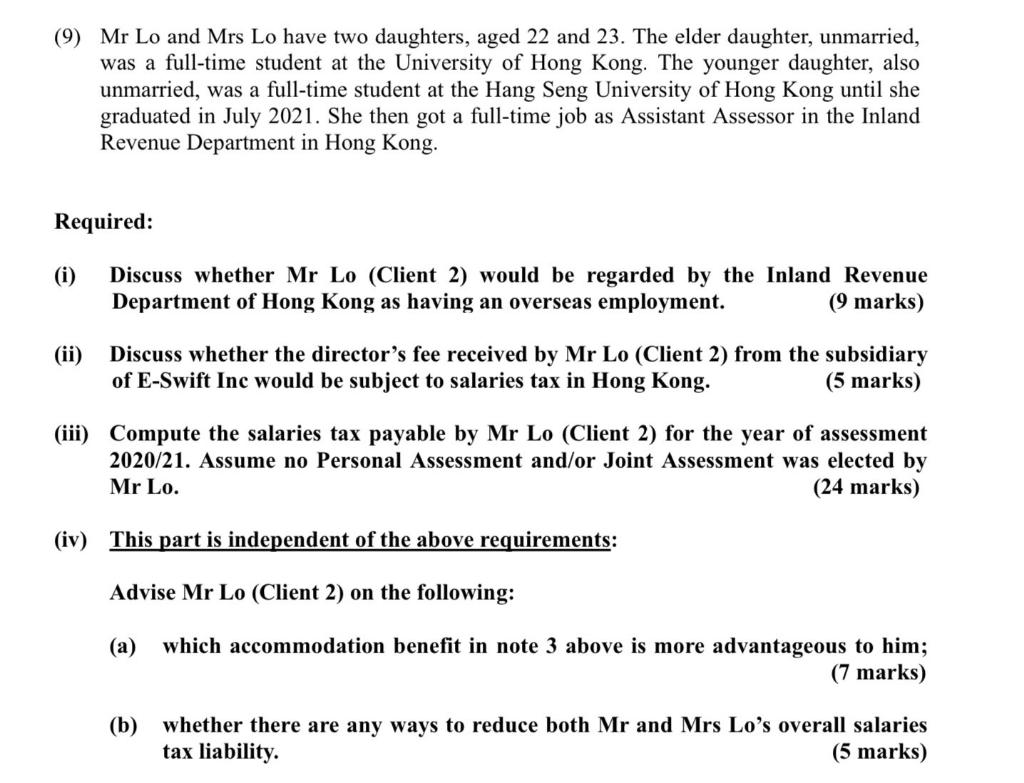

Client 2- Mr Lo Mr Lo was born in the USA and his family has always been living in San Francisco. He was employed by E-Swift Inc, a company incorporated in San Francisco, USA as the Chief Information Officer of its branch office in Hong Kong. All directors' meetings of the company were held in San Francisco. His employment contract was negotiated and signed in the USA by Mr Lo and E-Swift Inc. He was paid by the company in US dollars and his salary for the year was deposited into his account with Wanchai branch of the Citibank. Mr Lo arrived in Hong Kong with his wife and two children and reported his duty on 1 April 2020. For the year ended 31 March 2021, Mr Lo provided the following information to you (all amounts are denominated in Hong Kong dollars): (1) During the year, he spent 73 days working outside Hong Kong in the company's representative office in Beijing, China. No annual leave was taken by Mr Lo during the year. (2) Apart from its representative office in Beijing, E-Swift Inc also had a subsidiary in Shenzhen, China. Mr Lo was one of the directors of this subsidiary. All directors' meetings of this subsidiary were held in Shenzhen. He was paid a director fee of $50,000 for this post. (3) E-Swift Inc gave Mr Lo an option of being remunerated with a salary of $50,000 per month plus a rent-free accommodation benefit in the company's quarters at Taikoo Shing. The flat at Taikoo Shing was owned by E-Swift Inc and might be let out for $50,000 rental per month. Another option was a monthly salary of $60,000 plus $40,000 accommodation allowance per month. Mr Lo opted for the second option and rented a flat in Happy Valley for $40,000. (4) Pursuant to E-Swift Inc's staff share option scheme, Mr Lo was granted 5,000 options on 1 December 2020 (market value $30 per share) with no option cost. The exercise price of the option is $15 per share. Mr Lo exercised the options on 1 March 2021 (market value $25 per share) and sold all the shares on 30 March 2021 (market value $28 per share). (5) Mr Lo subscribed to a magazine called "Global Big Data' to keep himself abreast of the current business environment with an annual subscription of $1,000. He also purchased a laptop computer (costing $20,000) which he used to send emails and prepare his PowerPoint presentations. This laptop computer saved him enormous amount of time, especially when in his hotel room in Beijing and Shenzhen. He used the computer exclusively for work purposes. (6) Mr Lo contributed 5% towards his MPF during the year. (7) Mr Lo's wife worked as a part time media copywriter under a Hong Kong employment and earned a salary of $60,000 in the year. (8) Mr Lo's father-in-law, aged 65, had previously lived alone in Sai Kung, became ill and was unable to take care of himself. On 1 December 2020, Mr Lo sent his father-in-law to a nursing home (registered under the Nursery Homes and Maternity Homes Registration Ordinance) in Shau Kei Wan. Thereafter he paid all the nursing care, accommodation and food bills amounting $20,000 per month. (9) Mr Lo and Mrs Lo have two daughters, aged 22 and 23. The elder daughter, unmarried, was a full-time student at the University of Hong Kong. The younger daughter, also unmarried, was a full-time student at the Hang Seng University of Hong Kong until she graduated in July 2021. She then got a full-time job as Assistant Assessor in the Inland Revenue Department in Hong Kong. Required: (i) Discuss whether Mr Lo (Client 2) would be regarded by the Inland Revenue Department of Hong Kong as having an overseas employment. (9 marks) (ii) Discuss whether the director's fee received by Mr Lo (Client 2) from the subsidiary of E-Swift Inc would be subject to salaries tax in Hong Kong. (5 marks) (iii) Compute the salaries tax payable by Mr Lo (Client 2) for the year of assessment 2020/21. Assume no Personal Assessment and/or Joint Assessment was elected by Mr Lo. (24 marks) (iv) This part is independent of the above requirements: Advise Mr Lo (Client 2) on the following: (a) which accommodation benefit in note 3 above is more advantageous to him; (7 marks) (b) whether there are any ways to reduce both Mr and Mrs Lo's overall salaries