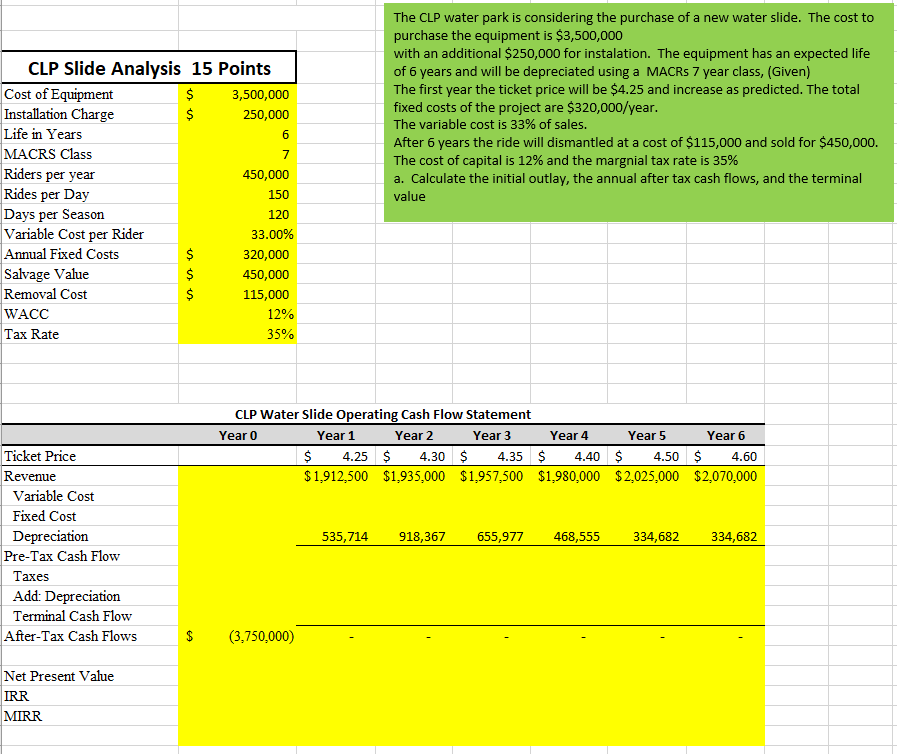

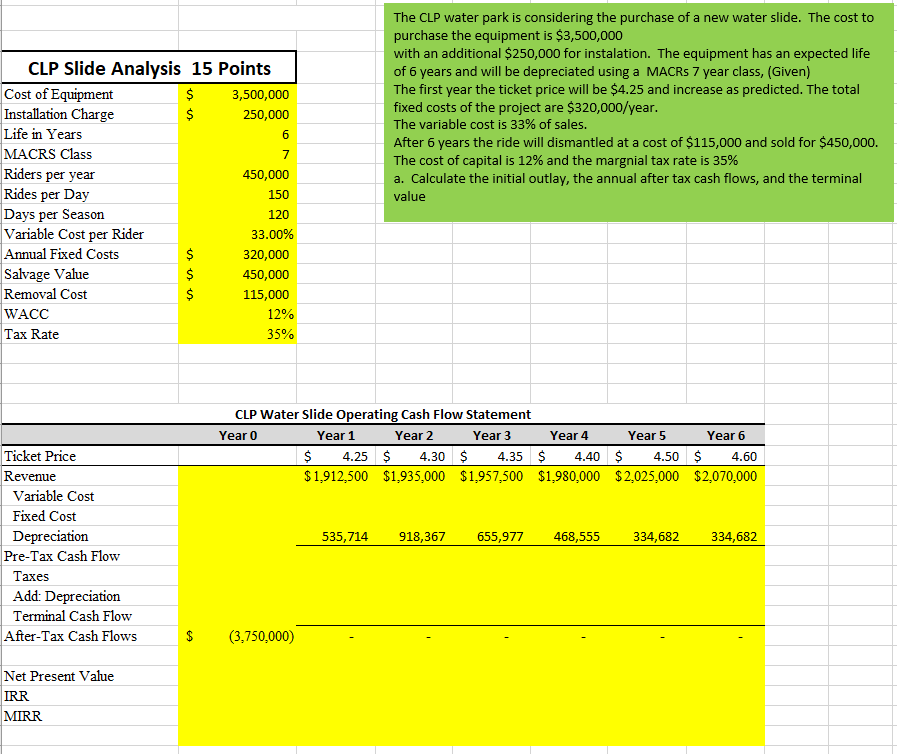

CLP Slide Analysis 15 Points Cost of Equipment $ 3,500,000 Installation Charge $ 250,000 Life in Years 6 MACRS Class 7 Riders per year 450,000 Rides per Day 150 Days per Season 120 Variable Cost per Rider 33.00% Annual Fixed Costs $ 320,000 Salvage Value $ 450,000 Removal Cost $ 115,000 WACC 12% Tax Rate 35% The CLP water park is considering the purchase of a new water slide. The cost to purchase the equipment is $3,500,000 with an additional $250,000 for instalation. The equipment has an expected life of 6 years and will be depreciated using a MACRs 7 year class, (Given) The first year the ticket price will be $4.25 and increase as predicted. The total fixed costs of the project are $320,000/year. The variable cost is 33% of sales. After 6 years the ride will dismantled at a cost of $115,000 and sold for $450,000. The cost of capital is 12% and the margnial tax rate is 35% a. Calculate the initial outlay, the annual after tax cash flows, and the terminal value CLP Water Slide Operating Cash Flow Statement Year o Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 $ 4.25 $ 4.30 $ 4.35 $ 4.40 $ 4.50 $ 4.60 $1,912,500 $1,935,000 $1,957,500 $1,980,000 $2,025,000 $2,070,000 535,714 918,367 655,977 468,555 334,682 334,682 Ticket Price Revenue Variable Cost Fixed Cost Depreciation Pre-Tax Cash Flow Taxes Add: Depreciation Terminal Cash Flow After-Tax Cash Flows $ (3,750,000) Net Present Value IRR MIRR CLP Slide Analysis 15 Points Cost of Equipment $ 3,500,000 Installation Charge $ 250,000 Life in Years 6 MACRS Class 7 Riders per year 450,000 Rides per Day 150 Days per Season 120 Variable Cost per Rider 33.00% Annual Fixed Costs $ 320,000 Salvage Value $ 450,000 Removal Cost $ 115,000 WACC 12% Tax Rate 35% The CLP water park is considering the purchase of a new water slide. The cost to purchase the equipment is $3,500,000 with an additional $250,000 for instalation. The equipment has an expected life of 6 years and will be depreciated using a MACRs 7 year class, (Given) The first year the ticket price will be $4.25 and increase as predicted. The total fixed costs of the project are $320,000/year. The variable cost is 33% of sales. After 6 years the ride will dismantled at a cost of $115,000 and sold for $450,000. The cost of capital is 12% and the margnial tax rate is 35% a. Calculate the initial outlay, the annual after tax cash flows, and the terminal value CLP Water Slide Operating Cash Flow Statement Year o Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 $ 4.25 $ 4.30 $ 4.35 $ 4.40 $ 4.50 $ 4.60 $1,912,500 $1,935,000 $1,957,500 $1,980,000 $2,025,000 $2,070,000 535,714 918,367 655,977 468,555 334,682 334,682 Ticket Price Revenue Variable Cost Fixed Cost Depreciation Pre-Tax Cash Flow Taxes Add: Depreciation Terminal Cash Flow After-Tax Cash Flows $ (3,750,000) Net Present Value IRR MIRR