Clothing Retail Business: UAE Case study

Context

Your team is working on a project relating to a clothing retailer in the UAE (AL- Bashir Clothing AL- Bashir). AL- Bashir is a subsidiary of a large family business (Sididi LTD) who own assets across a wide variety of sectors.

AL-Bashir opened at the end of 2018 and has grown from 2 stores in Dec-18 to 10 stores at Dec-20. AL-Bashir has developed a business plan to grow the business both in the UAE and also expand into other MENA countries potentially KSA and Qatar. However, the Sididi LTD are undecided whether to invest further in the business or wind down operations.

Project Scope

Sididi LTD have told you that they have received limited management reports from AL-Bashir over the past two years and do not have a good understanding of the business performance nor the growth prospects. Therefore they have asked you to assist them in providing advice regarding the future strategy of the business and specifically whether to invest and expand the business or exit.

Requirement

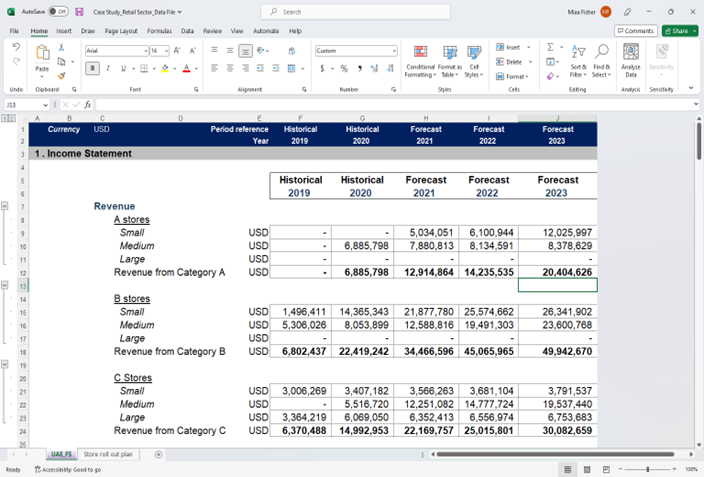

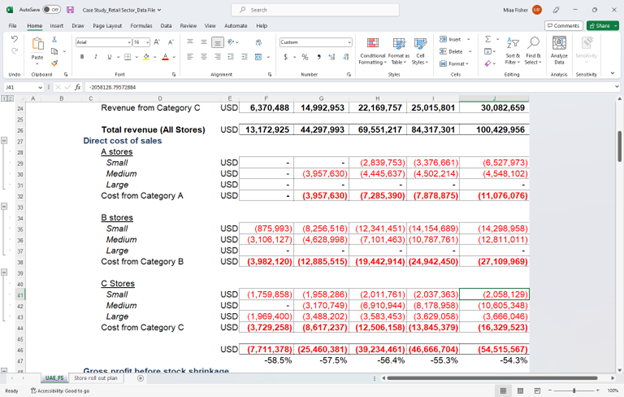

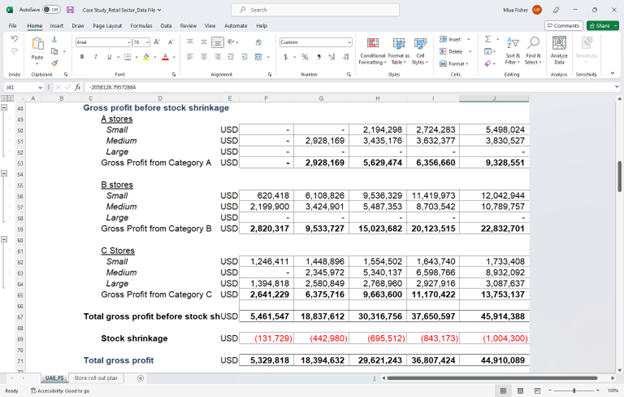

