Cloud 9 - Continuing Case W&S Partners has just won the January 31, 2023

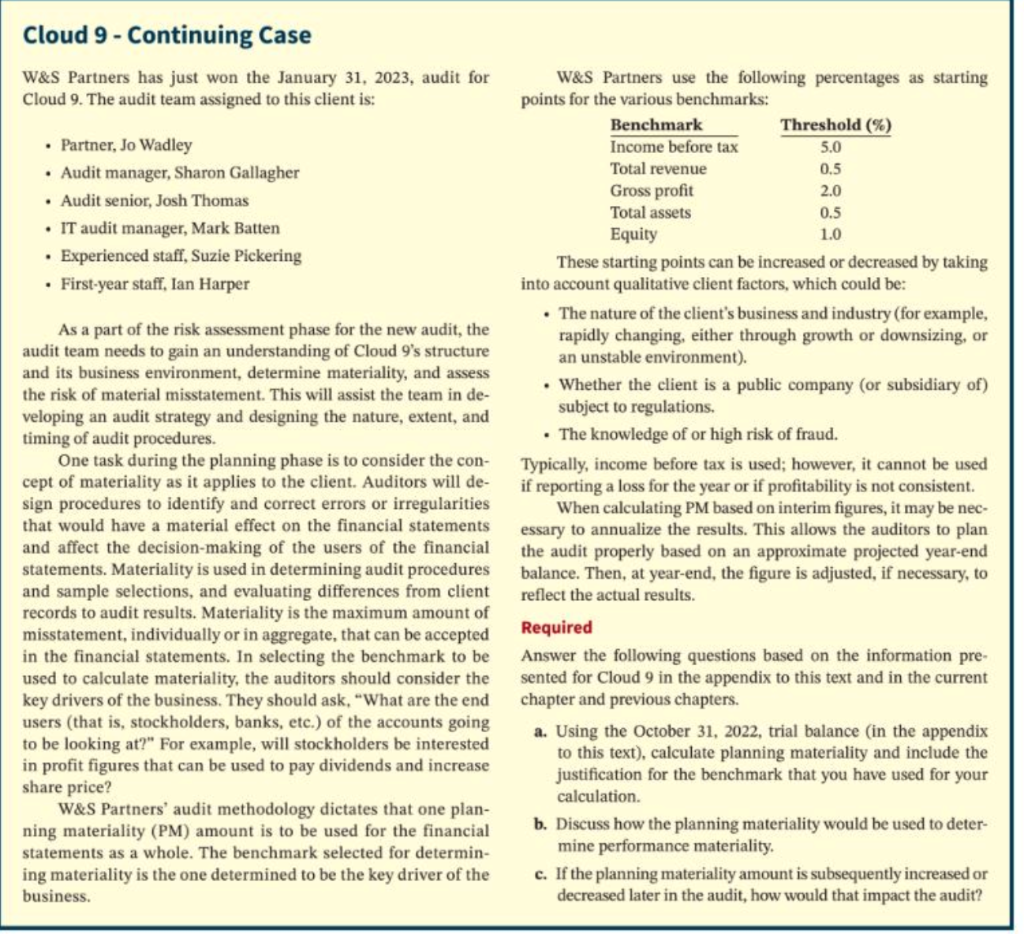

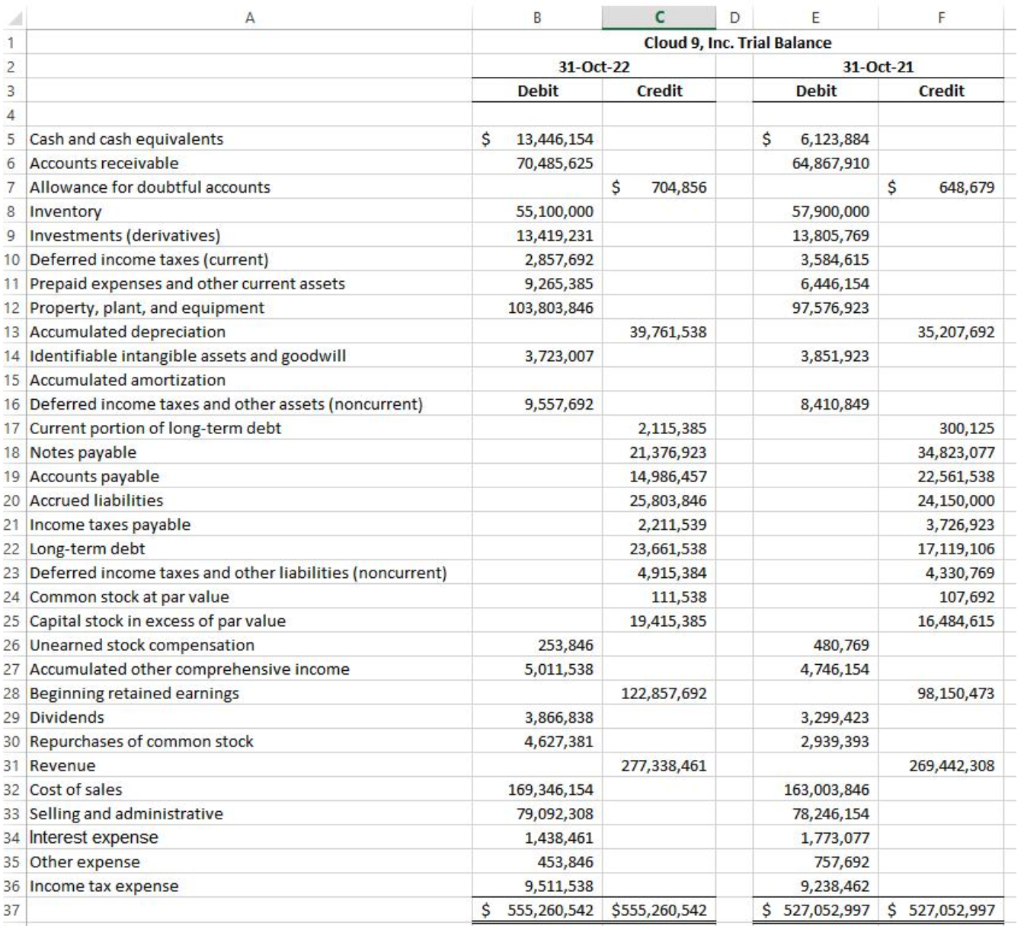

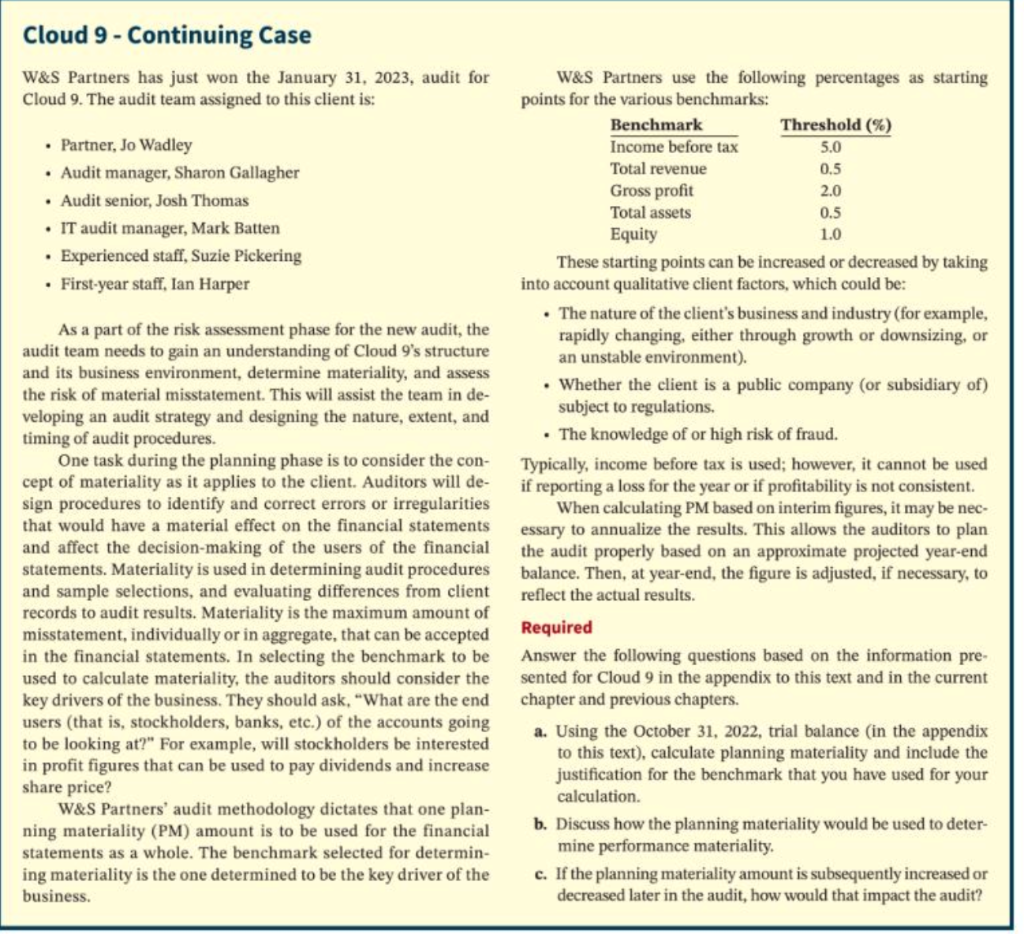

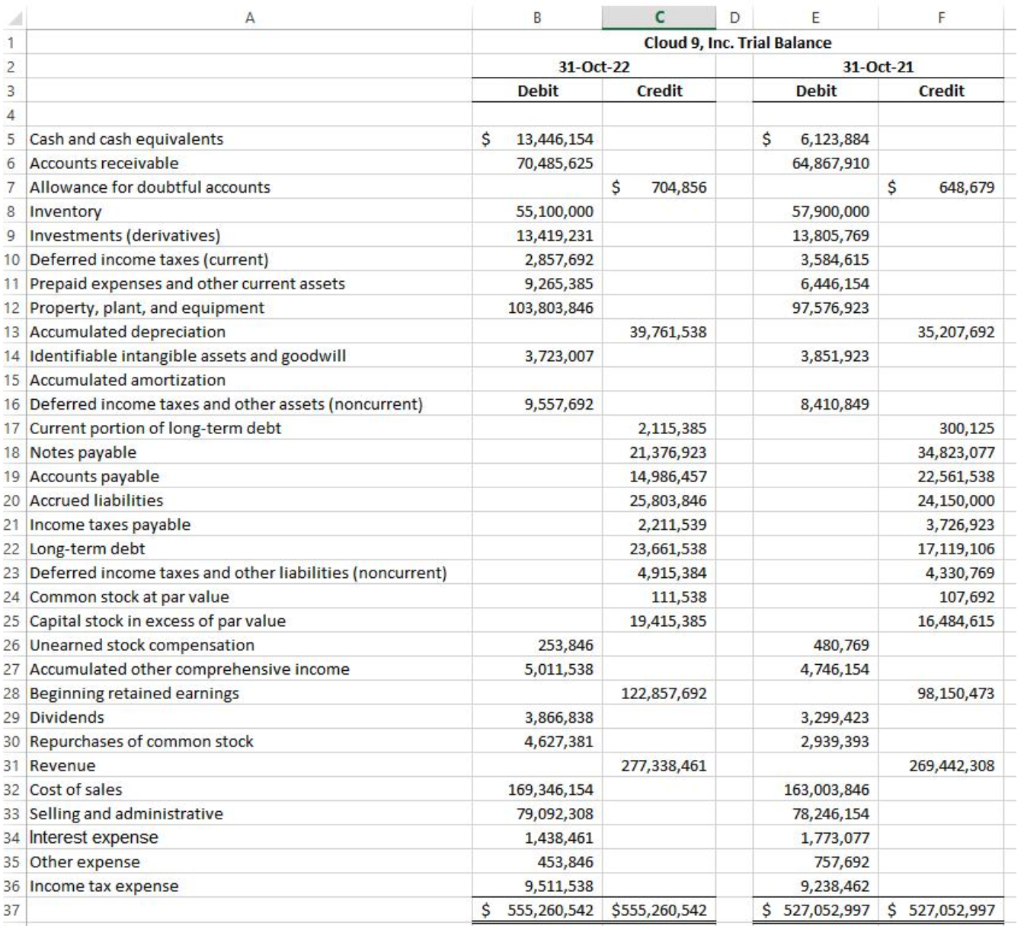

Cloud 9 - Continuing Case W&S Partners has just won the January 31, 2023, audit for Cloud 9. The audit team assigned to this client is: Partner, Jo Wadley Audit manager, Sharon Gallagher Audit senior, Josh Thomas IT audit manager, Mark Batten Experienced staff, Suzie Pickering . First-year staff, Ian Harper As a part of the risk assessment phase for the new audit, the audit team needs to gain an understanding of Cloud 9's structure and its business environment, determine materiality, and assess the risk of material misstatement. This will assist the team in de- veloping an audit strategy and designing the nature, extent, and timing of audit procedures. One task during the planning phase is to consider the con- cept of materiality as it applies to the client. Auditors will de- sign procedures to identify and correct errors or irregularities that would have a material effect on the financial statements and affect the decision-making of the users of the financial statements. Materiality is used in determining audit procedures and sample selections, and evaluating differences from client records to audit