 1%. (Round to one decimal place) c. Netflix's cost of common stock equity using the CAPM is % (Round to one decimal place) Weighted average cost of capital Personal Finance Problem John Dough has just been awarded his degree in business. He has three education loans outstanding. They all mature in 5 years and he can repay them without penalty any time before maturity The amounts owed on each loan and the annual interest rate associated with each loan are given in the following tablece John can also combine the total of his three debts (that is, $64,000) and create a consolidated loan from his bark His bank wi charge an annual interest rate of 7.1% for a period of 5 years. Should John do nothing (leave the three individual loans as is) or create a consolidated loan (the $64,000 question)? The weighted average annual interest rate on John's current loan portfolio is % (Round to two decimal places.) (Select from the drop-down menu.) John should alty any time before mahusty loan are given in the following table his three debts (that is, $64,000) and create a consolidated loan from his bank. His bank wil nterest rate of % for a period of 5 years. Should John do nothing (leave the three individual loans as is) ex reate a consolidate i Data Table The weighted avera ness. He ohn should (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Loan 1 2 3 Balance due $24,000 $12,000 $28,000 Annual Interest rate 5.8% 8.8% 4.8% Print Done The expected returns are 11% for investment 1 and 13% for investment 2. The standard deviations are 8% and 7% for investments 1 and 2 respectiely. Which investment is less risky based solely on standard deviation? Which investment looks better based on coefficient of variation? Which investment is less risky based solely on standard deviation? (Select from the drop-down menus.) is less risky because its standard deviation is Which investment is less risky based on coefficient of variation? (Select from the drop-down menus.) is less risky because its coefficient of variation is Ms Test: 22 pts possi Beta, required rate of return, and intrinsic value: You have collected the below information to determine SABIC's intrinsic vlaue -The risk-free rate (SAIBOR) is 4% The Expected return on the Market Portfolio (TASI) is 9% The next period dividends (D1) = SAR 5 and SABIC will distribute D1 forever. -The historical return on SABIC stock and TASI for the period from 2018-2021 as follows: Years SABIC Ret TASI Ret 2021 5% 10% 2020 9% 13% 2019 8% 17% 2018 25% 19% a. SABIC's Beta is b. SABIC's required rate of return is % C. SABIC's estimated SABIC price (intrinsic vlaue) is SARI TS Tesc 22 pts possible You were recently hired by AlOtham to estimate its cost of capital. You obtained the following data: 01 = SAR 3; selling price of its stock is SAR 111;9 7.00% (constant); and the flotation cost (F) = 6%. What is the cost of equity raised by selling new common stock (re)? The cost of equity when issuing new common stock (re) [% olem You are considering three stocks - A, B, and C - for possible inclusion in portfolio. Stock A has a beta of 1.6, stock B has a beta of 1.1, and stock C has a beta of -0.6. a. Rank these stocks from the most risky to the least risky. b. If you believed that the stock market was getting ready to experience a significant decline, which stock should you add to your portfolio? c. If you anticipated a major stock market rally, which stock would you add to your portfolio? a. Which stock is the most risky one? (Select the best answer below.) O A. Stock A OB. Stock C OC. Stock B 5 Which stock is the least risky one? (Select the best answer below.) O A. Stock A OB. Stock C O C. Stock B b. If you felt that the stock market was getting ready to experience a significant decline, which stock should you add to your portfolio? (Select the best answer below.) O A. Stock A B. Stock C Angina, Inc., has 9 million shares outstang. The firm is considering issuing an additional 1.8 million shares. After selling these shares at eir $18 per share offering price and netting 96% of the sale proceeds, the firm is obligated by an earlier agreement to sell an additional 450,000 shares at 86% of the offering price. In total, how much cash will the firm net from these stock sales? The total cash amount the firm will net from these stock sales is $ ). (Round to the nearest dollar.) MAADEN stock has the following data. Assuming the stock market is efficient and the stock is in equilbrium, which of the following statements is CORRECT? Expected dividend, D1 SAR 11 Current Price, PO SAR 50 Expected constant growth rate 22% A. The stock's expected capital gains yield is 25% B. The stock's expected dividend yield is 26.84% C. The stock's expected dividend yield and growth rate are equal D. The stock's expected price 10 years from now is SAR 100.00 O E. The stock's required return is 27% For a risk seeking investor, no increase in return would be required for an increase in risk. O True O False Before-tax cost of debt and after-tax cost of debt David Abbot is buying a new house, and he is taking out a 30-year mortgage David will borrow $210,000 from a bank, and to repay the loan he will make 360 monthly payments (principal and interest of $1,325.96 per month over the next 30 years. David can deduct interest payments on his mortgage from his taxable income, and based on his income, David is in the 32% tax bracket. a. What is the before-tax interest rate (per year) on David's loan? b. What is the after-tax interest rate that David is paying? a. The before-tax interest rate (per year) on David's loan is %. (Round to two decimal places.) b. The after-tax interest rate that David is paying is %. (Round to two decimal places.) Before-tax cost of debt and after-tax cost of debt David Abbot is buying a new house, and he is taking out a 30-year mortgage. David will borrow $210,000 from a bank, and to repay the loan he will make 360 monthly payments (principal and interest of $1,325.96 per month over the next 30 years. David can deduct interest payments on his mortgage from his taxable income, and based on his income, David is in the 32% tax bracket. a. What is the before-tax interest rate (per year) on David's loan? b. What is the after-tax interest rate that David is paying? a. The before-tax interest rate (per year) on David's loan is %. (Round to two decimal places.) b. The after-tax interest rate that David is paying is %. (Round to two decimal places) The WACC K. Bell Jewelers wishes to explore the effect on its cost of capital of the rate at which the company pays taxes. The firm wishes to maintain a capital structure of 20% debt, 15% preferred stock, and 65% common stock. The cost of financing with retained earnings is 15%, the cost of preferred stock financing is 9%, and the before-tax cost of debt financing is 7%. Calculate the weighted average cost of capital (WACC) given a tax rate of 21% The firm's WACC is %. (Round to two decimal places.) You wish to calculate the risk level of your portfolio based on its beta. The five stocks in the portfolio with their respective welghts and betas are shown in the following table: E. Calculate the beta of your portfolio. The beta of your portfolio is (Round to two decimal places.) NADEQ has equal amounts of low-risk, average-risk, and high-risk projects. You as the CFO know from FIN250 class you took at KFUPM that projects with different risks should have different WACC to evaluate them. The CEO disagrees with you and believes that the firm erage WACC should be used to evaluate all types of projects. If the CEO's position is accepted, what is likely to happen over time? O A. The company will take on too many high-risk projects B. Things will generally even out over time, and therefore, the firm's risk should remain constant over time. C. The CEO's recommendation would maximize the firm's intrinsic value. O D. The company will take on too many low-risk projects E. The company will reject too many high-risk projects. KFUPM gift shop forecasts the free cash flows as shown below. The weighted average cost of capital is 11% and FCF is expeded to grow at a rate of 4% after Year 2. NO preferred stock, however, the total debt equals SAR 400. There are only 100 share outstanding, what is expected stock price of the gift shop? FCF1 = - 48 FCF2 = 110 (use 2 decimals) Expected stock price of the gift shop is SAR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts