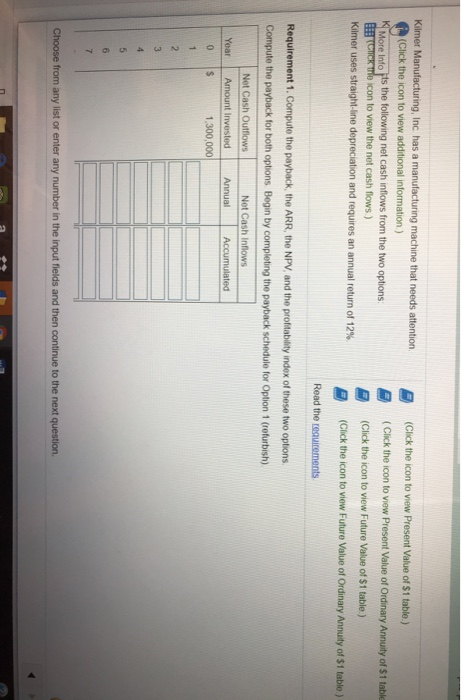

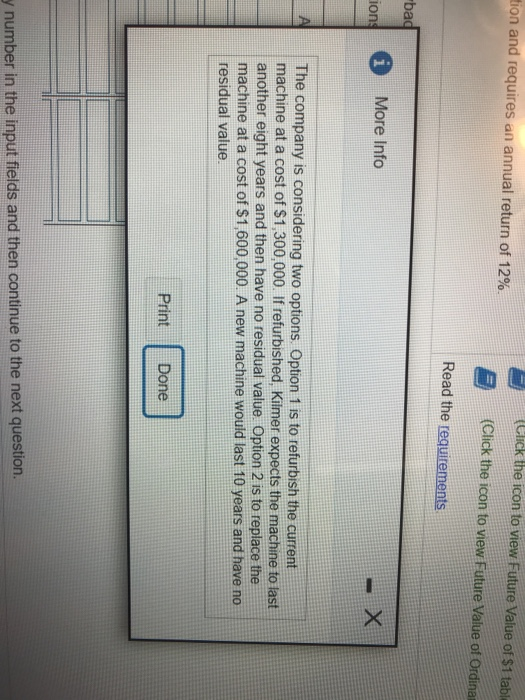

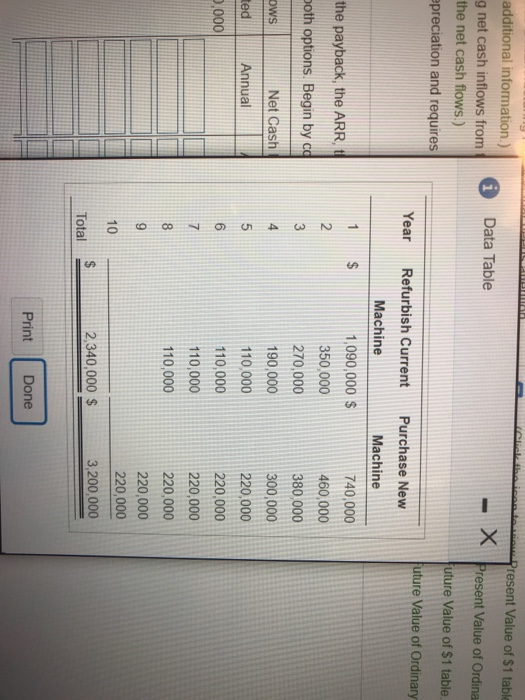

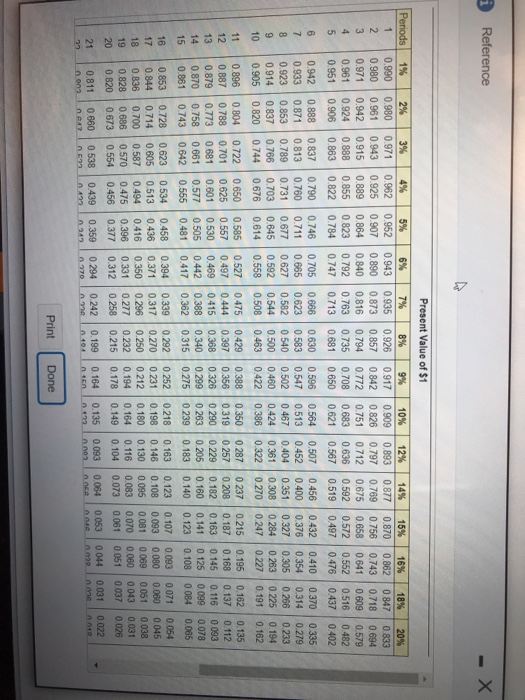

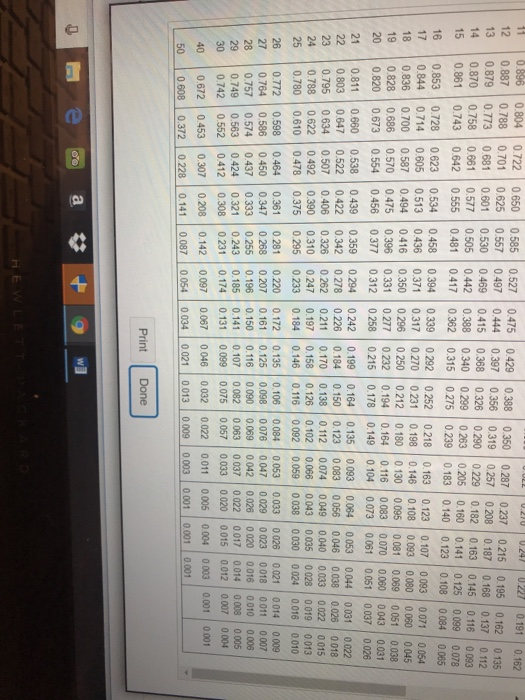

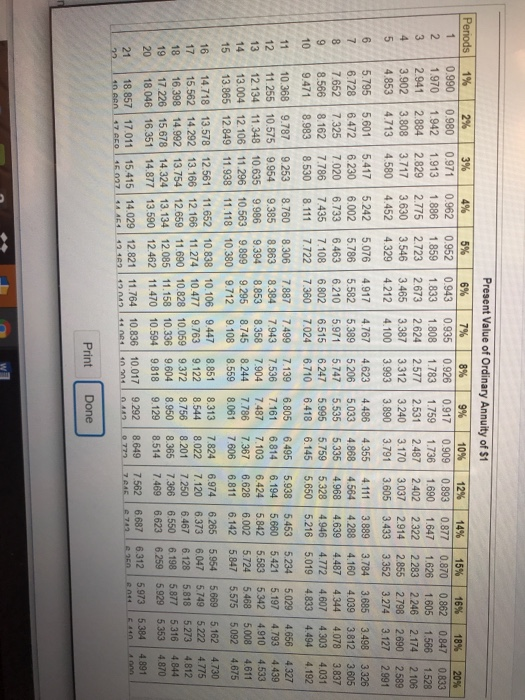

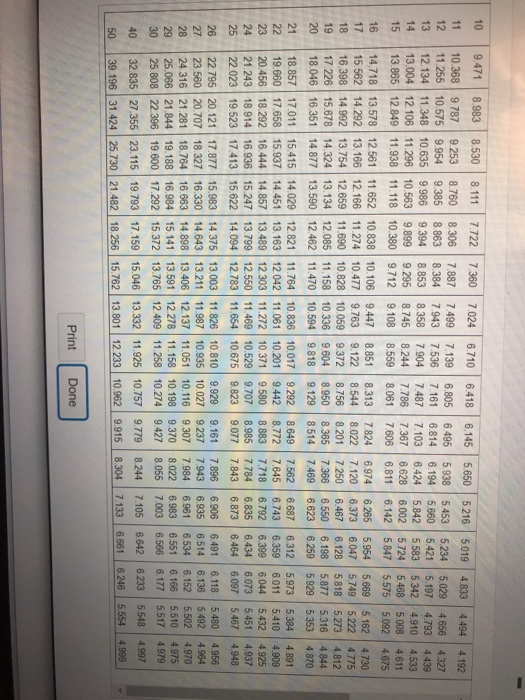

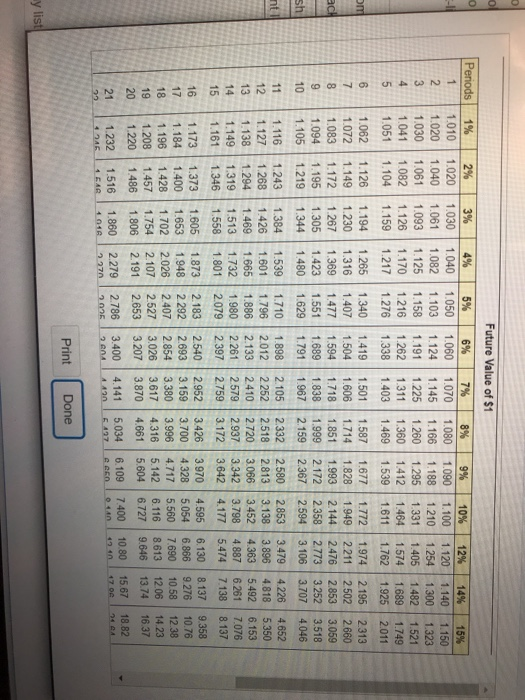

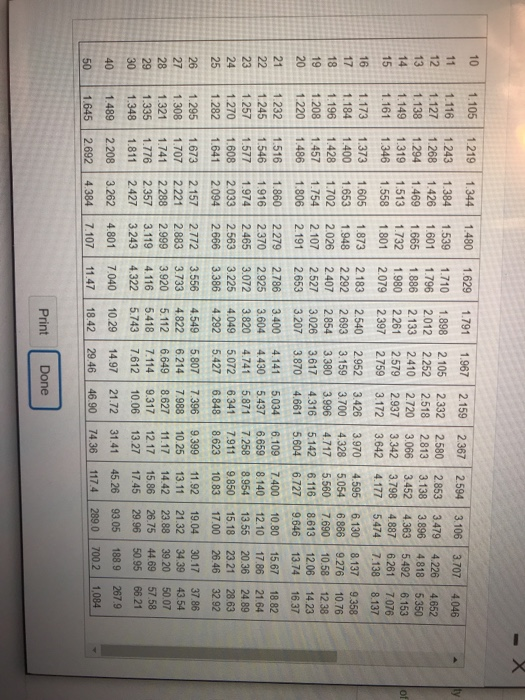

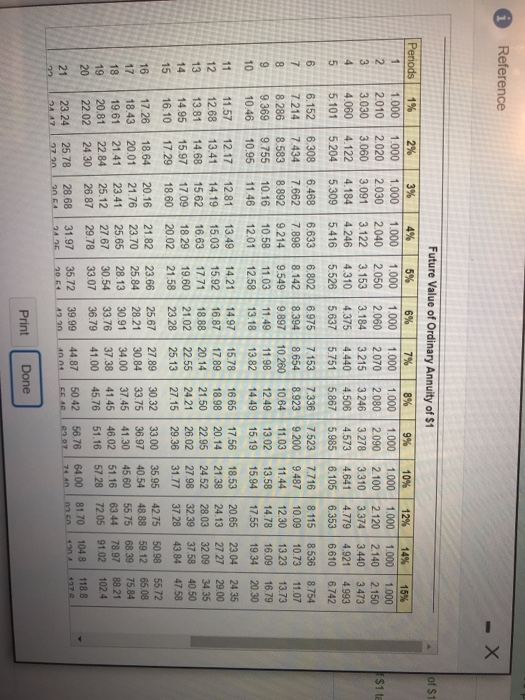

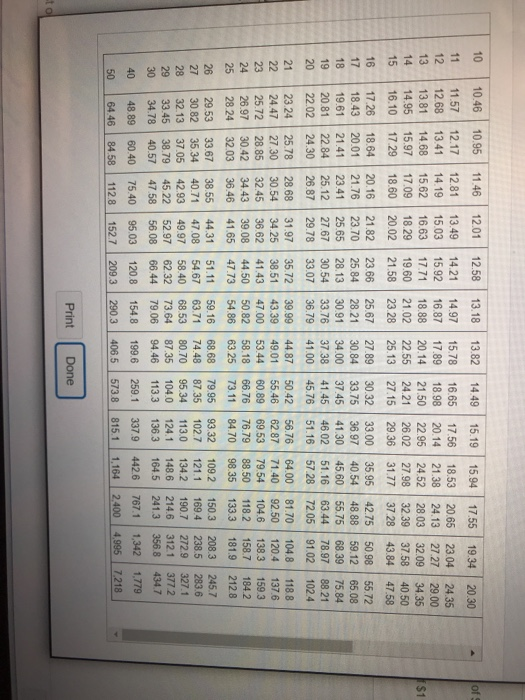

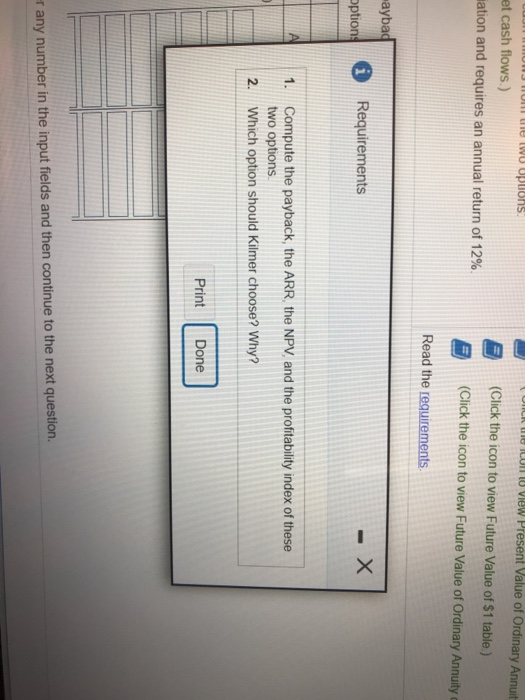

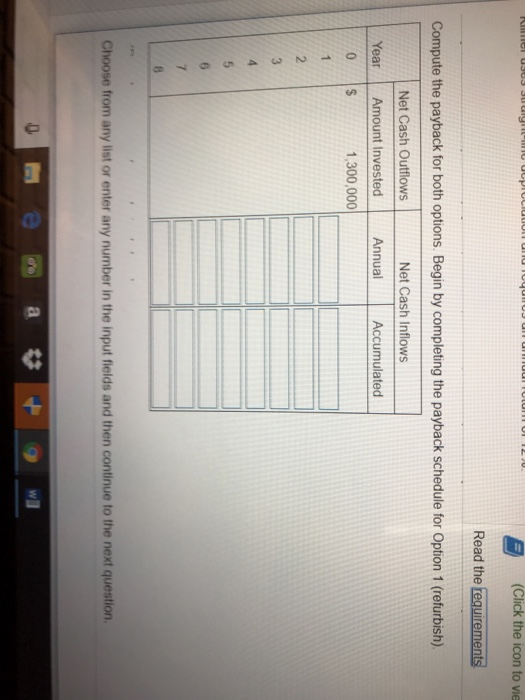

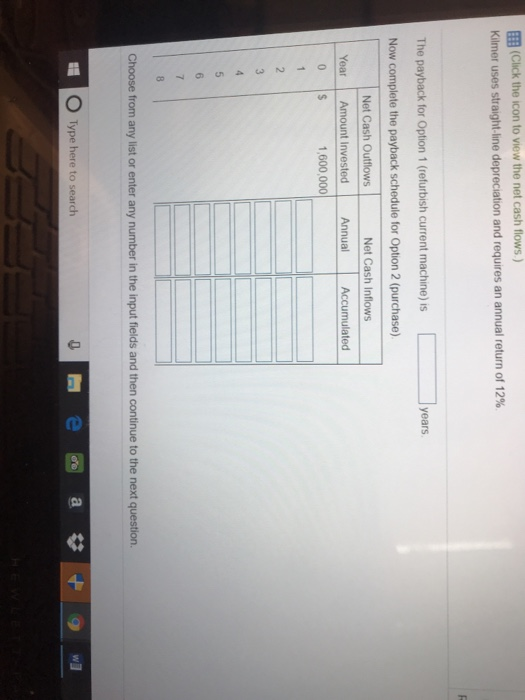

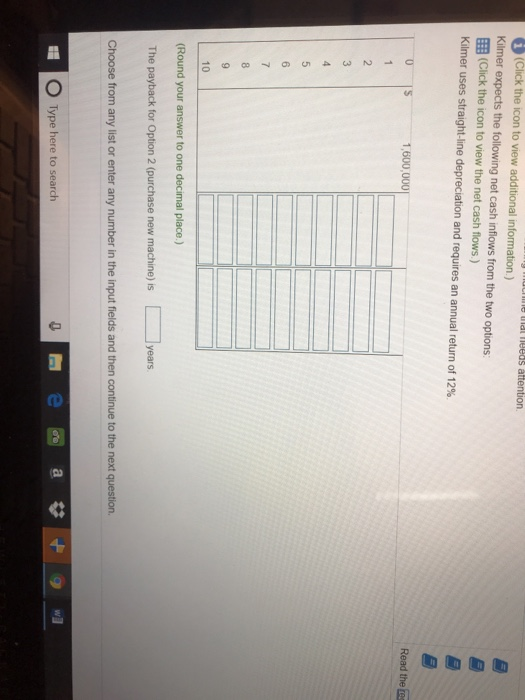

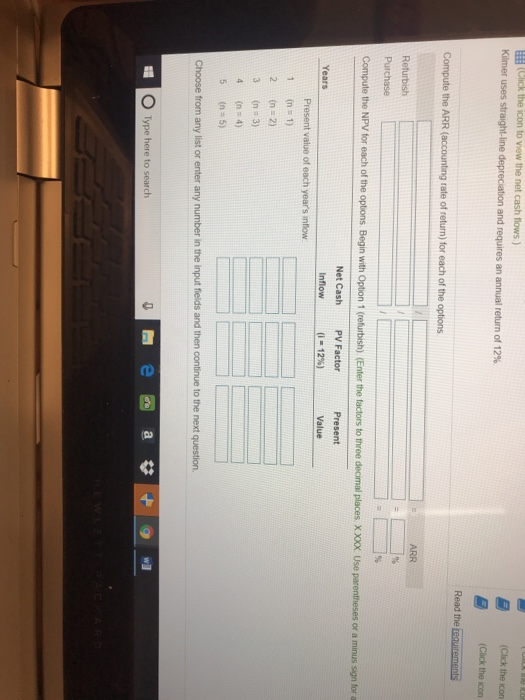

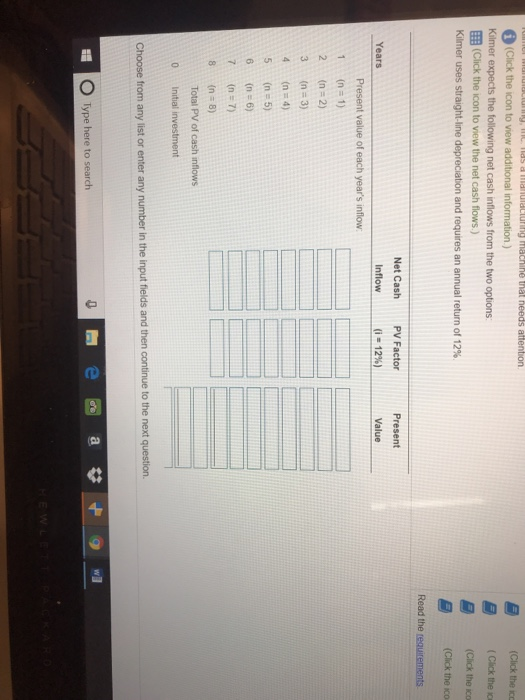

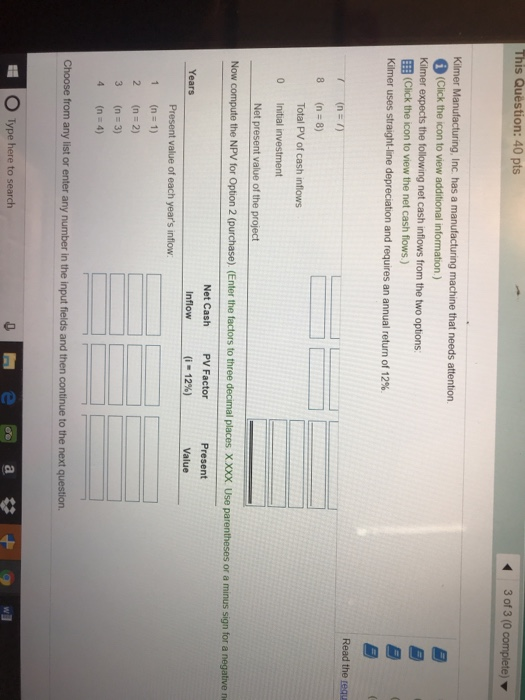

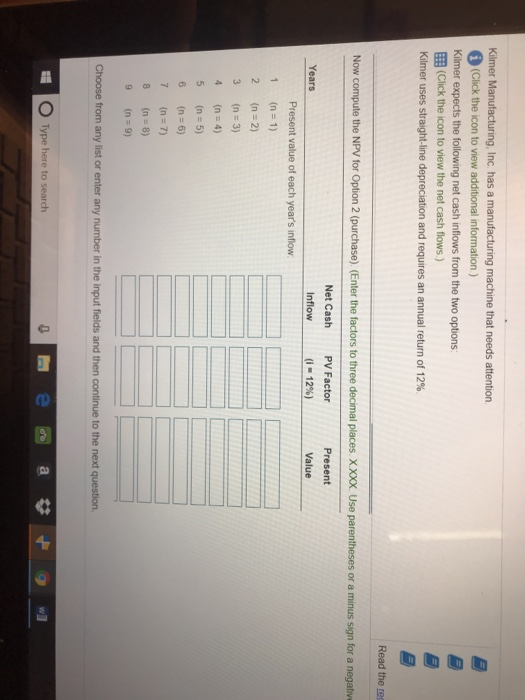

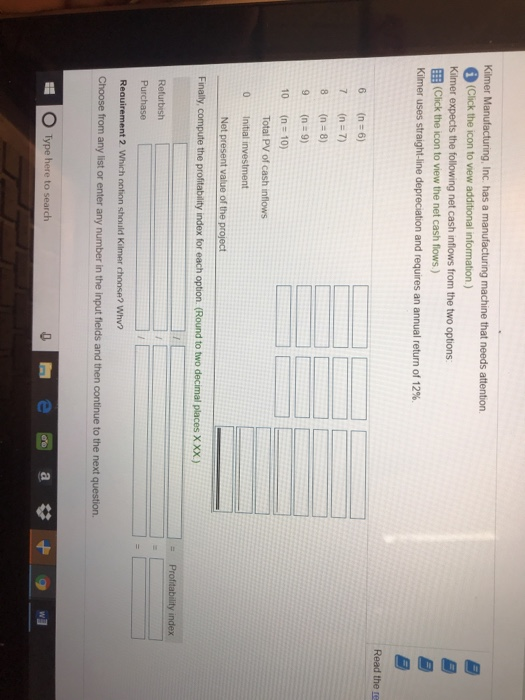

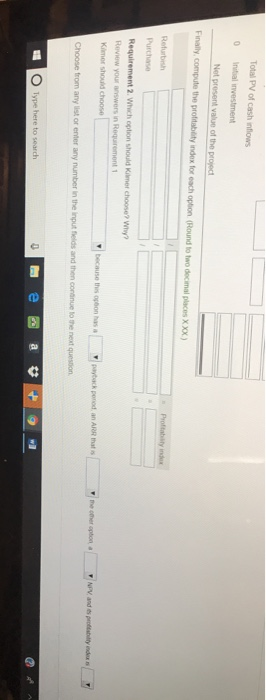

(Click the icon to view Present Value of $1 table) Kilmer Manufacturing, Inc has a manufacturing machine that needs attention (Click the icon to view additional information ) More Info is the following net cash inflows from the two options: CHO Te icon to view the net cash flows) Kilmer uses straight-line depreciation and requires an annual return of 12% Click the icon to view Present Value of Ordinary Annuity of $1 tab (Click the icon to view Future Value of $1 table) Click the icon to view Future Value of Ordinary Annuity of $1 table Read the requirements Requirement 1. Compute the payback the ARR, the NPV, and the profitability index of these two options Compute the payback for both options Begin by completing the payback schedule for Option 1 refurbish) Net Cash Outflows Not Cash Inflows Year Amount invested Annual Accumulated 1,300,000 Choose from any or enter any number in the input fields and then continue to the next question tion and requires an annual return of 12% Click the icon to view Future Value of $1 tabla (Click the icon to view Future Value of Ordinar Read the requirements -bad ion 1 More Info The company is considering two options. Option 1 is to refurbish the current machine at a cost of $1,300,000. If refurbished, Kiimer expects the machine to last another eight years and then have no residual value. Option 2 is to replace the machine at a cost of $1,600,000. A new machine would last 10 years and have no residual value Print Done y number in the input fields and then continue to the next question Click the icon Present Value of $1 table Data Table - additional information.) g net cash inflows from the net cash flows.) epreciation and requires Present Value of Ordina future Value of $1 table. uture Value of Ordinary Year Machine the payback, the ARR, both options. Begin by cd ows Net Cash Annual ted 000 AW N- Refurbish Current Purchase New Machine 1,090,000 $ 740,000 350,000 460,000 270,000 380 000 190,000 300,000 110,000 