Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) rate is currently 7.0% and that

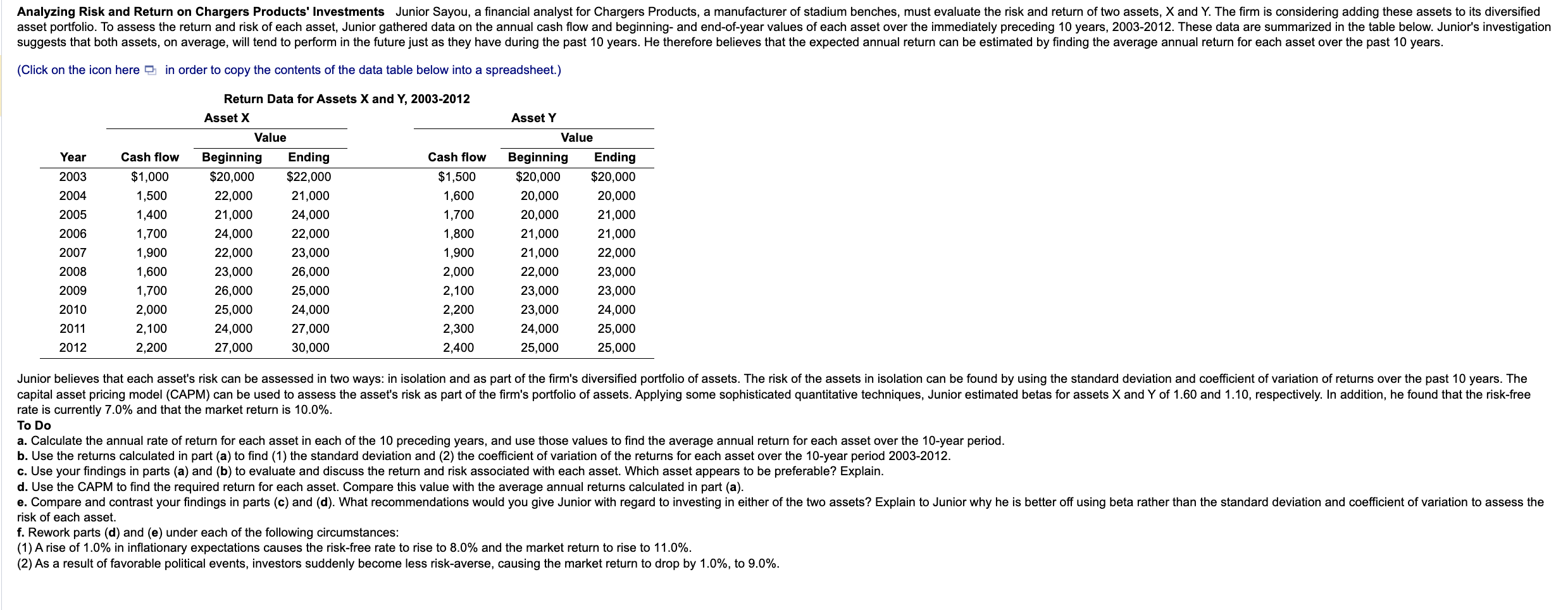

(Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) rate is currently 7.0% and that the market return is 10.0%. To Do a. Calculate the annual rate of return for each asset in each of the 10 preceding years, and use those values to find the average annual return for each asset over the 10 -year period. b. Use the returns calculated in part (a) to find (1) the standard deviation and (2) the coefficient of variation of the returns for each asset over the 10 -year period 20032012. c. Use your findings in parts (a) and (b) to evaluate and discuss the return and risk associated with each asset. Which asset appears to be preferable? Explain. d. Use the CAPM to find the required return for each asset. Compare this value with the average annual returns calculated in part (a). risk of each asset. f. Rework parts (d) and (e) under each of the following circumstances: (1) A rise of 1.0% in inflationary expectations causes the risk-free rate to rise to 8.0% and the market return to rise to 11.0%. (2) As a result of favorable political events, investors suddenly become less risk-averse, causing the market return to drop by 1.0%, to 9.0%

(Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) rate is currently 7.0% and that the market return is 10.0%. To Do a. Calculate the annual rate of return for each asset in each of the 10 preceding years, and use those values to find the average annual return for each asset over the 10 -year period. b. Use the returns calculated in part (a) to find (1) the standard deviation and (2) the coefficient of variation of the returns for each asset over the 10 -year period 20032012. c. Use your findings in parts (a) and (b) to evaluate and discuss the return and risk associated with each asset. Which asset appears to be preferable? Explain. d. Use the CAPM to find the required return for each asset. Compare this value with the average annual returns calculated in part (a). risk of each asset. f. Rework parts (d) and (e) under each of the following circumstances: (1) A rise of 1.0% in inflationary expectations causes the risk-free rate to rise to 8.0% and the market return to rise to 11.0%. (2) As a result of favorable political events, investors suddenly become less risk-averse, causing the market return to drop by 1.0%, to 9.0% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started