Section 1 Personal Information (1) Tim Choi, HKID D987654(3); Grace Lam: HKID D123456(7). Both are HKPR. (2) Tim and Grace are married with three

Section 1 – Personal Information

(1) Tim Choi, HKID D987654(3); Grace Lam: HKID D123456(7). Both are HKPR.

(2) Tim and Grace are married with three children, Daniel and Maria, their biological children and Joy, their adopted children since 2015, with information below:

- Daniel Choi, HKID P604578(2), DOB May 2, 2002, unmarried and currently a full-time student at University of Manchester.

- Maria Choi, HKID R297364(3), DOB September 23, 2004, unmarried and currently studying Form 6 at a local secondary school. -

Joy Mohamed, HKID Q234123(4), DOB January 5, 2013, unmarried and currently studying Primary 6 at a local primary school.

(3) Tim and his family reside at Flat 36B, Windsor Court, 1 King Kwong Street, Happy Valley, Hong Kong . The apartment was rented by Tim since six years ago.

(4) Tim’s daytime phone number is 2825 1234 and Tim’s mobile is 6030 0030. Grace’s daytime phone number is 3535 8282 and her mobile number is 9027 0203.

(5) Grace is a housewife. She is the only child of her mother who lives in a registered nursing home called Heavenly Elderly Village in Shatin. The nursing home bills for the year amount to $150,000, which was paid by Tim. On top of this, Grace paid $2,000 per month to her mother as petty cash. Personal information about Grace’s mother is below: - Name: Ms Sin Ping Cheung; - DOB: April 7, 1935; - HKID: A308302(1)

(6) Tim’s parents are living away from the couple. Tim paid $10,000 per month to his parents. It has been agreed between Tim and his elder sister that the dependent parent allowance for the parents will be claimed by his elder sister.

(7) Tim has a disabled younger sister Tammy, aged 35 – Tim has maintained her throughout her life. Tammy is living in Hong Kong and taken care of by a domestic helper paid by Tim at $5,000 per month and lived in rented apartment paid by Tim at $15,000 per month.

Section 2 – Financial Information

(8) Tim is employed as chief executive officer by Resonance Ltd, a company carrying on trading business in Hong Kong since 1 May 2000. The following information relates to Tim concerning the year of assessment 2020/21:

(i) Salaries and commission of $2,400,000, subject to a deduction of 5% as his contribution to the mandatory provident fund (MPF)

(ii) Performance bonus for the year: a Rolex gold watch valued at HK$50,000. (iii) During the year, $90,000 was paid out of a discretionary trust set up by Resonance Ltd directly to University of Manchester for the tuition fees of Tim’s son, Daniel. (iv) Tim was granted an allowance of $48,000 in December 2020 for the purchase of a holiday passage, of which he spent $20,000 when he was on vacation leave in January 2021. He spent the remaining $5,000 buying souvenir and gifts for his colleagues during the trip.

(v) Tim’s personal utility bills were borne by Resonance Ltd, totaling $24,000 for the year.

(vi) Tim rented his current residence in Happy Valley for $40,000 per month and received full reimbursement from his employer as housing reimbursement. Tim has submitted the lease contract and rental receipts to his employer as evidence.

(vii) Resonance Ltd operates an employee share option scheme. On 1 November 2020, Tim was granted an option to buy 10,000 shares at a cost of $500. The exercise price is $30 per share. On 5 January 2021, he exercised the option to buy 5,000 shares and sold the option for the balance of the shares to another staff at $1,000. Tim sold all his shares on 10 January 2021. The market price of the shares was as follows: - $50 per share on 5 January 2021 - $60 per share on 10 January 2021

(viii) During the year, Tim had an accident and was hospitalized for two weeks. Total hospital bill was $100,000. Tim received full reimbursement from the insurance company for Resonance Ltd had a very good group medical insurance plan for their senior staff. Tim also paid extra $50,000 to upgrade his room from a semi-private room to a private room for more privacy. He did not get a reimbursement for this amount.

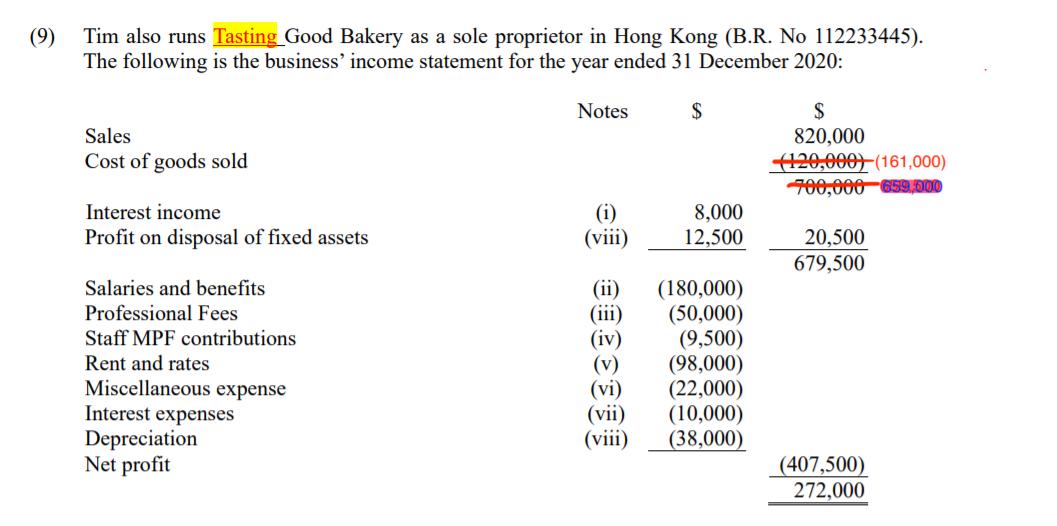

(9)

Additional information:

(i) Interest income includes $5,000 interest on US$ deposit placed in a HK bank and $2,000 interest on HK$ deposit placed in a UK bank and $1,000 overdue interests from restaurant customers.

