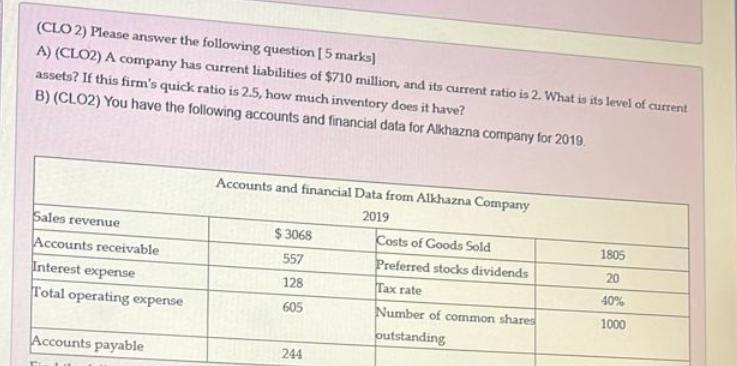

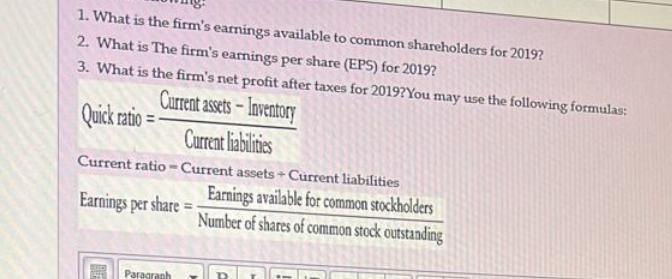

(CLO 2) Please answer the following question [5 marks] A) (CLO2) A company has current liabilities of $710 million, and its current ratio is 2. What is its level of current assets? If this firm's quick ratio is 2.5, how much inventory does it have? B) (CLO2) You have the following accounts and financial data for Alkhazna company for 2019. Accounts and financial Data from Alkhazna Company 2019 Sales revenue $3068 Costs of Goods Sold 1805 Accounts receivable 557 Preferred stocks dividends 20 Interest expense 128 Tax rate 40% Total operating expense 605 Number of common shares 1000 outstanding Accounts payable 244 1. What is the firm's earnings available to common shareholders for 2019? 2. What is The firm's earnings per share (EPS) for 2019? 3. What is the firm's net profit after taxes for 2019?You may use the following formulas: Quick ratio Current assets-Inventory Current liabilities Current ratio-Current assets + Current liabilities Earnings available for common stockholders Earnings per share= Number of shares of common stock outstanding Paragraph (CLO 2) Please answer the following question [5 marks] A) (CLO2) A company has current liabilities of $710 million, and its current ratio is 2. What is its level of current assets? If this firm's quick ratio is 2.5, how much inventory does it have? B) (CLO2) You have the following accounts and financial data for Alkhazna company for 2019. Accounts and financial Data from Alkhazna Company 2019 Sales revenue $3068 Costs of Goods Sold 1805 Accounts receivable 557 Preferred stocks dividends 20 Interest expense 128 Tax rate 40% Total operating expense 605 Number of common shares 1000 outstanding Accounts payable 244 1. What is the firm's earnings available to common shareholders for 2019? 2. What is The firm's earnings per share (EPS) for 2019? 3. What is the firm's net profit after taxes for 2019?You may use the following formulas: Quick ratio Current assets-Inventory Current liabilities Current ratio-Current assets + Current liabilities Earnings available for common stockholders Earnings per share= Number of shares of common stock outstanding Paragraph