220,000 110,000 220,000 110,000 220,000 110,000 220,000 220,000 220,000 2,340,000 $ 3,200,000 5,000 Total Print Done Reference Periods 3 10 11 12 13 14 15 1% 2% 3% 0.990 0.980 0.971 0.980 0.961 0.943 0.971 0.942 0.915 0.961 0.924 0.888 0.951 0.906 0.863 0.942 0.888 0.837 0.933 0.871 0.813 0.923 0.853 0.789 0.914 0.837 0.766 0.905 0.820 0.744 0.896 0.804 0.722 0.887 0.788 0.701 0.879 0.773 0.681 0.870 0.758 0.661 0.861 0.743 0.642 0.853 0.728 0.623 0.844 0.714 0.605 0.836 0.700 0.587 0.828 0.686 0.570 0.820 0.673 0.554 0.811 0.660 0.538 Ion LOBAL Present Value of $1 4% 5% 6% 7% 8% 9% 10% 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.731 0.677 0.627 0.5820.540 0.502 0.467 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.534 0.458 0.394 0.3390.292 0.252 0.218 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.439 0.359 0 294 0 242 0.199 0.164 0.135 4920249070 10460472 12% 14% 15% 16% 18% 20% 0.893 0.877 0.870 0.862 0.847 0.833 0.797 0.769 0.756 0.743 0.7180.694 0.712 0.675 0.658 0.641 0.609 0.579 0.636 0.592 0.572 0.552 0.516 0.482 0.567 0.519 0.497 0.476 0.437 0.402 0.507 0.456 0.432 0.410 0.370 0.335 0.452 0.400 0.376 0.354 0.3140.279 0.404 0.351 0.327 0.305 0.266 0.233 0.361 0.308 0.284 0.263 0.225 0.194 0.322 0.270 0.247 0.191 0.162 0.287 0237 0.215 0.195 0.162 0.135 0.2570 208 0.187 0.137 0.112 0.229 0.1820.163 0.116 0.093 0.205 0.1600.141 0.125 0.099 0.078 0.183 0.140 0.123 0.108 0.084 0.065 0.163 0.123 0.107 0.093 0.071 0.054 0.146 0.108 0.093 0.080 0.060 0.045 0.130 0.095 0.081 0.069 0.051 0.038 0.116 0.083 0.070 0.060 0.043 0.031 0.104 0.073 0.061 0.051 0037 0.026 0.093 0.064 0.014 0 031 0.022 0.002 Lan Print Done 14 15 0.585 0.557 0.530 0.505 0.481 0.458 0.436 0.416 0.396 0.377 0.896 0.804 0.722 0.650 0.887 0.788 0.701 0.625 0.879 0.773 0.681 0.601 0.870 0.758 0.661 0.577 0.861 0.743 0.642 0.555 0.853 0.728 0.623 0.534 0.844 0.714 0.605 0.513 0.836 0.700 0.587 0.494 0.828 0.686 0.570 0.475 0.820 0.673 0.554 0.456 0.811 0.660 0.538 0.439 0.803 0.647 0.522 0.422 0.795 0.634 0.507 0.406 0.788 0.622 0.492 0.390 0.780 0.610 0.478 0.375 0.772 0.598 0.464 0.361 0.764 0.586 0.450 0.347 0.757 0.574 0.437 0.333 0.7490.563 0.424 0.321 0.742 0.5520.412 0.308 0.672 0.453 0.307 0.208 0.608 0.372 0.228 0.141 0.527 0.475 0.497 0.444 0.469 0.415 0.442 0.388 0.417 0.362 0.394 0.339 0.371 0.317 0.350 0.296 0.3310 277 0.3120 258 0.294 0.242 0.278 0.226 0.262 0.211 0.247 0.197 0.233 0.184 0.220 0.172 0.207 0.161 0.1960.150 0.185 0.141 0.174 0.131 0.097 0.067 0.054 0.034 0.210 0.247 0.227 0.191 0.162 0.429 0.388 0.350 0.287 0.237 0.215 0.195 0.397 0.356 0.162 0.135 0.319 0.257 0.208 0.368 0.187 0.168 0.137 0.112 0.326 0.290 0.229 0.182 0.163 0.145 0.116 0.093 0.340 0.299 0.263 0.205 0.160 0.141 0.125 0.099 0.078 0.315 0.275 0.239 0.183 0.140 0.123 0.108 0.084 0.065 0.292 0.252 0218 0.163 0.123 0.107 