results. Materiality is the maximum amount of misstatement, individually or in aggregate, that can be accepted in the financial statements. In selecting the benchmark to be used to calculate materiality, the auditors should consider the key drivers of the business. They should ask, "What are the end users (that is, stockholders, banks, etc.) of the accounts going to be looking at?" For example, will stockholders be interested in profit figures that can be used to pay dividends and increase share price? W&S Partners' audit methodology dictates that one plan- ning materiality (PM) amount is to be used for the financial statements as a whole. The benchmark selected for determin- ing materiality is the one determined to be the key driver of the business. W&S Partners use the following percentages as starting points for the various benchmarks: Benchmark Threshold (%) Income before tax 5.0 Total revenue 0.5 Gross profit 2.0 Total assets 0.5 Equity 1.0 These starting points can be increased or decreased by taking into account qualitative client factors, which could be: The nature of the client's business and industry (for example, rapidly changing, either through growth or downsizing, or an unstable environment). Whether the client is a public company (or subsidiary of) subject to regulations. . The knowledge of or high risk of fraud. Typically, income before tax is used; however, it cannot be used if reporting a loss for the year or if profitability is not consistent. When calculating PM based on interim figures, it may be nec- essary to annualize the results. This allows the auditors to plan the audit properly based on an approximate projected year-end balance. Then, at year-end, the figure is adjusted, if necessary, to reflect the actual results. Required Answer the following questions based on the information pre- sented for Cloud 9 in the appendix to this text and in the current chapter and previous chapters. a. Using the October 31, 2022, trial balance in the appendix to this text), calculate planning materiality and include the justification for the benchmark that you have used for your calculation. b. Discuss how the planning materiality would be used to deter- mine performance materiality. c. If the planning materiality amount is subsequently increased or decreased later in the audit, how would that impact the audit? B 1 D E F Cloud 9, Inc. Trial Balance 31-Oct-21 Credit Debit Credit 2 31-Oct-22 Debit 3 $ $ 13,446,154 70,485,625 6,123,884 64,867,910 $ 704,856 $ 648,679 55,100,000 13,419,231 2,857,692 9,265,385 103,803,846 57,900,000 13,805,769 3,584,615 6,446,154 97,576,923 39,761,538 35,207,692 3,723,007 3,851,923 4 5 Cash and cash equivalents 6 Accounts receivable 7 