Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Triangle Ltd is an ASX listed company which aims to acquire 100% shares of an unlisted firm, Square Ltd, both of which operate in

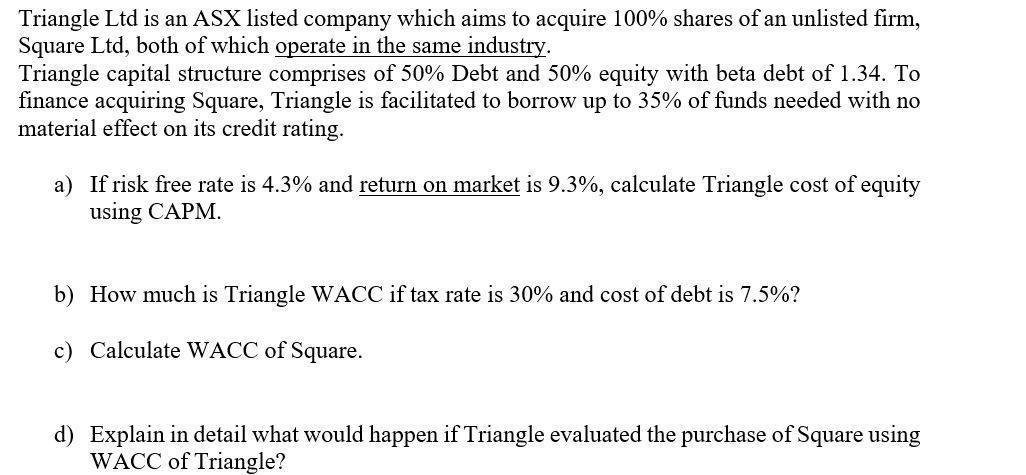

Triangle Ltd is an ASX listed company which aims to acquire 100% shares of an unlisted firm, Square Ltd, both of which operate in the same industry. Triangle capital structure comprises of 50% Debt and 50% equity with beta debt of 1.34. To finance acquiring Square, Triangle is facilitated to borrow up to 35% of funds needed with no material effect on its credit rating. a) If risk free rate is 4.3% and return on market is 9.3%, calculate Triangle cost of equity using CAPM. b) How much is Triangle WACC if tax rate is 30% and cost of debt is 7.5%? c) Calculate WACC of Square. d) Explain in detail what would happen if Triangle evaluated the purchase of Square using WACC of Triangle?

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a b c d as the capital structure of the Square is less risky than the cost of capital of the triangl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started