Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cloud Nine Corporation (CNC) sells and disrtributes household goods and cars across Canada. Their office is located in Vancouver BC. Their fiscal year end is

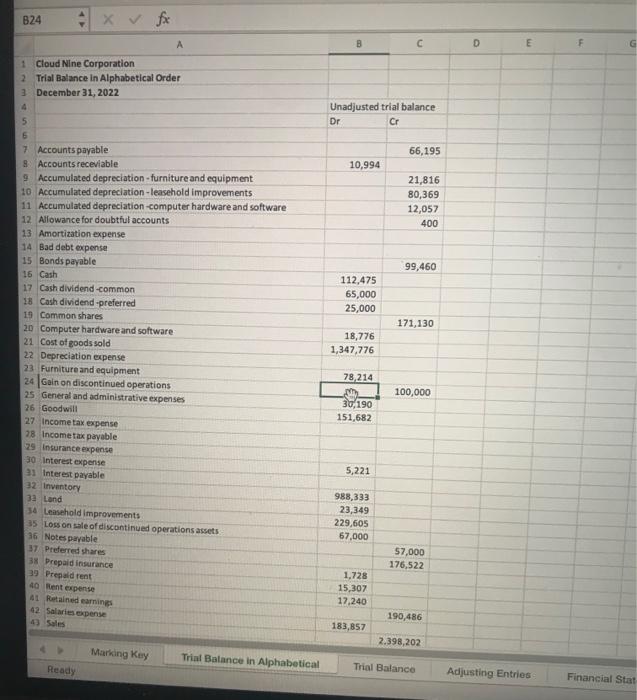

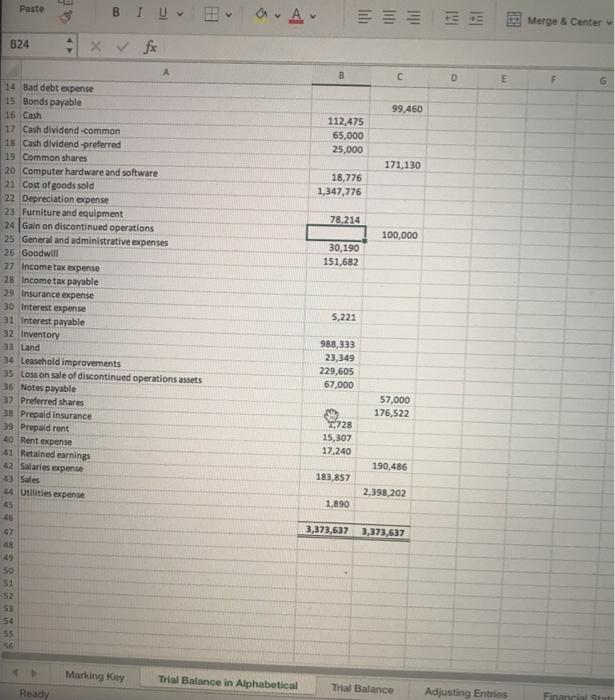

Cloud Nine Corporation (CNC) sells and disrtributes household goods and cars across Canada. Their office is located in Vancouver BC. Their fiscal year end is December 31 and they perform their adjusting entries annualy. CNC uses ASPE to report its financial statements. You have been hired by CNC to perfrom their accounting cycle starting with preparing the financial statements for the year ended December 31,2031. Gina and CNC, has provided you with an unadjusted trial balance and the following information:

?

?

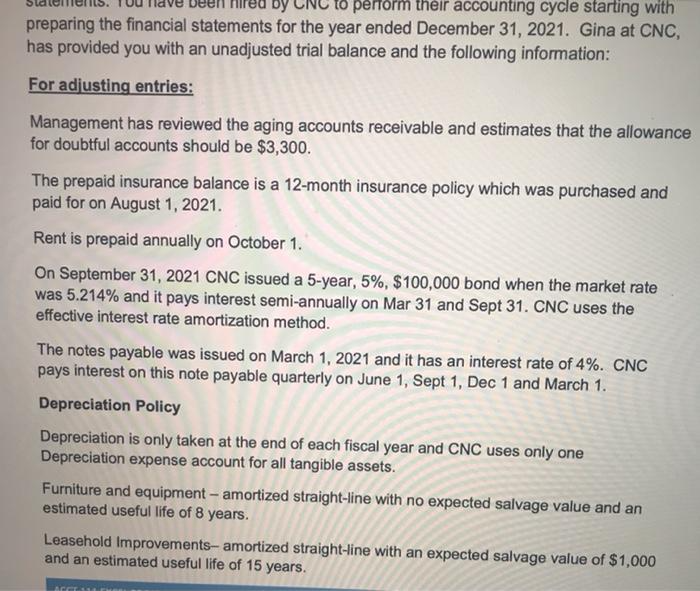

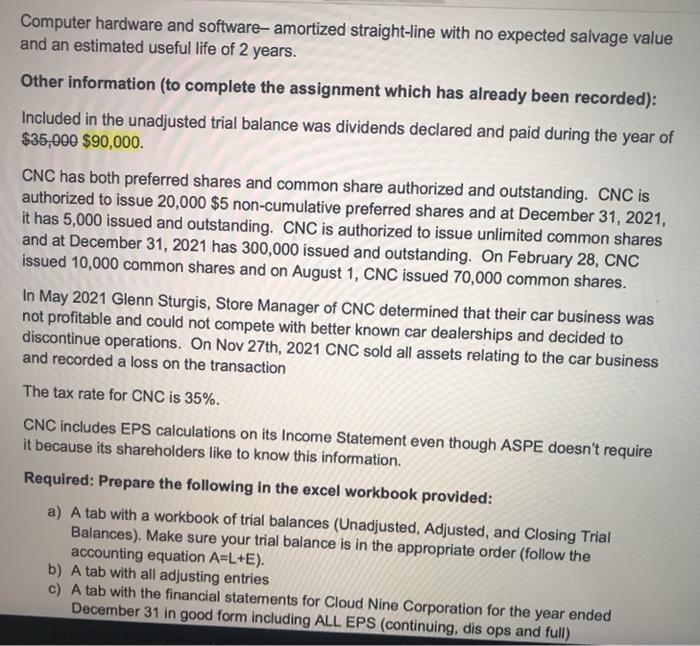

by to perform their accounting cycle starting with preparing the financial statements for the year ended December 31, 2021. Gina at CNC, has provided you with an unadjusted trial balance and the following information: For adjusting entries: Management has reviewed the aging accounts receivable and estimates that the allowance for doubtful accounts should be $3,300. The prepaid insurance balance is a 12-month insurance policy which was purchased and paid for on August 1, 2021. Rent is prepaid annually on October 1. On September 31, 2021 CNC issued a 5-year, 5%, $100,000 bond when the market rate was 5.214% and it pays interest semi-annually on Mar 31 and Sept 31. CNC uses the effective interest rate amortization method. The notes payable was issued on March 1, 2021 and it has an interest rate of 4%. CNC pays interest on this note payable quarterly on June 1, Sept 1, Dec 1 and March 1. Depreciation Policy Depreciation is only taken at the end of each fiscal year and CNC uses only one Depreciation expense account for all tangible assets. Furniture and equipment - amortized straight-line with no expected salvage value and an estimated useful life of 8 years. Leasehold Improvements- amortized straight-line with an expected salvage value of $1,000 and an estimated useful life of 15 years. ACCE

Step by Step Solution

★★★★★

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 Adjusting Entries Adjusting entries are made at the end of an accounting period to record revenues and expenses in the period they occur regardless of when the cash transactions happened Here are th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started