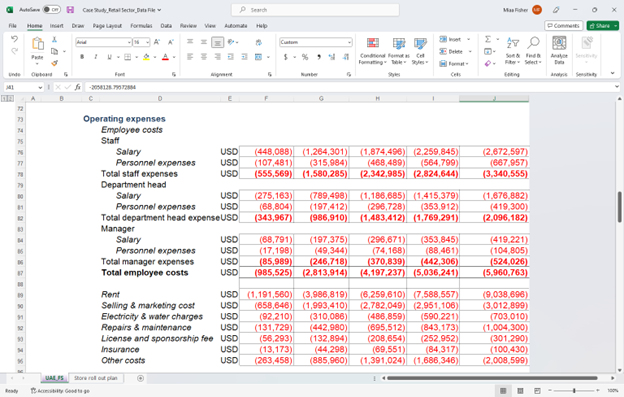

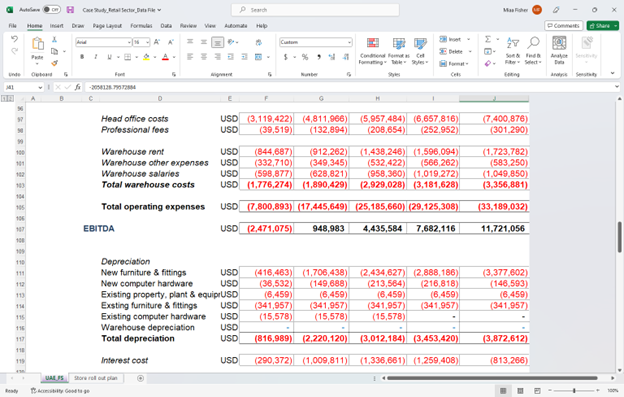

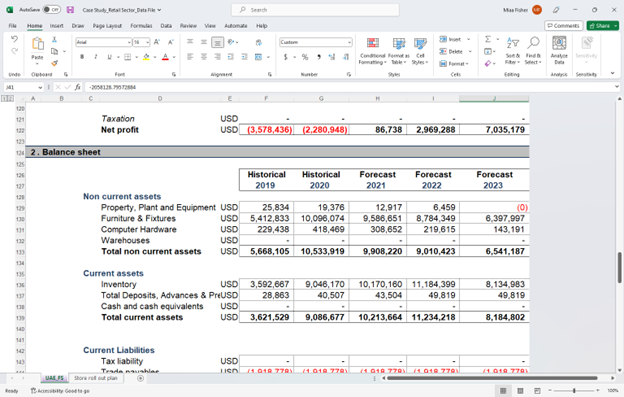

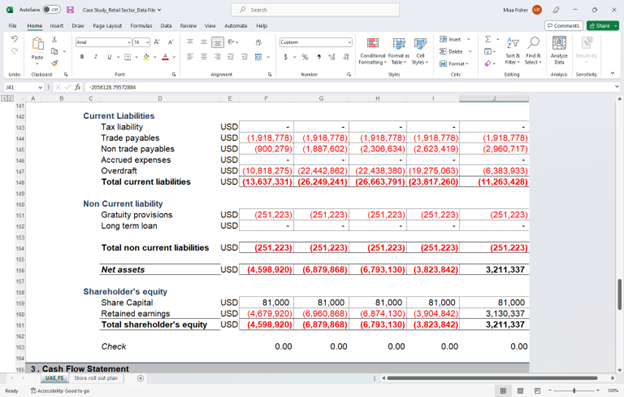

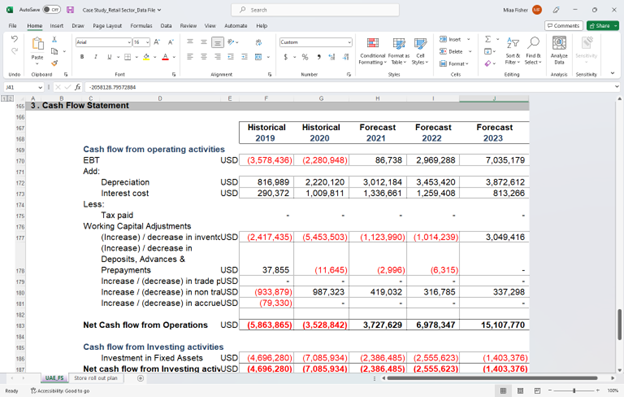

We have been given 5 years of financial information from AL-Bashir (2 years of Actuals and 3 years of forecasts) for the UAE business. There is a project kick off meeting with the management of Sididi LTD and we need to prepare a concise presentation (maximum 6 slides) covering the following:

Financial analysis of historical and forecast period (include graphs, tables and concise text);

A market overview of the clothing retail sector in UAE, KSA and Qatar and comment on the expansion prospects as well as the key risks of investing in this business;

A list of key questions relating to the financial information and any other important matters.

Your initial recommendations on the potential improvements in the business and the future business strategy (invest, expand or exist) along with an explanation of the rationale of your recommendations.

*The slides will slot into a presentation template the slide limit (5 slides) does not need to include a front cover page.

