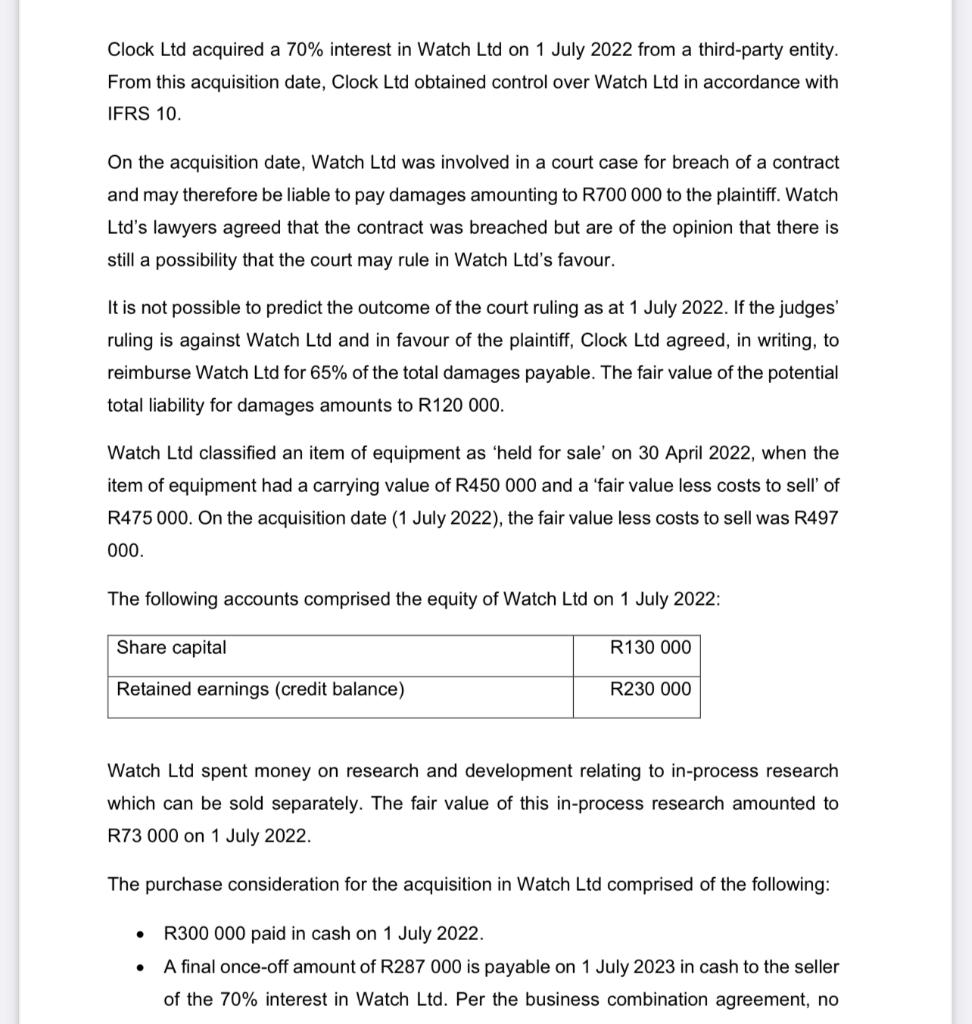

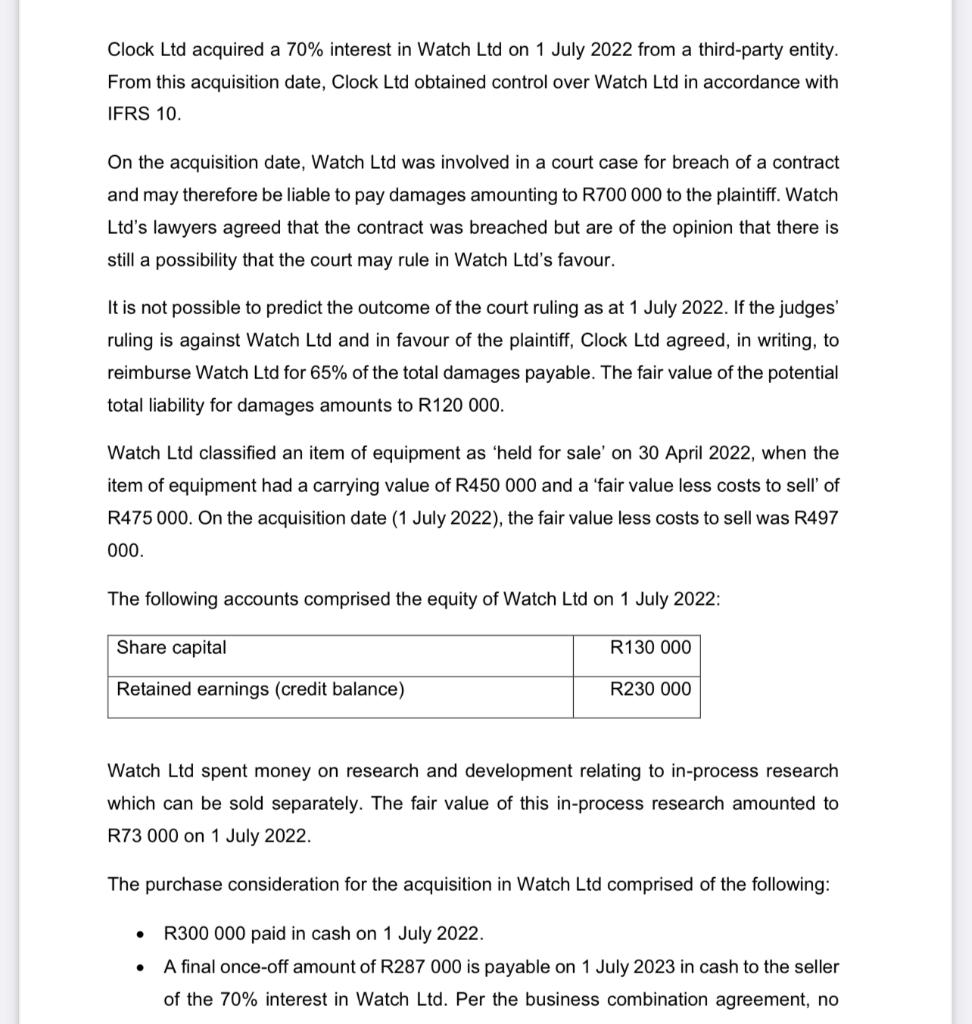

Clock Ltd acquired a 70% interest in Watch Ltd on 1 July 2022 from a third-party entity. From this acquisition date, Clock Ltd obtained control over Watch Ltd in accordance with IFRS 10. On the acquisition date, Watch Ltd was involved in a court case for breach of a contract and may therefore be liable to pay damages amounting to R700 000 to the plaintiff. Watch Ltd's lawyers agreed that the contract was breached but are of the opinion that there is still a possibility that the court may rule in Watch Ltd's favour. It is not possible to predict the outcome of the court ruling as at 1 July 2022 . If the judges' ruling is against Watch Ltd and in favour of the plaintiff, Clock Ltd agreed, in writing, to reimburse Watch Ltd for 65% of the total damages payable. The fair value of the potential total liability for damages amounts to R120 000. Watch Ltd classified an item of equipment as 'held for sale' on 30 April 2022, when the item of equipment had a carrying value of R450 000 and a 'fair value less costs to sell' of R475 000. On the acquisition date (1 July 2022), the fair value less costs to sell was R497 000. The following accounts comprised the equity of Watch Ltd on 1 July 2022 : Watch Ltd spent money on research and development relating to in-process research which can be sold separately. The fair value of this in-process research amounted to R73 000 on 1 July 2022. The purchase consideration for the acquisition in Watch Ltd comprised of the following: - R300 000 paid in cash on 1 July 2022. - A final once-off amount of R287 000 is payable on 1 July 2023 in cash to the seller of the 70% interest in Watch Ltd. Per the business combination agreement, no interest is charged on this amount. Assume a market-related effective rate of 15% per annum, pre-tax, applicable to Clock Ltd. REQUIRED: Prepare the pro forma journal entries to account for the investment in Watch Ltd at the acquisition date, 1 July 2022, in the records of the Clock Ltd Group. Dates and narrations are not required. Ignore all tax effects. Show and reference all your workings and calculations clearly and round off to the nearest rand where necessary