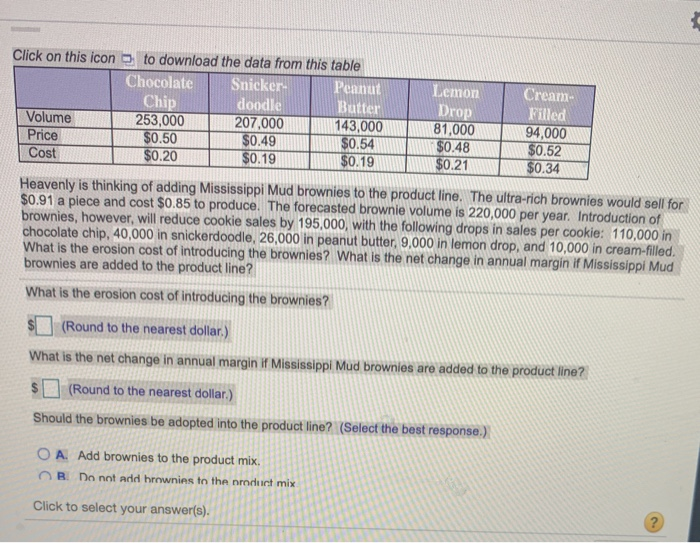

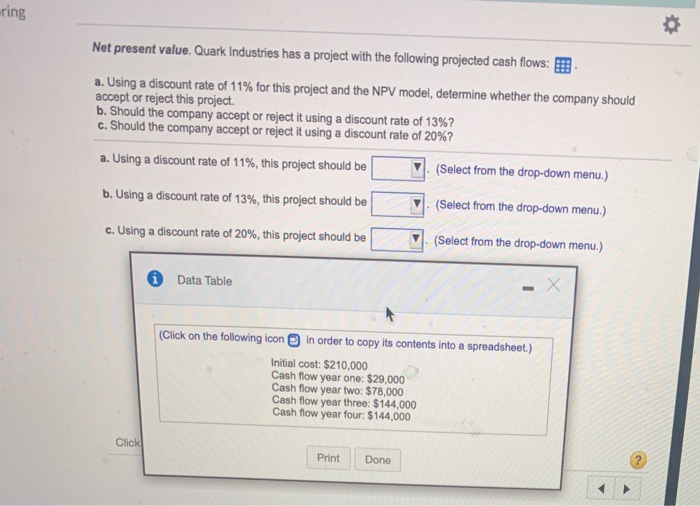

Click on this icon to download the data from this table Chocolate Snicker Peanut Chip doodle Butter Volume 253,000 207.000 143,000 Price $0.50 $0.49 $0.54 Cost $0.20 $0.19 $0.19 Lemon Drop 81,000 $0.48 $0.21 Filled 94,000 $0.52 $0.34 Heavenly is thinking of adding Mississippi Mud brownies to the product line. The ultra-rich brownies would sell for $0.91 a piece and cost $0.85 to produce. The forecasted brownie volume is 220,000 per year. Introduction of brownies, however, will reduce cookie sales by 195,000, with the following drops in sales per cookie: 110,000 in chocolate chip. 40,000 in snickerdoodle, 26,000 in peanut butter, 9,000 in lemon drop, and 10,000 in cream-filled. What is the erosion cost of introducing the brownies? What is the net change in annual margin if Mississippi Mud brownies are added to the product line? What is the erosion cost of introducing the brownies? (Round to the nearest dollar.) What is the net change in annual margin if Mississippi Mud brownies are added to the product line? (Round to the nearest dollar.) Should the brownies be adopted into the product line? (Select the best response.) O A. Add brownies to the product mix. B Do not add brownies to the noduct mix Click to select your answer(s). ? -ring Net present value. Quark Industries has a project with the following projected cash flows: a. Using a discount rate of 11% for this project and the NPV model, determine whether the company should accept or reject this project. b. Should the company accept or reject it using a discount rate of 13%? c. Should the company accept or reject it using a discount rate of 20%? a. Using a discount rate of 11%, this project should be (Select from the drop-down menu.) b. Using a discount rate of 13%, this project should be . (Select from the drop-down menu.) c. Using a discount rate of 20%, this project should be (Select from the drop-down menu.) Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Initial cost: $210,000 Cash flow year one: $29,000 Cash flow year two: $78,000 Cash flow year three: $144,000 Cash flow year four: $144,000 Click Print Done