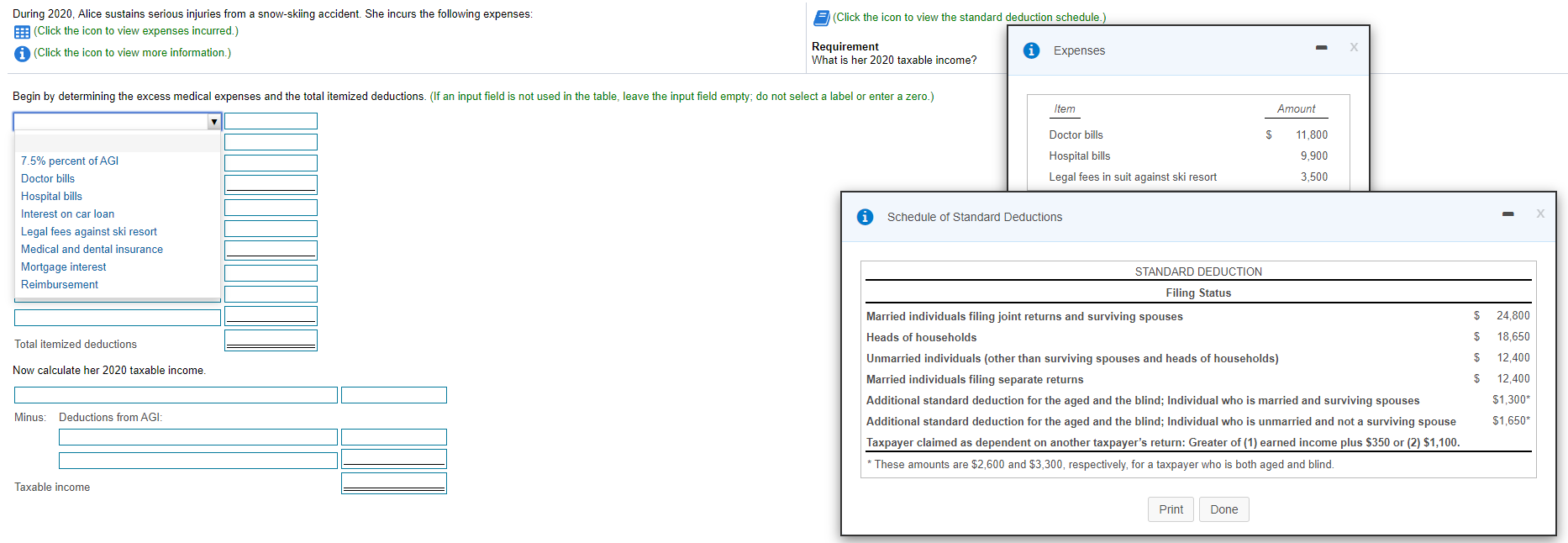

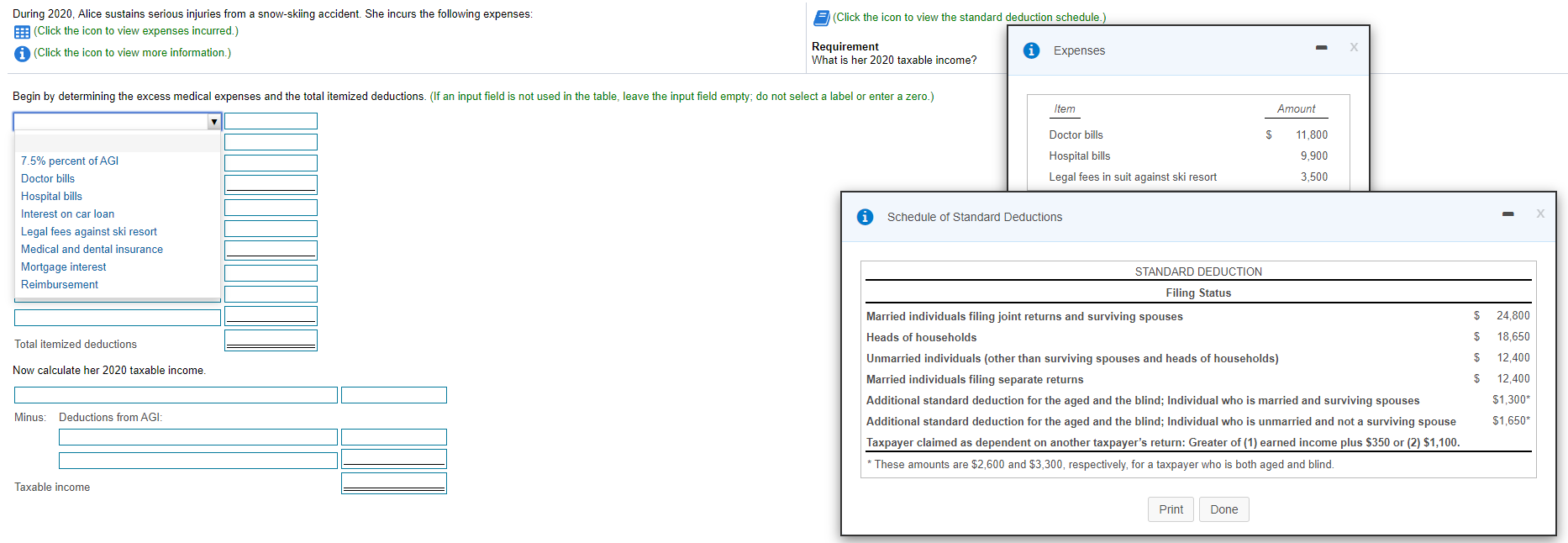

(Click the icon to view the standard deduction schedule.) During 2020, Alice sustains serious injuries from a snow-skiing accident. She incurs the following expenses: (Click the icon to view expenses incurred.) (Click the icon to view more information.) Requirement What is her 2020 taxable income? Expenses Begin by determining the excess medical expenses and the total itemized deductions. (If an input field is not used in the table, leave the input field empty; do not select a label or enter a zero.) Item Amount v 11,800 Doctor bills Hospital bills Legal fees in suit against ski resort 9,900 3,500 7.5% percent of AGI Doctor bills Hospital bills Interest on car loan Legal fees against ski resort Medical and dental insurance Mortgage interest Reimbursement Schedule of Standard Deductions STANDARD DEDUCTION Filing Status Married individuals filing joint returns and surviving spouses Heads of households $ 24,800 $ Total itemized deductions 18,650 12,400 $ Now calculate her 2020 taxable income. $ 12,400 $1,300* Minus: Deductions from AGI: Unmarried individuals (other than surviving spouses and heads of households) Married individuals filing separate returns Additional standard deduction for the aged and the blind; Individual who is married and surviving spouses Additional standard deduction for the aged and the blind; Individual who is unmarried and not a surviving spouse Taxpayer claimed as dependent on another taxpayer's return: Greater of (1) earned income plus $350 or (2) $1,100. * These amounts are $2,600 and $3,300, respectively, for a taxpayer who is both aged and