0.093 0.071 0.054 0 2700 2310.198 0.146 0.108 0.093 0.080 0.060 0.045 0.250 0212 0.180 0.130 0.095 0.081 0.069 0.051 0.038 0.232 0.194 0.164 0.116 0.083 0.070 0.060 0.043 0.031 0.215 0.178 0.149 0.104 0.073 0.061 0.051 0.037 0.026 0.1990.164 0.135 0.093 0.064 0.053 0.044 0.031 0.022 0.184 0.150 0.123 0.083 0.056 0.046 0.038 0.025 0.018 0.1700.138 0.112 0.074 0.049 0.040 0.033 0.022 0.015 0.158 0.126 0.1020.066 0.043 0.035 0.028 0.019 0.013 0.146 0.116 0.092 0.059 0.038 0.030 0.024 0.0160.010 0.135 0.106 0.084 0.053 0.033 0.025 0.021 0.014 0.009 0.125 0.098 0.076 0.047 0.029 0.023 0.018 0.011 0.007 0.116 0.090 0.069 0.042 0.026 0.020 0.016 0010 0.006 0.107 0.082 0.063 0.037 0.022 0.017 0.014 0.008 0.005 0.099 0.075 0.057 0.033 0.020 0.015 0.012 0.007 0.004 0.046 0.032 0.022 0.011 0.005 0.004 0.003 0.001 0.001 0.021 0.013 0.009 0.003 0.001 0.001 0.001 0.359 0.342 0.326 0.310 0.295 0.281 0.268 0.255 0.243 0.231 0.142 0.087 25 26 30 Print Done HEWLETTACKARO Periods Present Value of Ordinary Annuity of $1 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 0.990 0.9800.971 16% 18% 20% 0.962 0.952 0.943 0.935 0.9260.917 0.909 0.893 0.877 1.970 0.870 1.942 0.862 0.847 0.833 1.913 1.886 1.859 1.8331.8081.783 1.759 1.736 1.6901.647 1.626 2.941 1.605 2.884 1.566 1.528 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.40223222 283 3.902 2.246 3.808 2.1742 106 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.855 2.798 4.853 4.7134.580 2690 2 589 4.452 4.329 42124, 100 4.100 3.993 3.890 3.791 3.605 3.433 3.352 3.274 3.127 2.991 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.111 3.8893.784 3.685 3.498 3.326 6.7286.4726.230 6.002 5.786 5.5825.389 5206 5.033 4.868 4.564 4.288 4160 4.0393.812 3.605 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.6394.487 4.344 4.078 3.837 8.566 8.162 7.7867.435 7.108 6.802 6.515 6 247 5.9955.759 5.328 4.946 4.7724.607 4.303 4.031 9.471 8.983 8.530 8.1117.7227.360 7.024 6.710 6.418 6.145 5.650 5.216 5,019 4.833 4.494 4.192 10.368 9.7879.253 8.760 8.3067.887 7.499 7.1396.805 6.495 5.938 5.453 5.234 5.029 4.656 4.327 11.255 10.575 9.954 9.3858.863 8.384 7.943 7.536 7161 6.814 6.194 5.660 5.421 5.197 4.793 4439 12. 134 11.348 10.635 9.986 9.394 8.853 8.3587.904 7.487 7.103 6.424 5.842 5.583 5.342 4.910 4.533 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.724 5.468 5008 4.611 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.5598.0617.606 6.811 6.142 5.847 5.575 5.092 4.675 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 6.974 6.265 5.954 5.669 5.162 4.730 13.166 15.562 14.292 12.166 11.274 10.477 9.763 9.122 8.544 8.022 7.120 6.373 5.749 6.047 5.222 4.775 13.754 12.659 16.398 11.690 14.992 10.828 10.059 9.3728.756 6.128 8.2017 250 6.467 5.818 5273 4812 17.226 11.158 13.134 10.336 9.604 12.085 14 324 8.365 5.877 8.950 15.678 7.366 6.550 5316 6.198 4.844 