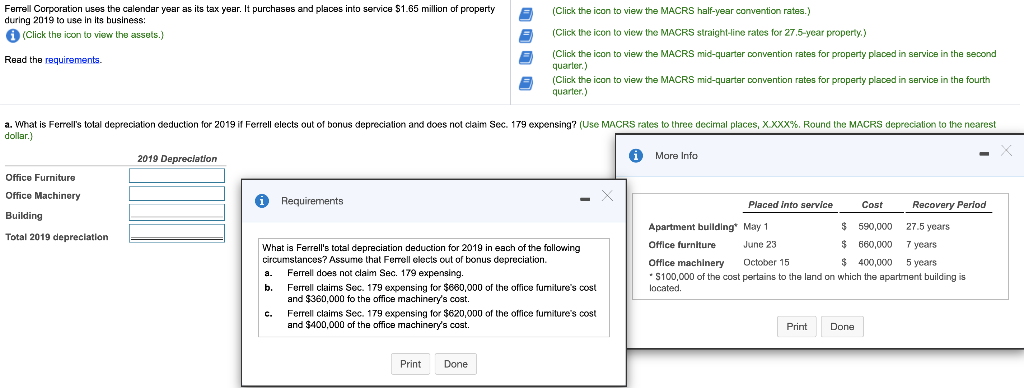

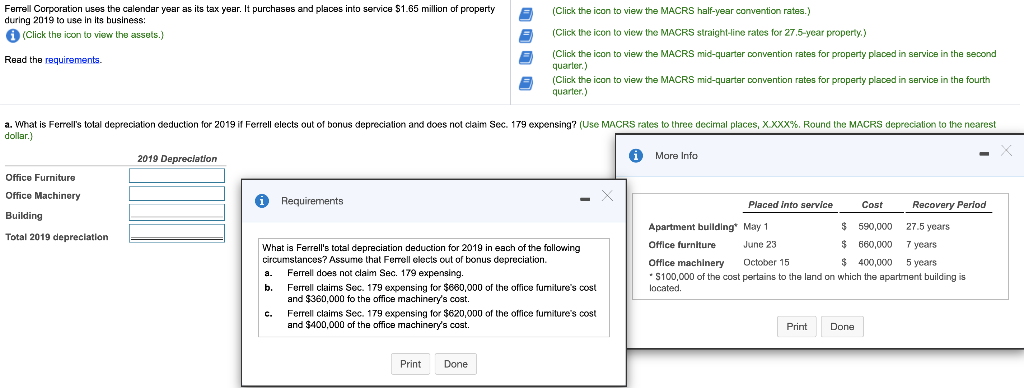

(Click the icon to view the MACRS half-year convention rates.) Ferrell Corporation uses the calendar year as its tax year. It purchases and places into service $1.65 million of property during 2019 to use in its business: (Click the icon to view the assets.) (Click the icon to view the MACRS straight-line rates for 27.5-year property.) Read the requirements. (Click the icon to view the MACRS mid-quarter convention rates for property placed in service in the second quarter.) (Click the icon to view the MACRS mid-quarter convention rates for property placed in service in the fourth quarter.) a. What is Ferrell's total depreciation deduction for 2019 if Ferrell elects out of bonus depreciation and does not claim Sec. 179 expensing? (Use MACRS rates to three decimal places, XXXX%. Round the MACRS depreciation to the nearest dollar.) i More Info 2019 Depreciation Requirements Office Furniture Office Machinery Building Total 2019 depreciation What is Ferrell's total depreciation deduction for 2019 in each of the following circumstances? Assume that Ferrell clecls out of bonus depreciation a. Ferrell does not claim Sec. 179 expensing. b. Ferrell claims Soc. 179 expensing for $680,000 of the office furniture's cost and $360,000 fo the office machinery's cost. c. Ferrell claims Sec. 179 expensing for $620,000 of the office furniture's cost and $400,000 of the office machinery's cost. Placed into service Cost Recovery Period Apartment building* May 1 $ 590,000 27.5 years Office furniture June 23 $ 660,000 7 years Office machinery October 15 $ 400,000 5 years * S100,000 of the cost pertains to the land on which the apartment building is located. Print Done Print Done (Click the icon to view the MACRS half-year convention rates.) Ferrell Corporation uses the calendar year as its tax year. It purchases and places into service $1.65 million of property during 2019 to use in its business: (Click the icon to view the assets.) (Click the icon to view the MACRS straight-line rates for 27.5-year property.) Read the requirements. (Click the icon to view the MACRS mid-quarter convention rates for property placed in service in the second quarter.) (Click the icon to view the MACRS mid-quarter convention rates for property placed in service in the fourth quarter.) a. What is Ferrell's total depreciation deduction for 2019 if Ferrell elects out of bonus depreciation and does not claim Sec. 179 expensing? (Use MACRS rates to three decimal places, XXXX%. Round the MACRS depreciation to the nearest dollar.) i More Info 2019 Depreciation Requirements Office Furniture Office Machinery Building Total 2019 depreciation What is Ferrell's total depreciation deduction for 2019 in each of the following circumstances? Assume that Ferrell clecls out of bonus depreciation a. Ferrell does not claim Sec. 179 expensing. b. Ferrell claims Soc. 179 expensing for $680,000 of the office furniture's cost and $360,000 fo the office machinery's cost. c. Ferrell claims Sec. 179 expensing for $620,000 of the office furniture's cost and $400,000 of the office machinery's cost. Placed into service Cost Recovery Period Apartment building* May 1 $ 590,000 27.5 years Office furniture June 23 $ 660,000 7 years Office machinery October 15 $ 400,000 5 years * S100,000 of the cost pertains to the land on which the apartment building is located. Print Done Print Done