(ii) There is only one employee working as shop supervisor for the bakery – Peter Chan, 26, unmarried, living at Room 1403, Yue Man Building, Hing Man Estate, Chai Wan, Hong Kong. Peter does not receive any remuneration other than salaries.

(iii) Professional fee includes $15,500 being tax advisory fees on tax filing as well as tax planning. Others relate to audit and accounting fees. (iv) The contributions to MPF schemes for staff represent 5% of the basic salary of staff.

(v) Rent and rates include $10,000 carpet replacement for the shop.

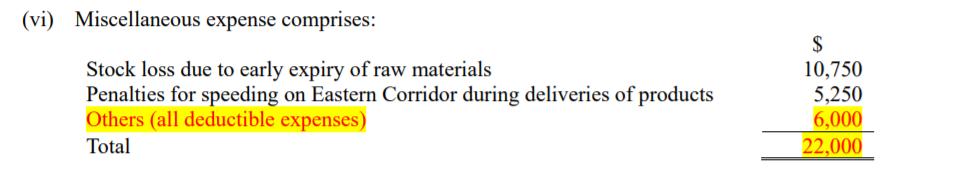

(vi)

(vii) Interest expense of $12,000 $10,000 was paid on a bank loan obtained to finance the business operation. The loan was secured by personal guarantee given by Tim.

(viii) During the year, an old delivery van was traded-in for $14,500 to acquire an electric van which had a cost of $90,000. The net book value of the old van was $8,000 (original cost $105,000). There is no other addition to fixed asset during the year. Based on 2019/20 profits tax return, the tax written down value of the plant and machinery 20% pool is $50,000 and 30% pool is $60,000.

(10) On 1 April 2020, Tim signed the ASP to purchase a residential property (first-time in his life buying properties) located at Flat D203, Block 2, Watsons Tower, Tin Hau, Hong Kong. Total costs paid by Tim included: - acquisition cost (consideration): $10,200,000 - legal cost and agency fee: $100,000 - renovation cost: $1,000,000 The property was subsequently leased out under the following terms:

(i) Term of lease: two years from 1 July 2020

(ii) Monthly rental: $48,000

(iii) Rent deposit: $96,000 paid on signing the lease agreement

(iv) Management fee: $3,500 per month, payable by the tenant to management company

(v) Rates: $4,000 per quarter, payable by the landlord to the government

(vi) Tenant failed to pay rent since 1 January 2021.

Tim was informed by the management company that the tenant had moved out on 28 February 2021 and could not be contacted. Tim partly financed the acquisition of the apartment through a mortgage from HSBC. The total amount of mortgage interest paid by Tim is $200,000 for the year ended 31 March 2021.

(11) On 1 May 2020, Grace bought a factory space located at Room 1407, 14/F, Block C, Hong Kong Industrial Building, 444 Des Voeux Road West, Sai Wan. The space was leased out under the following terms:

(i) Term of lease: three years from 1 July 2020

(ii) Monthly rental: $25,000

(iii) Rent-free period: one month from 1 July 2020

(iv) Rent deposit: $50,000 paid on signing the lease agreement

(v) Premium: $25,000 paid on signing the lease agreement

(vi) Management fee: $2,000, payable by the tenant to the management company

(vii) Rates: $2,500 per quarter, payable by the landlord to the government Grace paid a total of $150,000 as legal fee and stamp duty on the acquisition, and $25,000 as agency fee for the leasing. She financed the acquisition of the factory space by way of a loan borrowed from a relative called Rosemary Leung who is currently living in the UK. During the year ended 31 March 2021, Grace paid loan interest of $150,000 to Rosemary.

Questions

1. Salaries Tax Computation 2020/21 for Tim showing salaries tax payable. (28 marks)

2. Profits Tax Computation 2020/21 for Tasting Good Bakery showing profits tax payable including Depreciation Allowance Schedule. (22 marks)

(9) Tim also runs Tasting Good Bakery as a sole proprietor in Hong Kong (B.R. No 112233445). The following is the business' income statement for the year ended 31 December 2020: Sales Cost of goods sold Interest income Profit on disposal of fixed assets Salaries and benefits Professional Fees Staff MPF contributions Rent and rates Miscellaneous expense Interest expenses Depreciation Net profit Notes (i) (viii) (ii) (iii) (iv) (v) (vi) (vii) (viii) $ 8,000 12,500 (180,000) (50,000) (9,500) (98,000) (22,000) (10,000) (38,000) $ 820,000 (120,000) (161,000) 700,000 659,000 20,500 679,500 (407,500) 272,000

Step by Step Solution

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Salaries Tax Computation 202021 for Tim showing salaries tax payable Income from salaries and comm...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started