Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Click to view the Single Persons - Semimonthly Payroll Period. The withholding tax is ? Portion of IRS Withholding Table for Single Persons Paid Semimonthly

Click to view the Single PersonsSemimonthly Payroll Period.

The withholding tax is

Portion of IRS Withholding Table for Single Persons Paid Semimonthly

tabletableSINGLE PFor WagtablePersons SEes Paid ThEMrough,Decem,Y Paroll Period,,,,,,

tableAnd the wagesareAnd the number of withholding allowances claimed isAt least,tableBut lessthanThe amount of income tax to be withheld is $$$$$$$$$$$$$

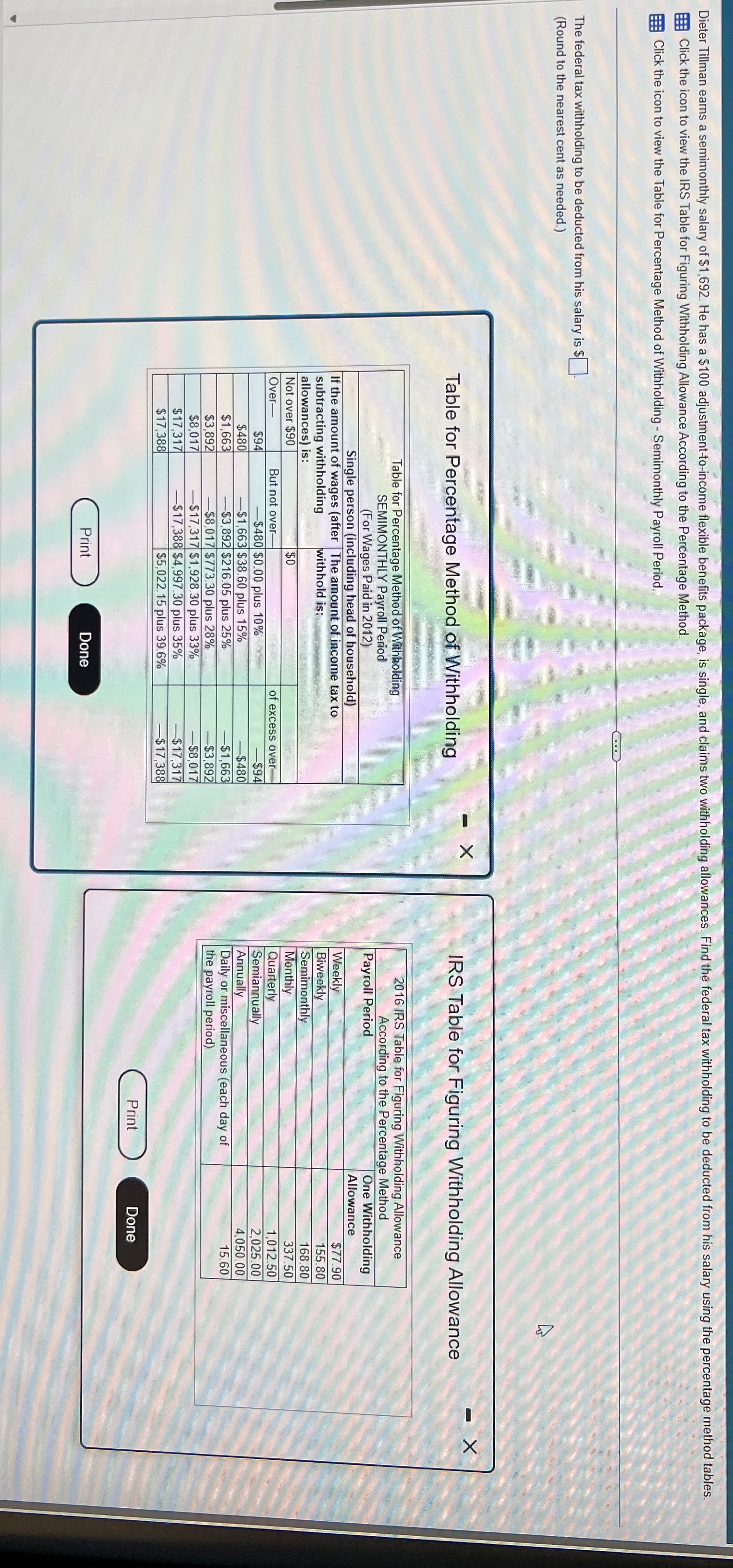

Click the icon to view the IRS Table for Figuring Withholding Allowance According to the Percentage Method.

Click the icon to view the Table for Percentage Method of Withholding Semimonthly Payroll Period

The federal tax withholding to be deducted from his salary is $

Round to the nearest cent as needed.

Table for Percentage Method of Withholding

tabletableTable for Percentage Method of WithholdingSEMIMONTHLY Payroll PeriodFor Wages Paid in Single person including head of householdtableIf the amount of wages aftersubtracting withholdingallowances is:tableThe amount of income tax towithhold is:Not over $$OverBut not overof excess over$ $$ plus $$ $$ plus $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started