Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Click to see additional instructions The yield from an investment in government stocks on the Ghana Stock Exchange is expected to be Hight with a

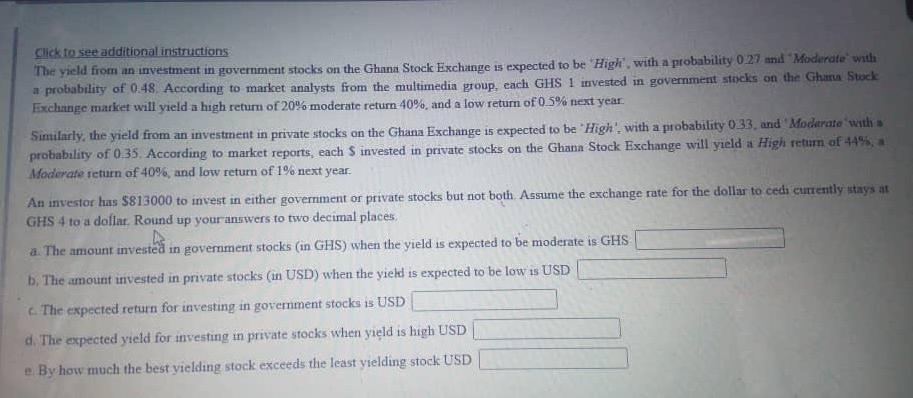

Click to see additional instructions The yield from an investment in government stocks on the Ghana Stock Exchange is expected to be "Hight with a probability 0.27 mm Moderate with a probability of 0.48. According to market analysts from the multimedia group, cach GHS 1 invested in government stocks on the Ghar Stock Exchange market will yield a high return of 20% moderate return 40%, and a low return of 0.5% next year Similarly, the yield from an investment in private stocks on the Ghana Exchange is expected to be "High" with a probability 033 and Moderate with probability of 0.35. According to market reports, each s invested in private stocks on the Ghann Stock Exchange will yield a High return of 44%, a Moderate return of 40%, and low return of 1% next year. An investor has $813000 to invest in either government or private stocks but not both Assume the exchange rate for the dollar to cedi currently stays at GHS 4 to a dofint. Round up your answers to two decimal places a. The amount invested in government stocks (in GHS) when the yield is expected to be moderate is GHS b. The amount invested in private stocks (in USD) when the yield is expected to be low is USD c. The expected return for investing in government stocks is USD d. The expected yield for investing in private stocks when yield is high USD e By how much the best vielding stock exceeds the least vielding stock USD

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started