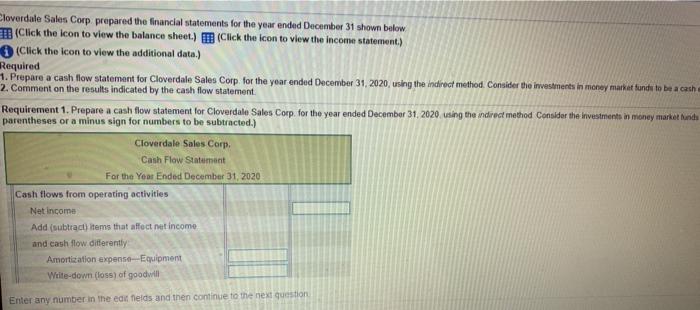

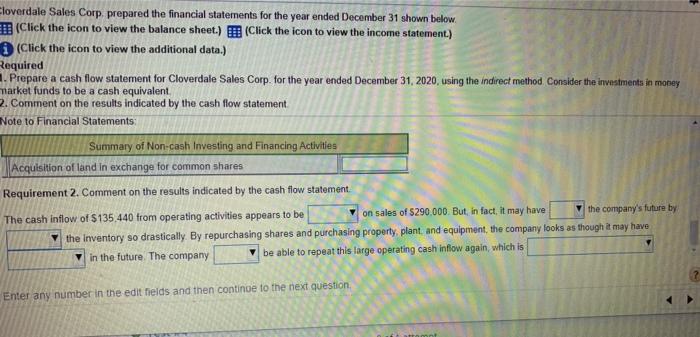

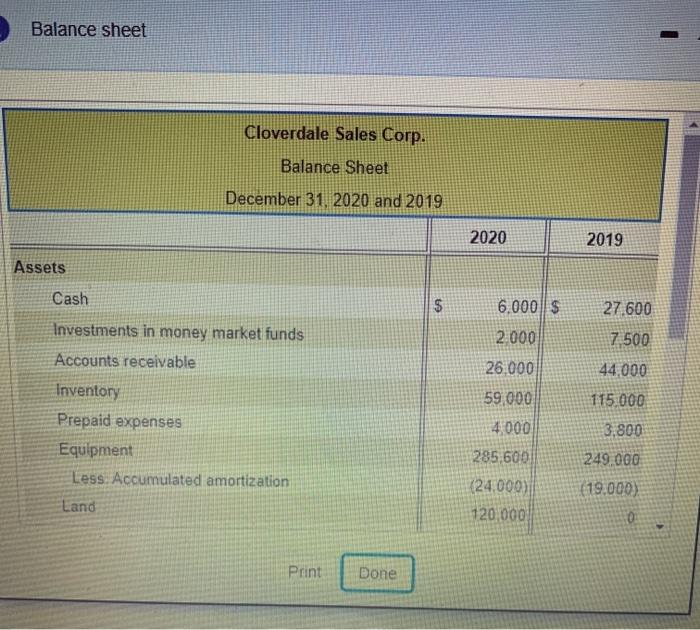

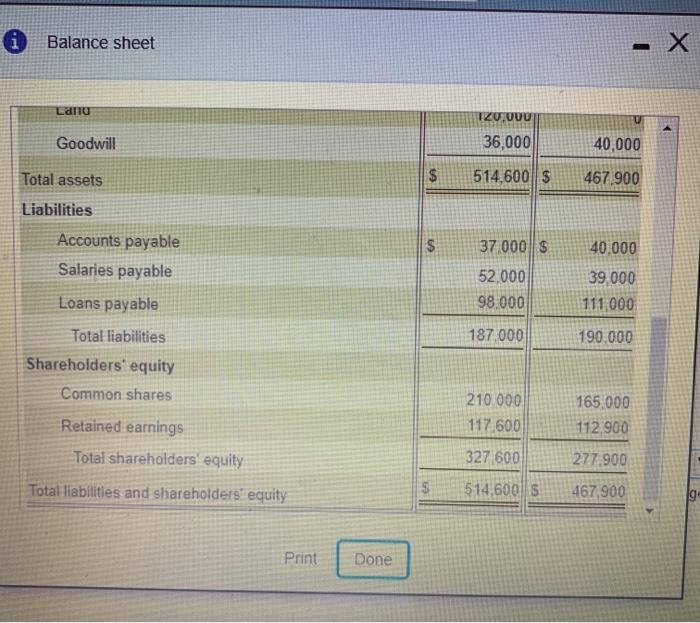

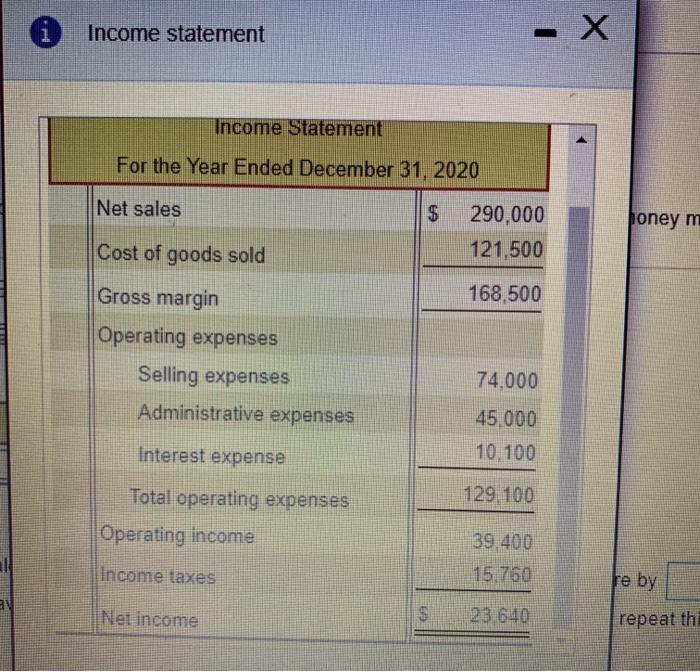

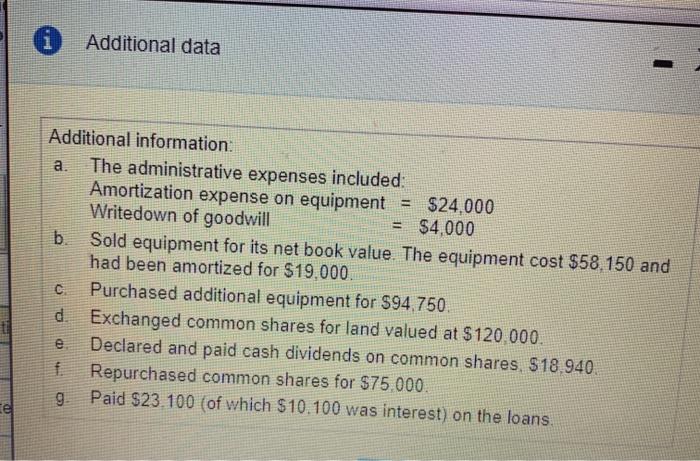

Cloverdale Sales Corp prepared the financial statements for the year ended December 31 shown below (Click the icon to view the balance sheet.) (Click the icon to view the income statement.) (Click the icon to view the additional data.) Required 1. Prepare a cash flow statement for Cloverdale Sales Corp. for the year ended December 31, 2020, using the Indirect method. Consider the investments in money market tunde to be a cash 2. Comment on the results indicated by the cash flow statement Requirement 1. Prepare a cash flow statement for Cloverdale Sales Corp. for the year ended December 31, 2020. using the indirect method Consider the investments in Money market hunde parentheses or a minus sign for numbers to be subtracted.) Cloverdale Sales Corp. Cash Flow Statement For the Year Ended December 31, 2020 Cash flows from operating activities Net Income Add(subtract) items that affect net income and cash flow differently Amortization expense-Equipment Weite-down (loss) of goodwill Enter any number in the edit Melds and then continue to the next question Cloverdale Sales Corp prepared the financial statements for the year ended December 31 shown below. (Click the icon to view the balance sheet.) Click the icon to view the income statement.) (Click the icon to view the additional data.) Required . Prepare a cash flow statement for Cloverdale Sales Corp. for the year ended December 31, 2020, using the Indirect method. Consider the investments in money market funds to be a cash equivalent 2. Comment on the results indicated by the cash flow statement Note to Financial Statements Summary of Non-cash Investing and Financing Activities