Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Client scenario: Ray Richardson - Qtr Ending 3 0 / 6 / 2 0 2 3 You have been approached by Ray Richardson, a local

Client scenario: Ray Richardson Qtr Ending

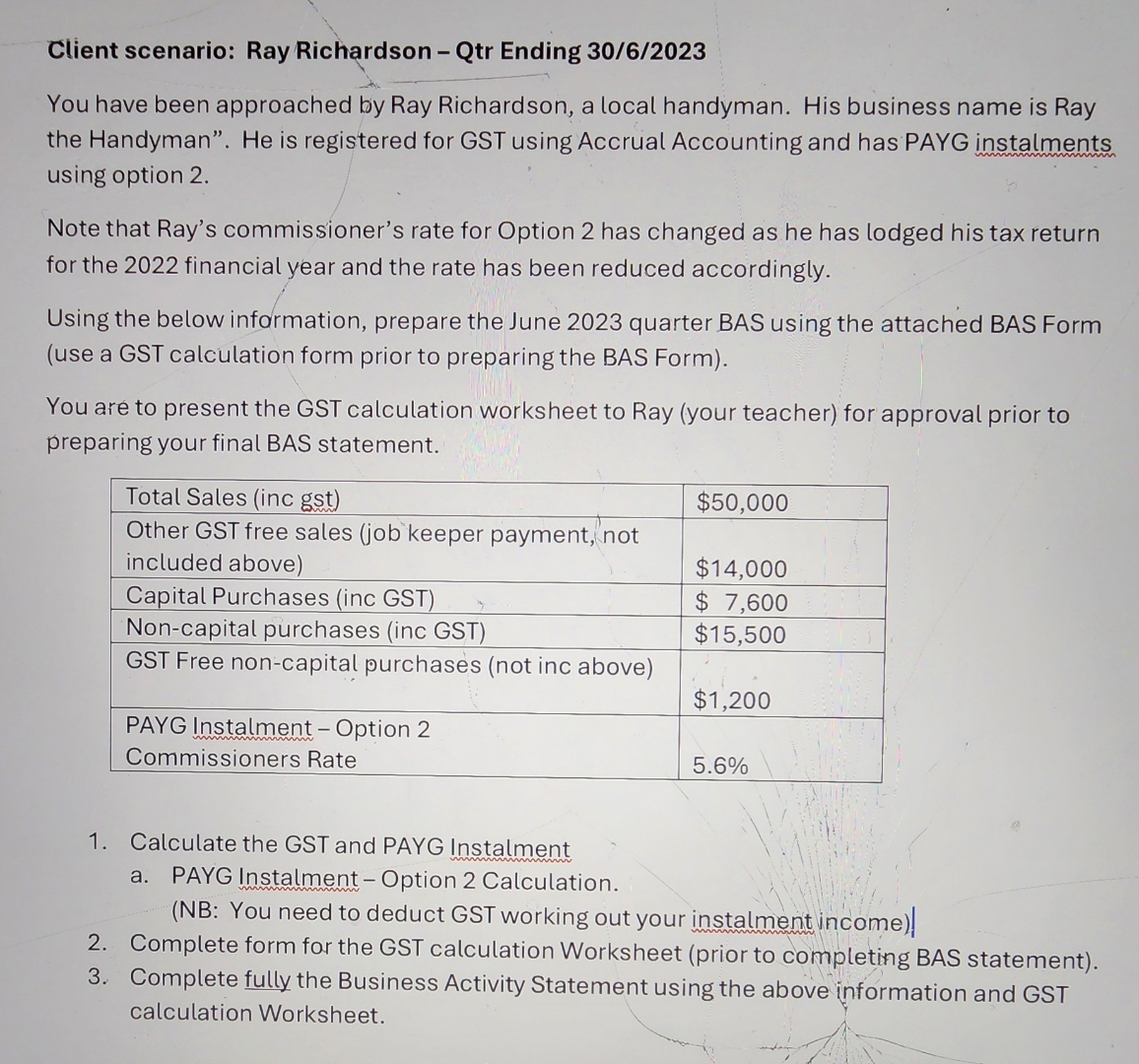

You have been approached by Ray Richardson, a local handyman. His business name is Ray the Handyman". He is registered for GST using Accrual Accounting and has PAYG instalments using option

Note that Ray's commissioner's rate for Option has changed as he has lodged his tax return for the financial year and the rate has been reduced accordingly.

Using the below information, prepare the June quarter BAS using the attached BAS Form use a GST calculation form prior to preparing the BAS Form

You are to present the GST calculation worksheet to Ray your teacher for approval prior to preparing your final BAS statement.

tableTotal Sales inc gst$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started