10.594 6.623 9.818 9.129 7.469 8.514 6.623 6.259 13.590 18.046 5.929 12.462 11.470 16.351 14.877 5.353 4.870 6.687 18.857 6.312 10.836 5.973 10.017 17.011 15.415 8.649 9.292 53844891 14.029 12.821 11.764 420 777 4 742 10. R I 17 REO 15.037 114 454 1 42 43 44 44 1 100 1 7.562 Print Done WE 5.669 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.650 5.216 5.019 4833 4.494 4.192 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5938 5.453 5 234 11.255 10.575 9.954 9.385 8.863 5.0294656 8.384 4327 7.943 7.536 7.161 6.814 6.194 5.660 5.421 12.134 5.1974.793 11.348 10.635 9.986 9.394 8.853 8.358 4439 7.9047.487 7.103 6.424 5.842 5.583 13.004 5.342 12.106 11.296 10.563 4.910 4533 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.724 5.468 5.008 13.865 4.611 12.849 11.938 11.118 10.380 9.7129.1088.5598.061 7.606 6.811 6.142 5.847 5.575 5.092 4.675 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 6.974 6.265 5.954 5.162 4.730 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.022 7.1206.373 6.047 5.749 5.222 4.775 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.2017.250 6.467 6.128 5 818 5.273 4.812 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.3666.550 6.198 5.877 5.316 4.844 18.046 16.351 14.877 13.590 12.462 11.470 10.5949.818 9.129 8.514 7.4696.623 6.259 5.929 5.353 4.870 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 9.2928.649 7.5626.687 6.312 5.384 4891 19.660 17.658 15.937 14.451 13.163 12.042 11.061 10.2019.442 8.772 7.645 6.743 6.359 6.011 5.410 4.909 20.456 18.292 16.444 14.857 13.489 12.303 11.272 10.371 9.580 8.883 7.718 6.792 6.399 6.044 5.432 4.925 21.243 18.914 16.936 15.247 13.799 12.550 11.469 10.529 9.707 8.9857.784 6.835 6.434 6.073 5.451 4.937 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 7.843 6.873 6.464 6.097 5.467 4.948 22.795 20.121 17.877 15.983 14.375 13.003 11.826 10.8109.929 9.161 7896 6.906 6.491 6.118 5.480 4.956 23.560 20.707 18.327 16.330 14.643 13.211 11.987 10.935 10.027 9.237 7.943 6.935 6.514 6.136 5.492 4.964 24.316 21.281 18.764 16.663 14.898 13.406 12.137 11.051 10.116 9.307 7.984 6.961 6.534 6.152 5.502 4.970 19.188 16.984 15.141 13.591 12.278 25.066 11.158 10.1989.370 8.022 6.983 6.551 6.166 5.510 4.975 17.292 15.372 13.765 12.409 11.258 25.808 19.600 10.274 9.427 8.055 7.003 6.566 6.177 5.517 4.979 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.244 7.105 6.642 6.233 5.548 4.997 18.256 15.762 13 B01 12.233 10.962 9.915 8 304 7.133 31.424 25.730 21.482 6.6616.246 5.5544999 Print Done Periods 1W ach 1% 2% 3% 4% 1.010 1.020 1030 1.040 1.020 1.040 1.061 1.082 1.030 1.061 1.093 1.125 1.041 1.082 1.126 1.170 1.051 1.104 1.159 1.217 1.062 1.126 1.194 1.265 1.072 1.149 1.2301.316 1.083 1.172 1.267 1.369 1.094 1.195 1.305 1.423 1.105 1.219 1.344 1.480 1.116 1.243 1.384 1.539 1.1271.2681.426 1.601 1.138 1.294 1.469 1.665 1.149 