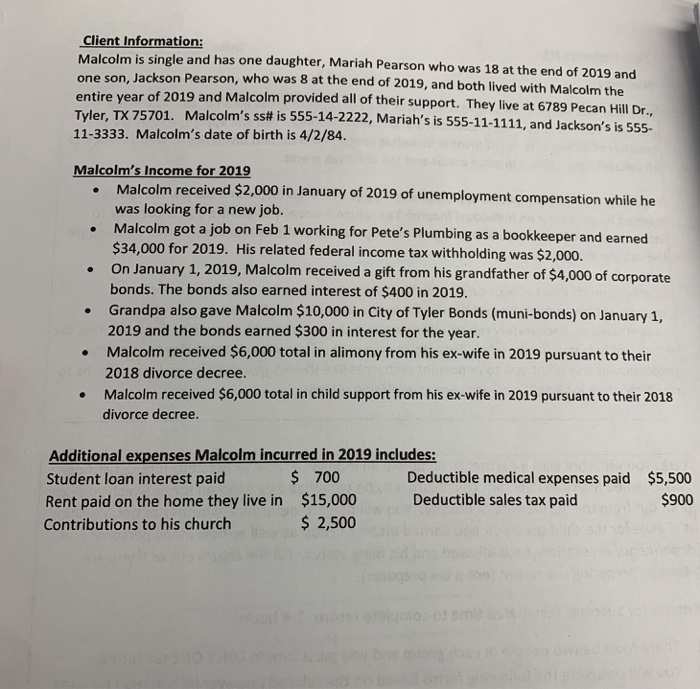

Client Information: Malcolm is single and has one daughter, Mariah Pearson who was 18 at the end of 2019 and one son, Jackson Pearson, who was 8 at the end of 2019, and both lived with Malcolm the entire year of 2019 and Malcolm provided all of their support. They live at 6789 Pecan Hill Dr., Tyler, TX 75701. Malcolm's ss is 555-14-2222, Mariah's is 555-11-1111, and Jackson's is 555- 11-3333. Malcolm's date of birth is 4/2/84. Malcolm's Income for 2019 Malcolm received $2,000 in January of 2019 of unemployment compensation while he was looking for a new job. Malcolm got a job on Feb 1 working for Pete's Plumbing as a bookkeeper and earned $34,000 for 2019. His related federal income tax withholding was $2,000. On January 1, 2019, Malcolm received a gift from his grandfather of $4,000 of corporate bonds. The bonds also earned interest of $400 in 2019. Grandpa also gave Malcolm $10,000 in City of Tyler Bonds (muni-bonds) on January 1, 2019 and the bonds earned $300 in interest for the year. Malcolm received $6,000 total in alimony from his ex-wife in 2019 pursuant to their 2018 divorce decree. Malcolm received $6,000 total in child support from his ex-wife in 2019 pursuant to their 2018 divorce decree. . Additional expenses Malcolm incurred in 2019 includes: Student loan interest paid $ 700 Deductible medical expenses paid $5,500 Rent paid on the home they live in $15,000 Deductible sales tax paid $900 Contributions to his church $ 2,500 Client Information: Malcolm is single and has one daughter, Mariah Pearson who was 18 at the end of 2019 and one son, Jackson Pearson, who was 8 at the end of 2019, and both lived with Malcolm the entire year of 2019 and Malcolm provided all of their support. They live at 6789 Pecan Hill Dr., Tyler, TX 75701. Malcolm's ss is 555-14-2222, Mariah's is 555-11-1111, and Jackson's is 555- 11-3333. Malcolm's date of birth is 4/2/84. Malcolm's Income for 2019 Malcolm received $2,000 in January of 2019 of unemployment compensation while he was looking for a new job. Malcolm got a job on Feb 1 working for Pete's Plumbing as a bookkeeper and earned $34,000 for 2019. His related federal income tax withholding was $2,000. On January 1, 2019, Malcolm received a gift from his grandfather of $4,000 of corporate bonds. The bonds also earned interest of $400 in 2019. Grandpa also gave Malcolm $10,000 in City of Tyler Bonds (muni-bonds) on January 1, 2019 and the bonds earned $300 in interest for the year. Malcolm received $6,000 total in alimony from his ex-wife in 2019 pursuant to their 2018 divorce decree. Malcolm received $6,000 total in child support from his ex-wife in 2019 pursuant to their 2018 divorce decree. . Additional expenses Malcolm incurred in 2019 includes: Student loan interest paid $ 700 Deductible medical expenses paid $5,500 Rent paid on the home they live in $15,000 Deductible sales tax paid $900 Contributions to his church $ 2,500