Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Client B-Elisha Simpson (Background Information) Elisha Simpson created a self-managed superfund called the Dragon Superannuation fund last year, and it is a complying superannuation

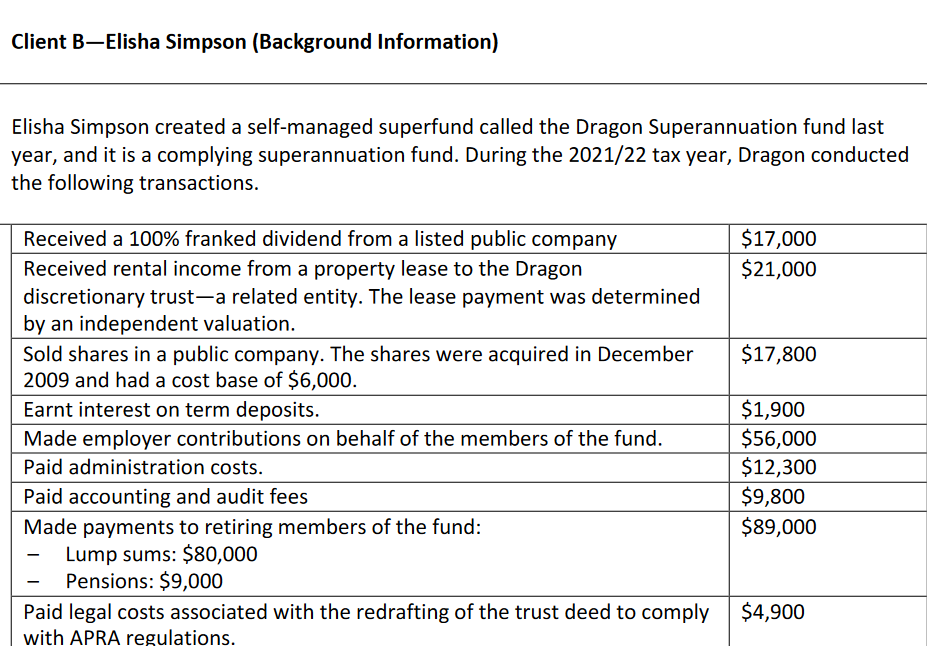

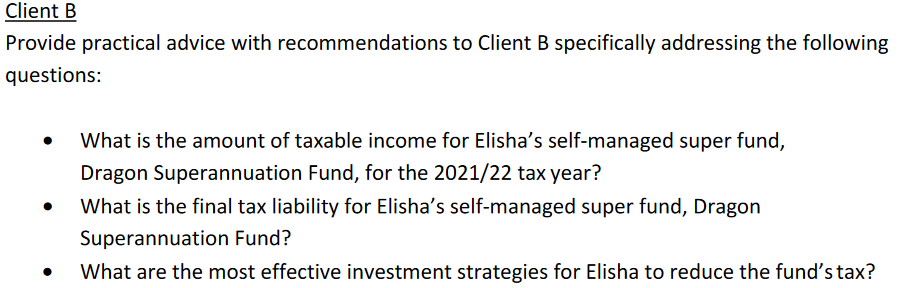

Client B-Elisha Simpson (Background Information) Elisha Simpson created a self-managed superfund called the Dragon Superannuation fund last year, and it is a complying superannuation fund. During the 2021/22 tax year, Dragon conducted the following transactions. Received a 100% franked dividend from a listed public company Received rental income from a property lease to the Dragon discretionary trust-a related entity. The lease payment was determined by an independent valuation. Sold shares in a public company. The shares were acquired in December 2009 and had a cost base of $6,000. Earnt interest on term deposits. Made employer contributions on behalf of the members of the fund. Paid administration costs. Paid accounting and audit fees Made payments to retiring members of the fund: Lump sums: $80,000 Pensions: $9,000 $17,000 $21,000 $17,800 $1,900 $56,000 $12,300 $9,800 $89,000 Paid legal costs associated with the redrafting of the trust deed to comply $4,900 with APRA regulations. Client B Provide practical advice with recommendations to Client B specifically addressing the following questions: What is the amount of taxable income for Elisha's self-managed super fund, Dragon Superannuation Fund, for the 2021/22 tax year? What is the final tax liability for Elisha's self-managed super fund, Dragon Superannuation Fund? What are the most effective investment strategies for Elisha to reduce the fund's tax?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To provide practical advice with recommendations for Client B Elisha Simpson regarding the tax implications and effective investment strategies ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started