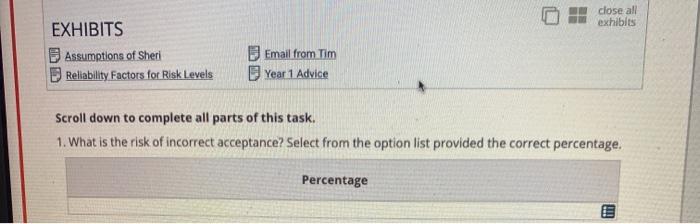

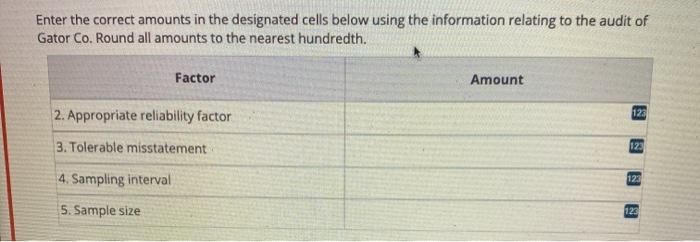

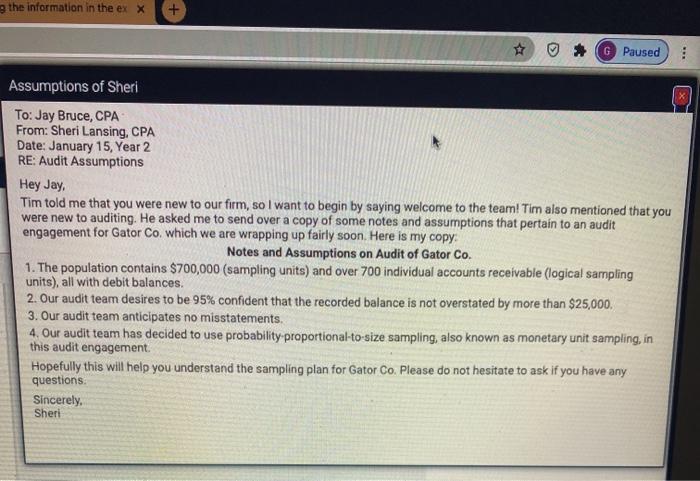

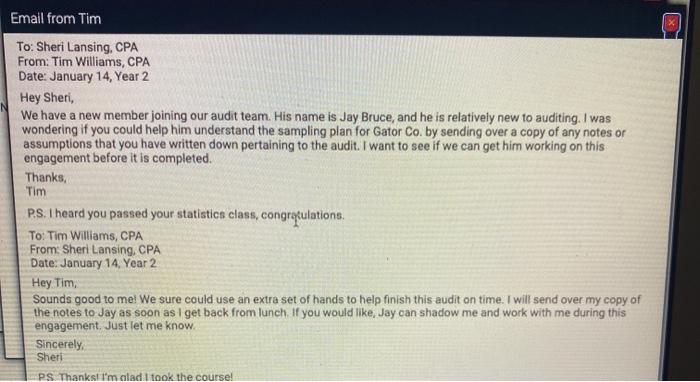

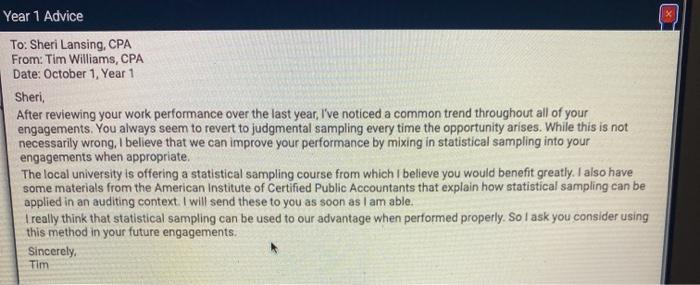

close all exhibits EXHIBITS Assumptions of Sheri Reliability Factors for Risk Levels Email from Tim Year 1 Advice Scroll down to complete all parts of this task. 1. What is the risk of incorrect acceptance? Select from the option list provided the correct percentage. Percentage 3 Enter the correct amounts in the designated cells below using the information relating to the audit of Gator Co. Round all amounts to the nearest hundredth. Factor Amount 123 2. Appropriate reliability factor 3. Tolerable misstatement 123 4. Sampling interval 123 5. Sample size 123 the information in the ex x G Paused : Assumptions of Sheri To: Jay Bruce, CPA From: Sheri Lansing, CPA Date: January 15, Year 2 RE: Audit Assumptions Hey Jay, Tim told me that you were new to our firm, so I want to begin by saying welcome to the team! Tim also mentioned that you were new to auditing. He asked me to send over a copy of some notes and assumptions that pertain to an audit engagement for Gator Co, which we are wrapping up fairly soon. Here is my copy Notes and Assumptions on Audit of Gator Co. 1. The population contains $700,000 (sampling units) and over 700 individual accounts receivable (logical sampling units), all with debit balances. 2. Our audit team desires to be 95% confident that the recorded balance is not overstated by more than $25,000. 3. Our audit team anticipates no misstatements. 4. Our audit team has decided to use probability proportional-to-size sampling, also known as monetary unit sampling, in this audit engagement. Hopefully this will help you understand the sampling plan for Gator Co. Please do not hesitate to ask if you have any questions Sincerely, Sheri umptions of Sheri Reliability Factors for Risk Levels Risk of Incorrect Acceptance 1% Reliability Factor 4.61 3.00 2.31 5% 10% Note: Figures provided are based on the assumption that no overstatements de expected. Email from Tim To: Sheri Lansing, CPA From: Tim Williams, CPA Date: January 14, Year 2 Hey Sheri, We have a new member joining our audit team. His name is Jay Bruce, and he is relatively new to auditing. I was wondering if you could help him understand the sampling plan for Gator Co. by sending over a copy of any notes or assumptions that you have written down pertaining to the audit. I want to see if we can get him working on this engagement before it is completed. Thanks, Tim PS. I heard you passed your statistics class, congratulations. To: Tim Williams, CPA From: Sheri Lansing, CPA Date: January 14, Year 2 Hey Tim, Sounds good to me! We sure could use an extra set of hands to help finish this audit on time. I will send over my copy of the notes to Jay as soon as I get back from lunch. If you would like, Jay can shadow me and work with me during this engagement, Just let me know. Sincerely, Sheri PS. Thanks I'm alad I took the course! Year 1 Advice To: Sheri Lansing, CPA From: Tim Williams, CPA Date: October 1, Year 1 Sheri After reviewing your work performance over the last year, I've noticed a common trend throughout all of your engagements. You always seem to revert to judgmental sampling every time the opportunity arises. While this is not necessarily wrong, I believe that we can improve your performance by mixing in statistical sampling into your engagements when appropriate. The local university is offering a statistical sampling course from which I believe you would benefit greatly. I also have some materials from the American Institute of Certified Public Accountants that explain how statistical sampling can be applied in an auditing context. I will send these to you as soon as I am able. I really think that statistical sampling can be used to our advantage