blind. $1,650* Taxable income Print Done (Click the icon to view the standard deduction schedule.) During 2020, Alice sustains serious injuries from a snow-skiing accident. She incurs the following expenses: (Click the icon to view expenses incurred.) (Click the icon to view more information.) Requirement What is her 2020 taxable income? Expenses Begin by determining the excess medical expenses and the total itemized deductions. (If an input field is not used in the table, leave the input field empty; do not select a label or enter a zero.) Item Amount v 11,800 Doctor bills Hospital bills Legal fees in suit against ski resort 9,900 3,500 7.5% percent of AGI Doctor bills Hospital bills Interest on car loan Legal fees against ski resort Medical and dental insurance Mortgage interest Reimbursement Schedule of Standard Deductions STANDARD DEDUCTION Filing Status Married individuals filing joint returns and surviving spouses Heads of households $ 24,800 $ Total itemized deductions 18,650 12,400 $ Now calculate her 2020 taxable income. $ 12,400 $1,300* Minus: Deductions from AGI: Unmarried individuals (other than surviving spouses and heads of households) Married individuals filing separate returns Additional standard deduction for the aged and the blind; Individual who is married and surviving spouses Additional standard deduction for the aged and the blind; Individual who is unmarried and not a surviving spouse Taxpayer claimed as dependent on another taxpayer's return: Greater of (1) earned income plus $350 or (2) $1,100. * These amounts are $2,600 and $3,300, respectively, for a taxpayer who is both aged and blind. $1,650* Taxable income Print Done