Allowance for doubtful accounts 8 Inventory 9 Investments (derivatives) 10 Deferred income taxes (current) 11 Prepaid expenses and other current assets 12 Property, plant, and equipment 13 Accumulated depreciation 14 Identifiable intangible assets and goodwill 15 Accumulated amortization 16 Deferred income taxes and other assets (noncurrent) 17 Current portion of long-term debt 18 Notes payable 19 Accounts payable 20 Accrued liabilities 21 Income taxes payable 22 Long-term debt 23 Deferred income taxes and other liabilities (noncurrent) 24 Common stock at par value 25 Capital stock in excess of par value 26 Unearned stock compensation 27 Accumulated other comprehensive income 28 Beginning retained earnings 29 Dividends 30 Repurchases of common stock 31 Revenue 32 Cost of sales 33 Selling and administrative 34 Interest expense 35 Other expense 36 Income tax expense 37 9,557,692 2,115,385 21,376,923 14,986,457 25,803,846 2,211,539 23,661,538 4,915,384 111,538 19,415,385 253,846 5,011,538 122,857,692 3,866,838 4,627,381 277,338,461 169,346,154 79,092,308 1,438,461 453,846 9,511,538 $ 555,260,542 $555,260,542 8,410,849 300,125 34,823,077 22,561,538 24,150,000 3,726,923 17,119,106 4,330,769 107,692 16,484,615 480,769 4,746,154 98,150,473 3,299,423 2,939,393 269,442,308 163,003,846 78,246,154 1,773,077 757,692 9,238,462 $ 527,052,997 $ 527,052,997