Question

Clover Fields is an all equity firm with 55,000 shares of stock outstanding at a market price of $17.50 a share. The company has

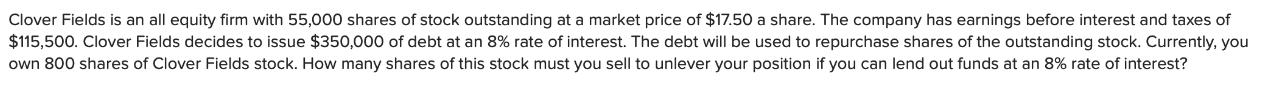

Clover Fields is an all equity firm with 55,000 shares of stock outstanding at a market price of $17.50 a share. The company has earnings before interest and taxes of $115,500. Clover Fields decides to issue $350,000 of debt at an 8% rate of interest. The debt will be used to repurchase shares of the outstanding stock. Currently, you own 800 shares of Clover Fields stock. How many shares of this stock must you sell to unlever your position if you can lend out funds at an 8% rate of interest?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Equity Asset Valuation

Authors: Jerald E. Pinto, Elaine Henry, Thomas R. Robinson, John D. Stowe, Abby Cohen

2nd Edition

470571439, 470571438, 9781118364123 , 978-0470571439

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App