close the ledger

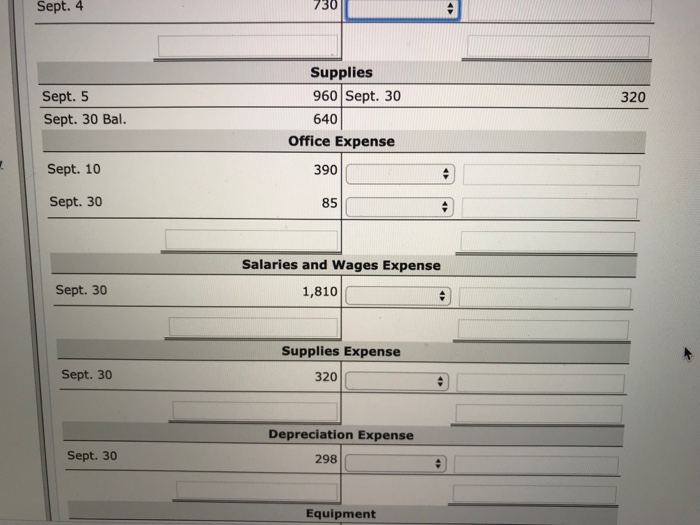

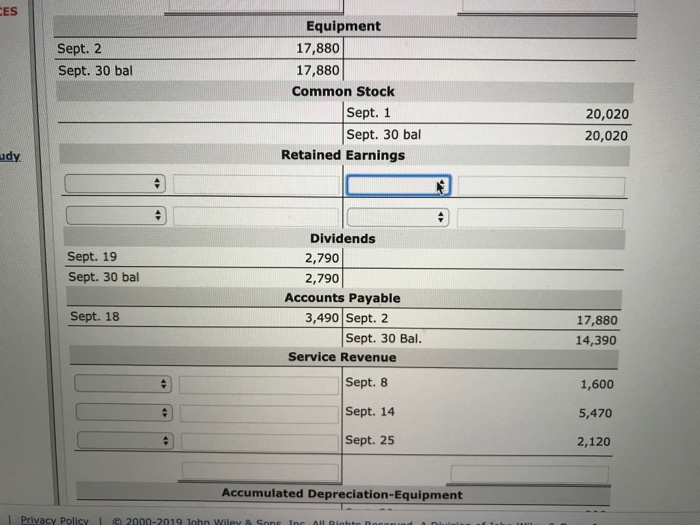

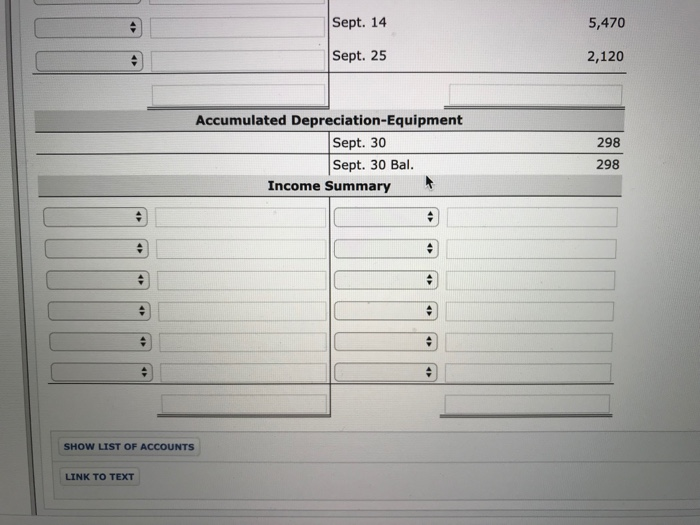

ment Problem 3-01 Listed below are the transactions of Thomas Taylor, D.D.S., for the month of September. Sept. 1 Taylor begins practice as a dentist, invests $20,020 cash and issues 2,002 shares of $10 par stock. 2 Purchases dental equipment on account from Green Jacket Co. for $17,880. 4 Pays rent for office space, $730 for the month. 4 Employs a receptionist, Michael Bradley. 5 Purchases dental supplies for cash, $960. 8 Receives cash of $1,600 from patients for services performed. 10 Pays miscellaneous office expenses, $390. 14 Bills patients $5,470 for services performed. 18 Pays Green Jacket Co. on account, $3,490. 19 Pays a dividend of $2,790 cash. 20 Receives $1,030 from patients on account. 25 Bills patients $2,120 for services performed. 30 Pays the following expenses in cash: Salaries and wages $1,810; miscellaneous office expenses $85. 30 Dental supplies used during September, $320. Record depreciation using a 5-year life on the equipment, the straight-line method, and no salvage value. Enter the transactions shown above in appropriate general ledger accounts (use T-accounts). (Post entries in Cash Sept. 1 20020 Sept. 4 730 Sept. 8 1600 Sept. 5 960 Close the ledger. (Post entries in the order as displayed in the problem statement.) 730 960 390 3,490 2,790 1,810 85 1,030 Cash Sept. 1 20,020 Sept. 4 Sept. 8 1,600 Sept. 5 Sept. 20 1,030 Sept. 10 Sept. 18 Sept. 19 Sept. 30 Sept. 30 Sept. 30 Bal. 12,395 Accounts Receivable Sept. 14 5,470 Sept. 20 Sept. 25 2,120 Sept. 30 Bal. 6,560 Rent Expense Sept. 4 730 Sept. 1 Sept. 2 Sept. 4 Sup Sept. 5 Sept. 5 960 Sept. 8 Sept. 30 Bal. 640 Sept. 10 Office Sept. 14 Sept. 18 Sent 10 390 Sept. 19 y Policy | 2000.2019 John Wiley & Sons Inc All 320 kvision of lohn Wiley & Sons Inc Sept. 4 730 320 Sept. 5 Sept. 30 Bal. Supplies 960 Sept. 30 640 Office Expense Sept. 10 390 Sept. 30 Salaries and Wages Expense Sept. 30 1,810 Supplies Expense Sept. 30 320 Sept. 30 Depreciation Expense 298 Equipment Sept. 2 Sept. 30 bal Equipment 17,880 17,880 Common Stock Sept. 1 Sept. 30 bal Retained Earnings 20,020 20,020 Sept. 19 Sept. 30 bal Sept. 18 Dividends 2,790 2,790 Accounts Payable 3,490 Sept. 2 Sept. 30 Bal. Service Revenue Sept. 8 17,880 14,390 1,600 5,470 Sept. 14 Sept. 25 2,120 Accumulated Depreciation Equipment Privacy Policy 2009 2010 lohn Wiles con ella Sept. 14 5,470 Sept. 25 2,120 Accumulated Depreciation-Equipment Sept. 30 Sept. 30 Bal. Income Summary SHOW LIST OF ACCOUNTS LINK TO TEXT