1.319 1.513 1.732 1.801 1.173 1.373 1.605 1.873 1.184 1.400 1.653 1.948 1.196 1.4281702 2.026 1.208 1.4571.754 2.107 1.220 1.486 1.806 2.191 1.516 1.860 2.279 4216 4 FAR 401 1270 sh nt 1 Future Value of $1 5% 6% 7% 8% 9% 10% 12% 14% 1.050 1.060 1070 1.080 1.090 1.100 1.120 1.140 1.103 1.124 1.145 1.166 1.188 1.210 1.254 1.300 1.158 1.191 1.225 1.260 1.295 1.331 1.405 1.482 1.216 1.262 1.311 1.360 1.4121.464 1.574 1.689 1.276 1.338 1.403 1.469 1.539 1.611 1.762 1.925 1.340 1.419 1.587 1.677 1.772 1.9742.195 1.407 1.504 1.606 1.7141.828 1.949 2.211 2502 1.477 1594 1.718 1.851 1.993 2.144 2.476 2.853 1.551 1.689 1.8381.999 2.172 2.358 2.773 3.252 1.629 1.791 1.967 2.159 2.367 2.594 3.106 3.707 1.7101.898 2.105 2.332 2.580 2.8533.4794.226 1.796 2.0122252 2.518 2.813 3.138 3.896 4.818 1.886 2.133 2410 2.720 3.066 3.452 4.363 5.492 1.980 2.261 25792.937 3.342 3.798 4.887 6.261 2.079 23972.759 3.172 3.642 4.177 5.4747.138 2.183 2.540 2.952 3.426 3.970 4.595 6.130 8.137 2292 2.6933.159 3.700 4.328 5.054 6.866 9 276 2.407 2.854 3.380 3.996 4.717 5.560 7.690 10.58 2527 3.026 3.617 4.316 5.142 6.116 8.613 12.06 2.653 3.2073.870 4.661 5.604 6.727 9.646 13.74 2.786 3.400 4.141 5.034 6.109 7400 70 2005 15% 1.150 1.323 1.521 1.749 2.011 2313 2.660 3.059 3.518 4.046 4.652 5.350 6.153 7.076 8.137 9.358 10.76 12.38 14.23 NB 1.232 2014 6427LAELO Print Done y list 1.105 | 1.219 1.116 1243 1.127 1.268 1.138 1.294 1.149 1.319 1.161 1.346 1.173 1.184 1.196 1.208 1.220 1.232 1.245 1.257 1.270 1.282 1.295 1.308 1.321 1.335 1.348 1.489 1.373 1.400 1.428 1.457 1.486 1.516 1.546 1.577 1.608 1.641 1.673 1.707 1.741 1.776 1.811 2.208 1.344 1.384 1.426 1.469 1.513 1.558 1.605 1.653 1.702 1.754 1.806 1.860 1.916 1.974 2.033 2.094 2.157 2221 2.288 2.357 2.427 1.480 1.629 1.791 1.967 2.159 2367 2594 3.106 1.539 1.710 1.898 2105 2332 2580 2853 3.479 1.601 1.796 2012 2.252 2518 2813 3.138 3.896 1.665 1886 2.133 24102.720 3.066 3.452 4.363 1.732 1.980 2261 2.579 2.937 3.342 3.798 4.887 1.801 2079 2397 2.759 3.1723.642 4.177 5.474 1.873 2.183 2.540 2.952 3.426 3.970 4.595 6.130 1.948 2292 2.6933.159 3.700 4.328 5.0546.866 2.0262.407 2.854 3.380 3.996 4.717 5.5607.690 2.107 2.527 3.026 3.617 4.316 5.142 6.116 8.613 2.1912.653 3.2073.870 4.661 5.604 6.727 9.646 2.279 2.786 3.400 4.1415.034 6.1097.400 10.80 2.370 2.925 3.604 4.430 5.4376.659 8.140 12.10 2465 3.072 3.820 4.741 5.8717.258 8.954 13.55 2.563 3.225 4.049 5.0726.3417.911 9.850 15.18 3.386 4.292 5.427 6.8488.623 10.83 17.00 2772 3.556 4.549 5.8077.396 9.399 11.92 19.04 2883 3.733 4.822 6.214 7.988 10.25 13.11 21.32 2.999 3.920 5.112 6.649 8.627 11.17 14.42 23.88 3.1194.116 5.418 7.114 9.317 12.17 15.86 26.75 3.243 4.3225.743 7.612 10.06 13.27 17.45 4.801 7040 10.29 14.97 21.72 31.41 7.107 11.47 18.42 29.46 46.9074.36 3.707 4226 4818 5.492 6.261 7.138 8.137 9.276 10.58 12.06 13.74 15.67 