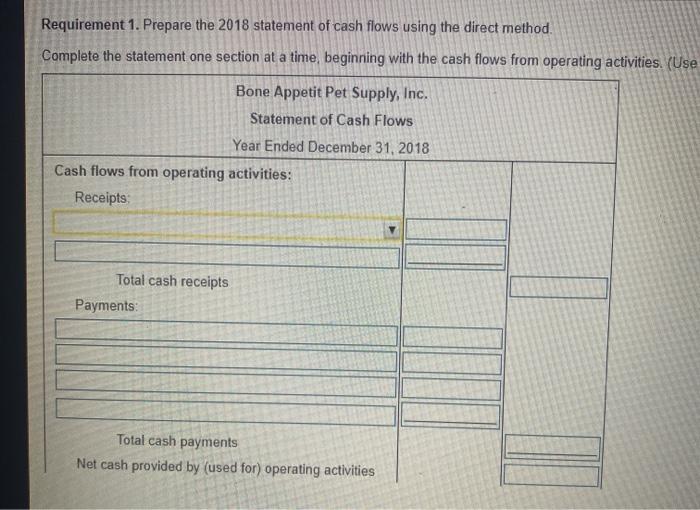

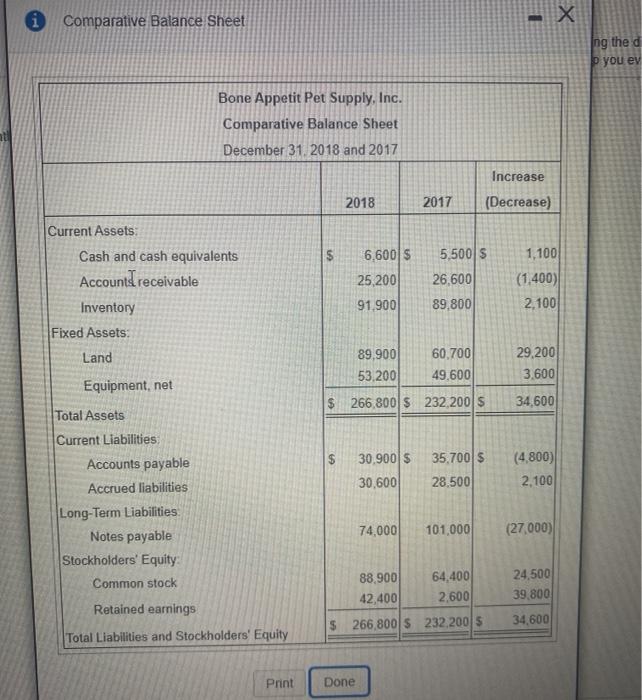

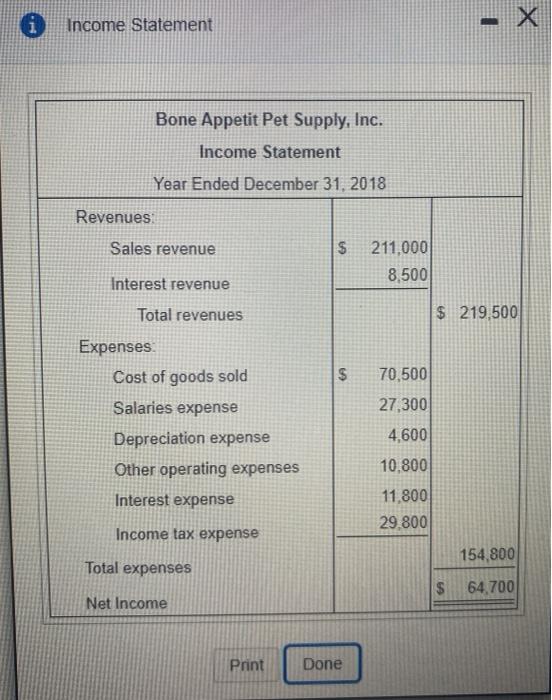

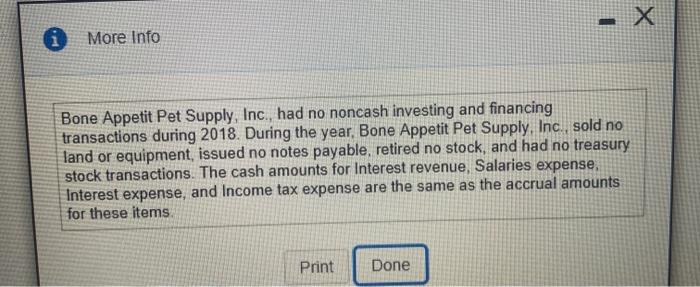

(Click the icon for more information Requirements 1. Prepare the 2018 statement of cash flows using the direct method, 2. How will what you learned in this problem help you evaluate an investment in Bone Appetit Pet Supply, Inc.? Requirement 1. Prepare the 2018 statement of cash flows using the direct method. Complete the statement one section at a time, beginning with the cash flows from operating activities. (Use Bone Appetit Pet Supply, Inc. Statement of Cash Flows Year Ended December 31, 2018 Cash flows from operating activities: Receipts Total cash receipts Payments: Total cash payments Net cash provided by (used for) operating activities i Comparative Balance Sheet Ing the d o you ev Bone Appetit Pet Supply, Inc. Comparative Balance Sheet December 31, 2018 and 2017 Increase (Decrease) 2018 2017 $ 6.600 $ 1,100 5,500 $ 26,600 Current Assets Cash and cash equivalents Account I receivable Inventory Fixed Assets Land 25,200 91.900 (1.400) 2,100 89.800 89,900 53,200 60,700 49,600 29,200 3.600 Equipment, net $ 266,800 $ 232,200 $ 34,600 $ 30,900 $ 35,700$ 28.500 (4.800) 2.100 30,600 Total Assets Current Liabilities Accounts payable Accrued liabilities Long-Term Liabilities Notes payable Stockholders' Equity Common stock 74,000 101,000 (27,000) 88.900 64,400 42,400 2,600 $ 266,800 $ 232.2005 24,500 39,800 34,600 Retained earnings Total Liabilities and Stockholders' Equity Print Done i Income Statement x Bone Appetit Pet Supply, Inc. Income Statement Year Ended December 31, 2018 Revenues Sales revenue $ 211,000 Interest revenue 8,500 Total revenues $ 219,500 Expenses Cost of goods sold $ 70,500 Salaries expense 27,300 Depreciation expense 4,600 Other operating expenses 10.800 Interest expense 11,800 29.800 Income tax expense 154,800 Total expenses 64.700 Net Income Print Done x More Info Bone Appetit Pet Supply, Inc., had no noncash investing and financing transactions during 2018. During the year, Bone Appetit Pet Supply, Inc., sold no land or equipment, issued no notes payable, retired no stock, and had no treasury stock transactions. The cash amounts for Interest revenue, Salaries expense, Interest expense, and Income tax expense are the same as the accrual amounts for these items Print Done