when performed properly. So I ask you consider using this method in your future engagements Sincerely, Tim close all exhibits EXHIBITS Assumptions of Sheri Reliability Factors for Risk Levels Email from Tim Year 1 Advice Scroll down to complete all parts of this task. 1. What is the risk of incorrect acceptance? Select from the option list provided the correct percentage. Percentage 3 Enter the correct amounts in the designated cells below using the information relating to the audit of Gator Co. Round all amounts to the nearest hundredth. Factor Amount 123 2. Appropriate reliability factor 3. Tolerable misstatement 123 4. Sampling interval 123 5. Sample size 123 the information in the ex x G Paused : Assumptions of Sheri To: Jay Bruce, CPA From: Sheri Lansing, CPA Date: January 15, Year 2 RE: Audit Assumptions Hey Jay, Tim told me that you were new to our firm, so I want to begin by saying welcome to the team! Tim also mentioned that you were new to auditing. He asked me to send over a copy of some notes and assumptions that pertain to an audit engagement for Gator Co, which we are wrapping up fairly soon. Here is my copy Notes and Assumptions on Audit of Gator Co. 1. The population contains $700,000 (sampling units) and over 700 individual accounts receivable (logical sampling units), all with debit balances. 2. Our audit team desires to be 95% confident that the recorded balance is not overstated by more than $25,000. 3. Our audit team anticipates no misstatements. 4. Our audit team has decided to use probability proportional-to-size sampling, also known as monetary unit sampling, in this audit engagement. Hopefully this will help you understand the sampling plan for Gator Co. Please do not hesitate to ask if you have any questions Sincerely, Sheri umptions of Sheri Reliability Factors for Risk Levels Risk of Incorrect Acceptance 1% Reliability Factor 4.61 3.00 2.31 5% 10% Note: Figures provided are based on the assumption that no overstatements de expected. Email from Tim To: Sheri Lansing, CPA From: Tim Williams, CPA Date: January 14, Year 2 Hey Sheri, We have a new member joining our audit team. His name is Jay Bruce, and he is relatively new to auditing. I was wondering if you could help him understand the sampling plan for Gator Co. by sending over a copy of any notes or assumptions that you have written down pertaining to the audit. I want to see if we can get him working on this engagement before it is completed. Thanks, Tim PS. I heard you passed your statistics class, congratulations. To: Tim Williams, CPA From: Sheri Lansing, CPA Date: January 14, Year 2 Hey Tim, Sounds good to me! We sure could use an extra set of hands to help finish this audit on time. I will send over my copy of the notes to Jay as soon as I get back from lunch. If you would like, Jay can shadow me and work with me during this engagement, Just let me know. Sincerely, Sheri PS. Thanks I'm alad I took the course! Year 1 Advice To: Sheri Lansing, CPA From: Tim Williams, CPA Date: October 1, Year 1 Sheri After reviewing your work performance over the last year, I've noticed a common trend throughout all of your engagements. You always seem to revert to judgmental sampling every time the opportunity arises. While this is not necessarily wrong, I believe that we can improve your performance by mixing in statistical sampling into your engagements when appropriate. The local university is offering a statistical sampling course from which I believe you would benefit greatly. I also have some materials from the American Institute of Certified Public Accountants that explain how statistical sampling can be applied in an auditing context. I will send these to you as soon as I am able. I really think that statistical sampling can be used to our advantage when performed properly. So I ask you consider using this method in your future engagements Sincerely, Tim