tax liability. (5 marks) Client 2- Mr Lo Mr Lo was born in the USA and his family has always been living in San Francisco. He was employed by E-Swift Inc, a company incorporated in San Francisco, USA as the Chief Information Officer of its branch office in Hong Kong. All directors' meetings of the company were held in San Francisco. His employment contract was negotiated and signed in the USA by Mr Lo and E-Swift Inc. He was paid by the company in US dollars and his salary for the year was deposited into his account with Wanchai branch of the Citibank. Mr Lo arrived in Hong Kong with his wife and two children and reported his duty on 1 April 2020. For the year ended 31 March 2021, Mr Lo provided the following information to you (all amounts are denominated in Hong Kong dollars): (1) During the year, he spent 73 days working outside Hong Kong in the company's representative office in Beijing, China. No annual leave was taken by Mr Lo during the year. (2) Apart from its representative office in Beijing, E-Swift Inc also had a subsidiary in Shenzhen, China. Mr Lo was one of the directors of this subsidiary. All directors' meetings of this subsidiary were held in Shenzhen. He was paid a director fee of $50,000 for this post. (3) E-Swift Inc gave Mr Lo an option of being remunerated with a salary of $50,000 per month plus a rent-free accommodation benefit in the company's quarters at Taikoo Shing. The flat at Taikoo Shing was owned by E-Swift Inc and might be let out for $50,000 rental per month. Another option was a monthly salary of $60,000 plus $40,000 accommodation allowance per month. Mr Lo opted for the second option and rented a flat in Happy Valley for $40,000. (4) Pursuant to E-Swift Inc's staff share option scheme, Mr Lo was granted 5,000 options on 1 December 2020 (market value $30 per share) with no option cost. The exercise price of the option is $15 per share. Mr Lo exercised the options on 1 March 2021 (market value $25 per share) and sold all the shares on 30 March 2021 (market value $28 per share). (5) Mr Lo subscribed to a magazine called "Global Big Data' to keep himself abreast of the current business environment with an annual subscription of $1,000. He also purchased a laptop computer (costing $20,000) which he used to send emails and prepare his PowerPoint presentations. This laptop computer saved him enormous amount of time, especially when in his hotel room in Beijing and Shenzhen. He used the computer exclusively for work purposes. (6) Mr Lo contributed 5% towards his MPF during the year. (7) Mr Lo's wife worked as a part time media copywriter under a Hong Kong employment and earned a salary of $60,000 in the year. (8) Mr Lo's father-in-law, aged 65, had previously lived alone in Sai Kung, became ill and was unable to take care of himself. On 1 December 2020, Mr Lo sent his father-in-law to a nursing home (registered under the Nursery Homes and Maternity Homes Registration Ordinance) in Shau Kei Wan. Thereafter he paid all the nursing care, accommodation and food bills amounting $20,000 per month. (9) Mr Lo and Mrs Lo have two daughters, aged 22 and 23. The elder daughter, unmarried, was a full-time student at the University of Hong Kong. The younger daughter, also unmarried, was a full-time student at the Hang Seng University of Hong Kong until she graduated in July 2021. She then got a full-time job as Assistant Assessor in the Inland Revenue Department in Hong Kong. Required: (i) Discuss whether Mr Lo (Client 2) would be regarded by the Inland Revenue Department of Hong Kong as having an overseas employment. (9 marks) (ii) Discuss whether the director's fee received by Mr Lo (Client 2) from the subsidiary of E-Swift Inc would be subject to salaries tax in Hong Kong. (5 marks) (iii) Compute the salaries tax payable by Mr Lo (Client 2) for the year of assessment 2020/21. Assume no Personal Assessment and/or Joint Assessment was elected by Mr Lo. (24 marks) (iv) This part is independent of the above requirements: Advise Mr Lo (Client 2) on the following: (a) which accommodation benefit in note 3 above is more advantageous to him; (7 marks) (b) whether there are any ways to reduce both Mr and Mrs Lo's overall salaries tax liability