17.86 20.36 23.21 4.046 4652 5.350 6.153 7.076 8.137 9.358 10.76 12.38 14.23 16.37 18.82 21.64 24.89 28.63 32.92 34.39 39.20 44.69 50.07 57.58 66.21 267.9 1,084 3.262 700 2 1.645 2.692 4.384 Print Done i Reference of $1 Periods Site 12% 1.000 2.120 3.374 4.779 6.353 8.115 10.09 12.30 14.78 17.55 14% 1.000 2140 3.440 4.921 6.610 8.536 10.73 13.23 16.09 19.34 15% 1.000 2.150 3.473 4.993 6.742 8.754 11.07 13.73 16.79 COCO Future Value of Ordinary Annuity of $1 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 2.010 2020 2030 2040 2050 2060 2.070 2.080 2090 2.100 3.0303.060 3.091 3.122 3.153 3.184 3.215 3.246 3.278 3.310 4.0604.122 4.184 4.246 4.310 4.375 4.440 4.506 4.573 4.641 5.101 5.204 5.309 5.416 5.526 5.637 5.751 5.867 5.985 6.105 6.152 6.308 6.468 6.633 6.802 6.975 7.1537.3367.523 7.716 7.214 7.434 7.6627.898 8.142 8.394 8.654 8.923 9200 9.487 8.286 | 8.583 8.892 | 9.214 9.549 9.897 10 260 10.64 11.03 11.44 9.369 9.755 10.16 10.58 11.03 11.49 11.98 12.49 13.02 13.58 10.46 10.95 11.46 12.01 12.58 13.18 13.82 14.49 15.1915.94 11.57 12.17 12.81 13.49 14.21 14.97 15.78 16.65 1756 18.53 12.68 13.41 14.19 15.03 15.92 16.87 18.98 20.14 21.38 13.81 14.68 16.63 17.71 21.50 24.52 14.95 15.97 18.29 17.29 20.02 2158 23.28 25.13 27.15 29.36 31.77 18.64 21.82 25.67 23.66 35.95 27.89 33.00 30 32 18.43 20.01 21.76 23.70 19.61 21.41 23.41 25.65 22.84 25.12 27.67 24.30 26.87 25.78 97. 000 540 17.89 15.62 20.14 19.60 37 28 42.75 43.84 50.98 126 47.58 5572 65.08 75.84 88.21 102.4 118.8 437 3N B Print Done C : 1789 n%mm 21.82 35 95 | 48.8 | mH2SHB a w | 10.46 | 10.95 | 11.46 | 12.01 | 12.58 | 13.18 | 13 82 | 14.49 | 15.19 | 15.94 17.55 | 1934 | 20.30 157 | 12.17 | 12.81 | 13.49 | 4.21 14.97 16.65 18.53 23.04 24.35 12.68 | 13.41 | 14.19 | 15.03 | 15.92 | | 16.87 18.98 21.38 27.27 29.00 13.81 | 14.68 | 15.62 | 1663 17.71 18.88 21.50 24.52 32.09 14.95 | 15.97 17.09 | 19.60 22.55 24.21 27.98 16.10 1729 18.60 | 20.02 21.58 25.13 27.15 31.77 17.26 18.64 2016 23.66 20.01 21.76 25.84 30.84 33.75 | 40.54 | 21.41 23.41 28.13 34.00 37 45 | 41.30 | 45.60 | 55.75 | 68.39 75.84 2284 25.12 30.54 | 37 38 141 45 | 46.02 | 51.16 | 63.44 | 78.97 | 88 21 22.02 | | 24.30 26.87 41.00 | 45.76 151.16 | 57.28 | 2.05 | 91.02 | 1024 28.68 | 4.87 | 50.42 | 56.76 | 4.00 | 81.70 | 104.8 | 1188 24.47 30.54 34.25 38.51 | 49.01 | 5.46 | 62 87 | 71.40 | 92.50 | 1204 | 1376 25.72 | 28.85 32.45 | 362 41.43 | 47.00 | 53 44 | 60.89 | 69 53 | 79.54 | 104.6 | 138.3 | 1593 26.97 | 30.42 34.43 39.08 44.50 150 82 | 58.18 16.76 | 76.79 | 88.50 | 1182 | 158.7 | 184.2 32.03 36.46 47.73 54.86 | 63.25 | 73.11 | 84.70 | 98.35 | 1333 | 1819 212.8 38.55 51.11 68.68 795 | 93 32 | 1092 | 1503 | 208.3 | 245.7 40.71 154.67 74.48 87 35 | 1027 | | 121.1 | 169.4 238.5 ( 283.6 32.13 42 93 4997 58.40 68 53 | 0.70 195.34 | 113.0 | 134.2 | 190.7 2729 | 327.1 33.45 45 22 | 73 64 | 87.35 | 104.0 | 124.1 | 148.6 | | 214.6 | 3121 | 372 47 58 56.08 644 79.06 94.46 | 113.3 | 1363 | 164.5 | 3568 | | 4347 75.40 95.03 1208 259.1 | | 3379 | 4426| 767.1 1.342 | 1.779 1128 1527 | 2903 | 4065 5738 1815.1 1164 2 400 | 4.995 7218. 