Answered step by step

Verified Expert Solution

Question

1 Approved Answer

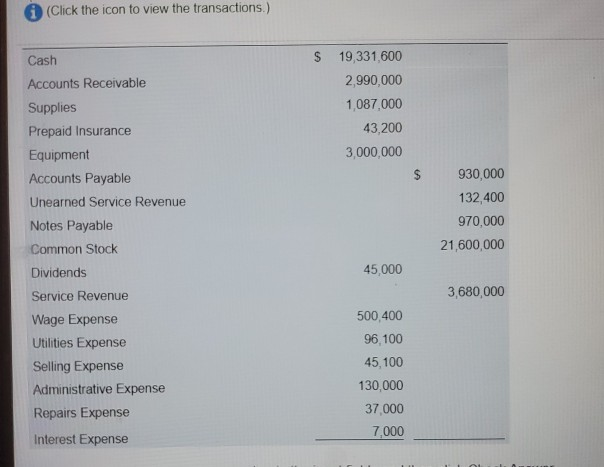

(Click the icon to view the transactions.) $ 19,331,600 2,990,000 1,087,000 43,200 3,000,000 $ Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accounts Payable Unearned Service

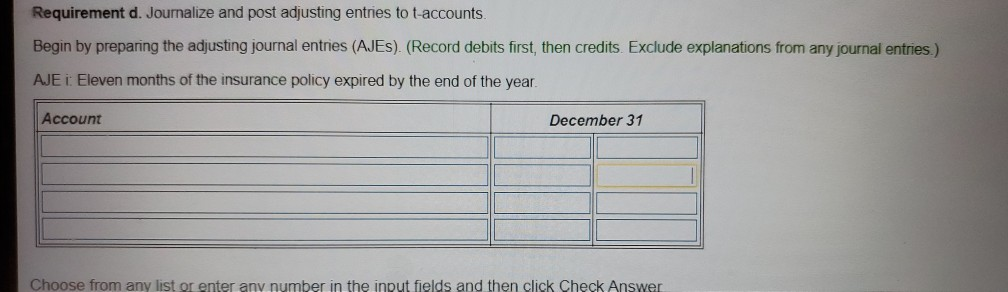

(Click the icon to view the transactions.) $ 19,331,600 2,990,000 1,087,000 43,200 3,000,000 $ Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accounts Payable Unearned Service Revenue Notes Payable Common Stock Dividends Service Revenue Wage Expense Utilities Expense Selling Expense Administrative Expense Repairs Expense Interest Expense 930,000 132,400 970,000 21,600,000 45,000 3,680,000 500,400 96 100 45,100 130,000 37,000 7,000 Requirement d. Journalize and post adjusting entries to t-accounts. Begin by preparing the adjusting journal entries (AJES). (Record debits first, then credits. Exclude explanations from any journal entries.) AJE : Eleven months of the insurance policy expired by the end of the year. Account December 31 Choose from any list or enter any number in the input fields and then click Check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started