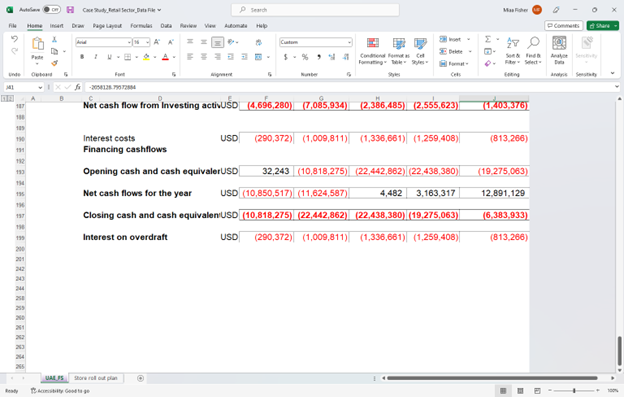

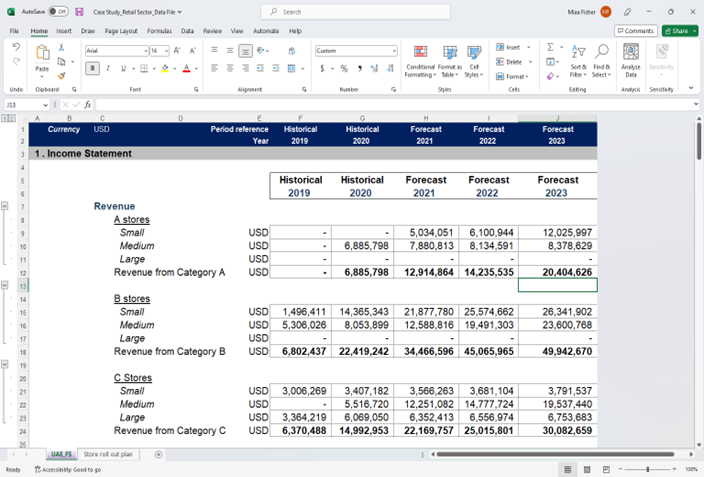

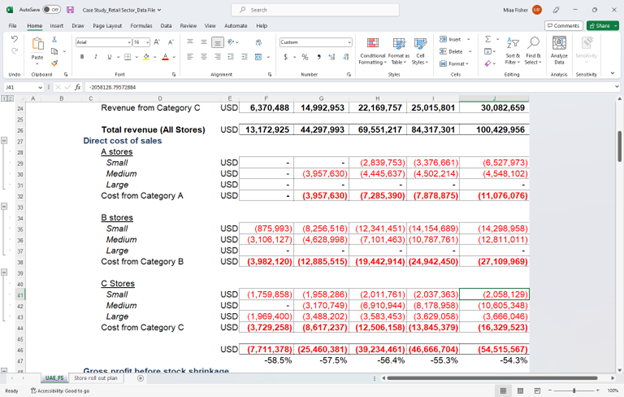

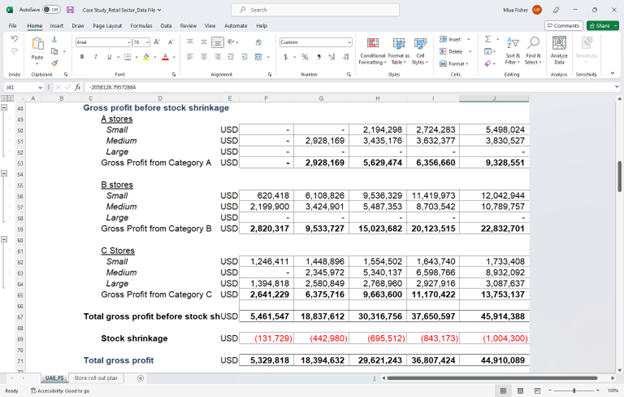

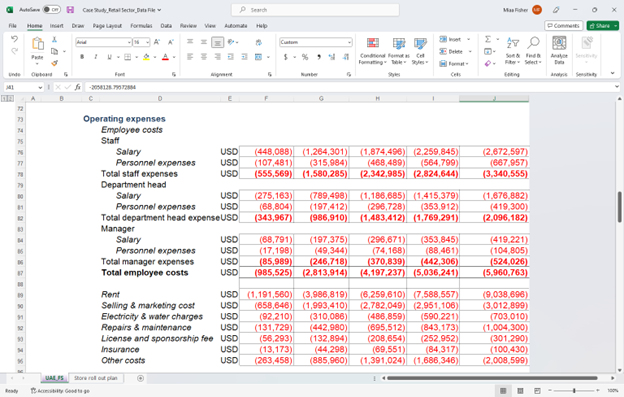

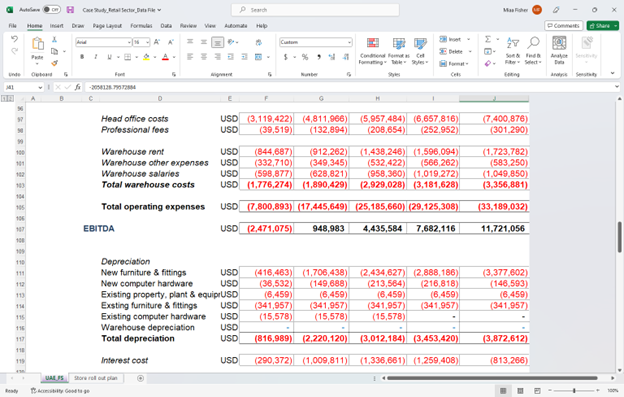

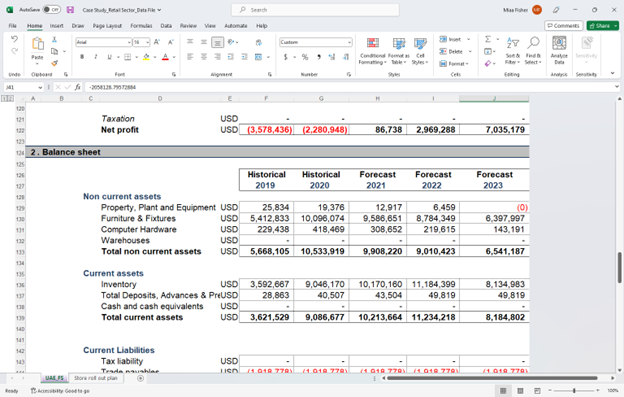

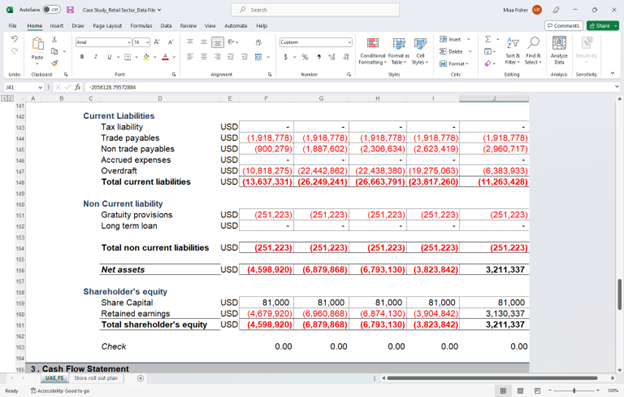

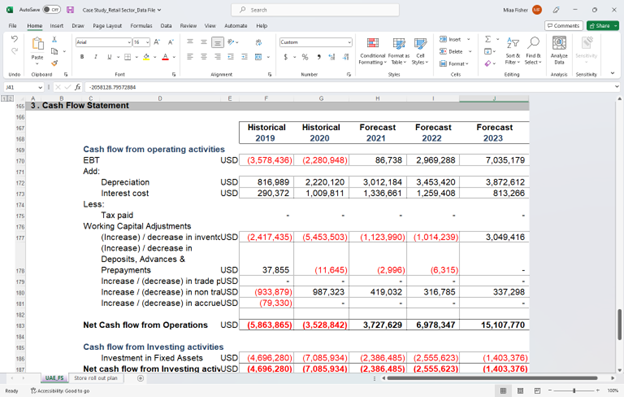

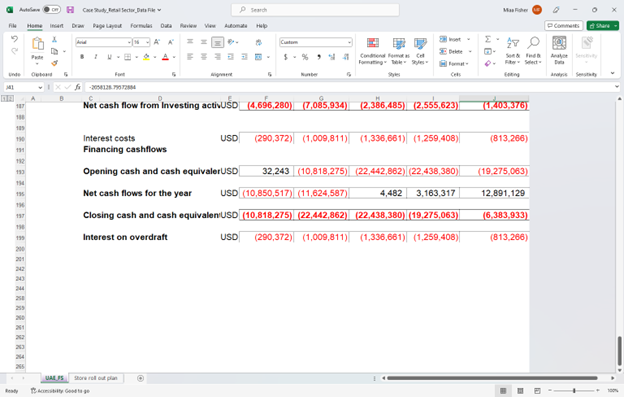

\begin{tabular}{|c|cc} [12] & \multicolumn{1}{c}{B} & C \\ \cline { 3 - 3 } & & Currenty USD \\ 2 & & \\ 3 & 1. Income Statement \\ \hline \end{tabular} \begin{tabular}{|ccccc} \hline Historical & Historical & Forecast & Forecast & Forecast \\ 2019 & 2020 & 2021 & 2022 & 2023 \\ \hline \end{tabular} Revenue \begin{tabular}{|l|l|r|r|r|r|r|r|} \hline B stores \\ \cline { 1 - 8 } Small & USD & 1,496,411 & 14,365,343 & 21,877,780 & 25,574,662 & 26,341,902 \\ \hline Medium & USD & 5,306,026 & 8,053,899 & 12,588,816 & 19,491,303 & 23,600,768 \\ \hline Large & USD & - & - & - & - & - \\ \hline Revenue from Category B & USD & 6,802,437 & 