Answered step by step

Verified Expert Solution

Question

1 Approved Answer

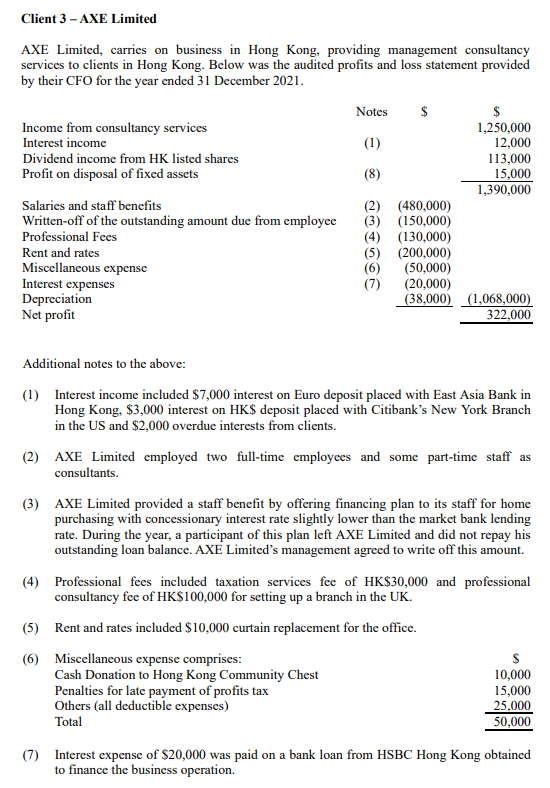

Client 3- AXE Limited AXE Limited, carries on business in Hong Kong, providing management consultancy services to clients in Hong Kong. Below was the

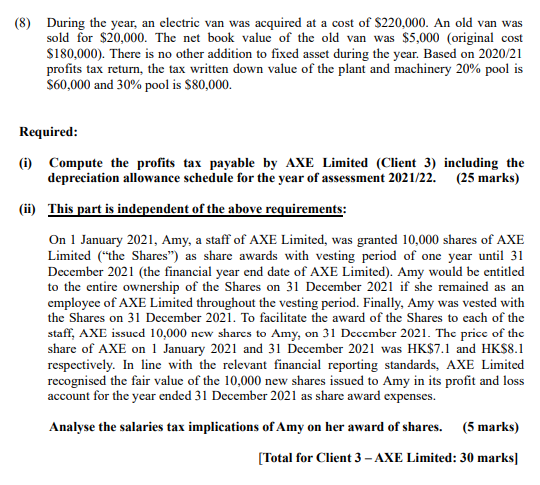

Client 3- AXE Limited AXE Limited, carries on business in Hong Kong, providing management consultancy services to clients in Hong Kong. Below was the audited profits and loss statement provided by their CFO for the year ended 31 December 2021. Income from consultancy services Interest income Dividend income from HK listed shares Profit on disposal of fixed assets Salaries and staff benefits Written-off of the outstanding amount due from employee Professional Fees Rent and rates Miscellaneous expense Interest expenses Depreciation Net profit Notes $ (1) (8) (2) (480,000) (3) (150,000) (4) (130,000) (5) (200,000) (50,000) (20,000) (38,000) $ 1,250,000 12,000 (5) (6) 113,000 15,000 1,390,000 (1,068,000) 322,000 Additional notes to the above: (1) Interest income included $7,000 interest on Euro deposit placed with East Asia Bank in Hong Kong, $3,000 interest on HK$ deposit placed with Citibank's New York Branch in the US and $2,000 overdue interests from clients. (2) AXE Limited employed two full-time employees and some part-time staff as consultants. (3) AXE Limited provided a staff benefit by offering financing plan to its staff for home purchasing with concessionary interest rate slightly lower than the market bank lending rate. During the year, a participant of this plan left AXE Limited and did not repay his outstanding loan balance. AXE Limited's management agreed to write off this amount. (4) Professional fees included taxation services fee of HK$30,000 and professional consultancy fee of HK$100,000 for setting up a branch in the UK. Rent and rates included $10,000 curtain replacement for the office. Miscellaneous expense comprises: Cash Donation to Hong Kong Community Chest Penalties for late payment of profits tax Others (all deductible expenses) Total $ 10,000 15,000 25,000 50,000 (7) Interest expense of $20,000 was paid on a bank loan from HSBC Hong Kong obtained to finance the business operation. (8) During the year, an electric van was acquired at a cost of $220,000. An old van was sold for $20,000. The net book value of the old van was $5,000 (original cost $180,000). There is no other addition to fixed asset during the year. Based on 2020/21 profits tax return, the tax written down value of the plant and machinery 20% pool is $60,000 and 30% pool is $80,000. Required: (i) Compute the profits tax payable by AXE Limited (Client 3) depreciation allowance schedule for the year of assessment 2021/22. (ii) This part is independent of the above requirements: On 1 January 2021, Amy, a staff of AXE Limited, was granted 10,000 shares of AXE Limited ("the Shares") as share awards with vesting period of one year until 31 December 2021 (the financial year end date of AXE Limited). Amy would be entitled to the entire ownership of the Shares on 31 December 2021 if she remained as an employee of AXE Limited throughout the vesting period. Finally, Amy was vested with the Shares on 31 December 2021. To facilitate the award of the Shares to each of the staff, AXE issued 10,000 new shares to Amy, on 31 December 2021. The price of the share of AXE on 1 January 2021 and 31 December 2021 was HK$7.1 and HK$8.1 respectively. In line with the relevant financial reporting standards, AXE Limited recognised the fair value of the 10,000 new shares issued to Amy in its profit and loss account for the year ended 31 December 2021 as share award expenses. Analyse the salaries tax implications of Amy on her award of shares. (5 marks) [Total for Client 3-AXE Limited: 30 marks] including the (25 marks)

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Part i Computation of Profits Tax Payable for AXE Limited Income from Consultancy Services 1250000 Interest Income Euro deposit interest 7000 HKS depo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started