Acquisition of land in exchange for common shares Requirement 2. Comment on the results indicated by the cash flow statement The cash inflow of $135.440 from operating activities appears to be on sales of $290,000. But, in fact, it may have V the company's future by the inventory so drastically. By repurchasing shares and purchasing property, plant, and equipment, the company looks as though it may have in the future. The company be able to repeat this large operating cash inflow again, which is Enter any number in the edit fields and then continue to the next question, nmnt Balance sheet x Lartu IZUOVU U Goodwill 36.000 40,000 Total assets $ 514,600||$ 467.900 Liabilities S Accounts payable Salaries payable 37,000 $ 40.000 52.000 98,000 39.000 111,000 Loans payable 187.000 190.000 Total liabilities Shareholders' equity Common shares 210 000 117 600 165,000 112.900 Retained earnings Total shareholders equity 327 600 277.900 Total liabilities and shareholders' equity $ 514,6001S 467.900 lg Print Done Income statement - X Income Statement For the Year Ended December 31, 2020 Net sales $ honey m 290,000 121,500 Cost of goods sold 168,500 Gross margin Operating expenses Selling expenses Administrative expenses 74.000 45.000 10 100 Interest expense 129 100 Total operating expenses Operating income 39.400 15 760 Income taxes re by av Net income 5 23.640 repeat th Additional data Additional information. a. The administrative expenses included: Amortization expense on equipment = $24,000 Writedown of goodwill $4,000 b Sold equipment for its net book value. The equipment cost $58. 150 and had been amortized for $19,000. Purchased additional equipment for $94.750. d Exchanged common shares for land valued at $120.000. Declared and paid cash dividends on common shares. $18.940. f Repurchased common shares for $75.000 9 Paid $23.100 (of which $10.100 was interest) on the loans. C e cel