22,419,242 & 34,466,596 & 45,065,965 & 49,942,670 \\ \hline \end{tabular} \begin{tabular}{l|l|r|r|r|r|r|r|} \hline C Stores \\ \cline { 1 - 8 } Small & USD & 3,006,269 & 3,407,182 & 3,566,263 & 3,681,104 & 3,791,537 \\ \hline Medium & USD & & 5,516,720 & 12,251,082 & 14,777,724 & 19,537,440 \\ \hline Large & USD & 3,364,219 & 6,069,050 & 6,352,413 & 6,556,974 & 6,753,683 \\ \hline Revenue from Category C & USD & 6,370,488 & 14,992,953 & 22,169,757 & 25,015,801 & 30,082,659 \\ \hline \end{tabular} Ginee ninfit hatnie etnok ehrinkane 9ire rinel iot phan Bosy towanstaty Gestage Operating expenses Empioyee costs Staff Current Liabilities \begin{tabular}{|l|l|r|r|r|r|r|r|} \hline Tax lability & USD & - & - & - & - & - \\ \hline Trade payables & USD & (1,918,778) & (1,918,778) & (1,918,778) & (1,918,778) & (1,918,778) \\ \hline Non trade payables & USD & (900,279) & (1,887,602) & (2,306,634) & (2,623,419) & (2,960,717) \\ \hline Acerued expenses & USD & - & - & - & - & - \\ \hline Overdraft & USD & (10,818,275) & (22,442,862) & (22,438,380) & (19,275,063) & (6,383,933) \\ \hline Total current liabilities & USD & (13,637,331) & (26,249,241) & (26,663,791) & (23,817,260) & (11,263,428) \\ \hline \end{tabular} Non Current liability \begin{tabular}{l|l|r|r|r|r|r|} Gratuity provisions & USD & (251,223) & (251,223) & (251,223) & (251,223) & (251,223) \\ \hline Long term loan & USD & & & - & - & \\ \hline \end{tabular} Total non current liabilities USD (251,223)(251,223)(251,223)(251,223)(251,223)] Shareholder's equity Share Capital Retained earnings Total shareholder's equity \begin{tabular}{r|r|r|r|r|r} \hline USD & 81,000 & 81,000 & 81,000 & 81,000 & 81,000 \\ \hline USD & (4,679,920) & (6,960,868) & (6,874,130) & (3,904,842) & 3,130,337 \\ \hline USD & (4,598,920) & (6,879,868) & (6,793,130) & (3,823,842) & 3,211,337 \\ \hline & 0.00 & 0.00 & 0.00 & 0.00 & 0.00 \end{tabular} 3. Cash Flow Statement [465 3. Cash Flow Statement Cash flow from operating activities EBT Less: Tax paid Working Capital Adjustments \begin{tabular}{l|r|r|r|r|r|r|} \hline (Increase) / decrease in inventcUSD & (2,417,435) & (5,453,503) & (1,123,990) & (1,014,239) & 3,049,416 \\ \hline (Increase) / decrease in \end{tabular} Cash flow from lnvesting activities. \begin{tabular}{|l|l|l|l|l|l|l|} \hline Investment in Flxed Assets USD & (4,696,280) & (7,085,934) & (2,386,485) & (2,555,623) & (1,403,376) \\ \hline cash flow from Investing activUSD & (4,696,280) & (7,085,934) & (2,386,485) & (2,555,623) & (1,403,376) \\ \hline \end{tabular} Net cash Neaty if Acuristatyr Gest ta ge Net cash flow from lnvesting activUSD (4,696,280)(7,085,934)(2,386,485)(2,555,623) [1,403,376) Interest costs USD (290,372)(1,009,811)(1,336,661)(1,259,408) (813266) Financing cashflows Opening cash and cash equivalerUSD 32,243(10,818,275)(22,442,862)(22,438,380)(19,275,063) \begin{tabular}{|l|l|l|l|l|l|l|} Net cash flows for the year USD & (10,850,517) & (11,624,587) & 4,482 & 3,163,317 & 12,891,129 \end{tabular} Closing cash and cash equivalenusD (10,818,275)(22,442,862)(22,438,380)(19,275,063)(6,383,933) Interest on overdraft USD (290,372)(1,009,811)(1,336,661)(1,259,408)(813,266)