23 24 25.8 27 30 16 527 2413 | 1998 | 2093 Ft Done Print (Click the icon to vie Read the requirements Compute the payback for both options. Begin by completing the payback schedule for Option 1 (refurbish). Net Cash Outflows Amount Invested 1,300,000 Net Cash Inflows Annual Accumulated Year Choose from any list or enter any number in the input fields and then continue to the next question D era * P9 will Kilmer uses straight-line depreciation and requires an annual return of 12% years The payback for Option 1 (refurbish current machine) is Now complete the payback schedule for Option 2 (purchase) Net Cash Outflows Net Cash Inflows Year Amount invested Annual Accumulated 1,600,000 Choose from any list or enter any number in the input fields and then continue to the next question. O Type here to search libus attention Con to view additional information.) Kilmer expects the following net cash inflows from the two options: (Click the icon to view the net cash flows) Kilmer uses straight-line depreciation and requires an annual return of 12% 1,600,000 Read the (Round your answer to one decimal place.) The payback for Option 2 (purchase new machine) is chine) is years. Choose from any list or enter any number in the input fields and then continue to the next question Type here to search e a 9 Click the icon to view the net cash flows) Kilmer uses straight-line depreciation and requires an annual return of 12% (Click the icon (Click the icon Read the requirements Compute the ARR (accounting rate of return) for each of the options ARR Refurbish Purchase Compute the NPV for each of the options. Begin with Option 1 (refurbish) (Enter the factors to three decimal places. XXOOX Use parentheses or a minus sign for a Net Cash PV Factor Present Years Inflow (i = 12%) Value Present value of each year's inflow (n = 1) 2 (n = 3 (n = 3) 5 (n = 5) Choose from any list or enter any number in the input fields and then continue to the next question O Type here to search (Click the ice W y ds during machine that needs attention (Click the icon to view additional information.) Kilmer expects the following net cash inflows from the two options: B! (Click the icon to view the net cash flows.) Kilmer uses straight-line depreciation and requires an annual return of 12% (Click the i (Click the ico (Click the ico Read the requirements Net Cash Inflow PV Factor (i = 12%) Present Value Years Present value of each year's inflow (n = 1) (n=2) (n = 3) DAN (n = (n = 7) (n = 8) Total PV of cash inflows Initial investment 0 Choose from any list or enter any number in the input fields and then continue to