Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Clive plc is considering the acquisition of Blessed plc. Clive plc has a current market value of $100,000,000. Blessed plc has a current market value

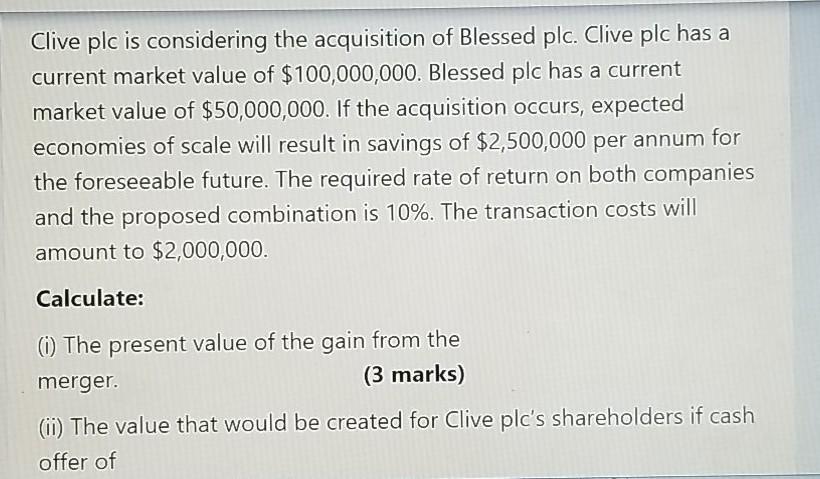

Clive plc is considering the acquisition of Blessed plc. Clive plc has a current market value of $100,000,000. Blessed plc has a current market value of $50,000,000. If the acquisition occurs, expected economies of scale will result in savings of $2,500,000 per annum for the foreseeable future. The required rate of return on both companies and the proposed combination is 10%. The transaction costs will amount to $2,000,000. Calculate: () The present value of the gain from the merger. (3 marks) (ii) The value that would be created for Clive plc's shareholders if cash offer of Clive plc is considering the acquisition of Blessed plc. Clive plc has a current market value of $100,000,000. Blessed plc has a current market value of $50,000,000. If the acquisition occurs, expected economies of scale will result in savings of $2,500,000 per annum for the foreseeable future. The required rate of return on both companies and the proposed combination is 10%. The transaction costs will amount to $2,000,000. Calculate: () The present value of the gain from the merger. (3 marks) (ii) The value that would be created for Clive plc's shareholders if cash offer of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started