the next question. # O Type here to search Questoh: 40 pts 3 of 3 (0 complete) Kilmer Manufacturing, Inc. has a manufacturing machine that needs attention (Click the icon to view additional information ) Kilmer expects the following net cash inflows from the two options: (Click the icon to view the net cash flows.) Kilmer uses straight-line depreciation and requires an annual return of 12% Read the te 8 (n = 8) Total PV of cash inflows O Initial investment Net present value of the project Now compute the NPV for Option 2 (purchase) (Enter the factors to three decimal places XXX Use parentheses or a minus sign for a negative Years Net Cash Inflow PV Factor (i-12%) Present Value 1 2 3 4 Present value of each year's inflow. (n = 1) (n=2) (n = 3) (n = 4) Choose from any list or enter any number in the input fields and then continue to the next question Type here to search Kilmer Manufacturing, Inc. has a manufacturing machine that needs attention (Click the icon to view additional information) Kilmer expects the following net cash inflows from the two options: :: (Click the icon to view the net cash flows.) Kilmer uses straight-line depreciation and requires an annual return of 12% Read the rec Now compute the NPV for Option 2 (purchase). (Enter the factors to three decimal places. XXXX. Use parentheses or a minus sign for a negative Net Cash PV Factor Present Years Inflow (1 - 12%) Value Present value of each year's inflow 1 (n = 1) 2 (n=2) (n = 3) (n = 4) 5 (n = 5) 6 (n=6) 7 (n = 7) 8 (n = 8) 9 (n=9) Choose from any list or enter any number in the input fields and then continue to the next question Type here to search Kilmer Manufacturing, Inc. has a manufacturing machine that needs attention (Click the icon to view additional information) Kimer expects the following net cash inflows from the two options (Click the icon to view the net cash flows) Kilmer uses straight-line depreciation and requires an annual return of 12% 6 (n=6) (n=7) Read the (n = 8) (n=9) (n = 10) Total PV of cash inflows Initial investment 0 Net present value of the project Finally, compute the profitability index for each option (Round to two decimal places XXX) Refurbish Purchase Profitability index Requirement 2. Which notion should Kilmer choose? Why? Choose from any list or enter any number in the input fields and then continue to the next question O Type here to search Total PV of cash inflows 0 talvestment Not present value of the project Finally, compute the profitability index for each option (Round to two decimal places XXX) Reuth Purchase Requirement 2. Which option should Kilmer choose? Why? HOW YOUwers in Roquement 1 K ot should choose because this options back poned, an ARR that is option NV and is problems Choose from any or enter any number in the input fields and then continue to the next question O Type here to search