Question

You are the consumer staples analyst at an asset management company. In a recent meeting, consensus concluded that there is a high likelihood of a

You are the consumer staples analyst at an asset management company. In a recent meeting, consensus concluded that there is a high likelihood of a recession within the next 12 months. One of the managing directors of the firm suggested you do some work on Clorox (CLX) as a possible addition to the portfolio given its lack of economic sensitivity.

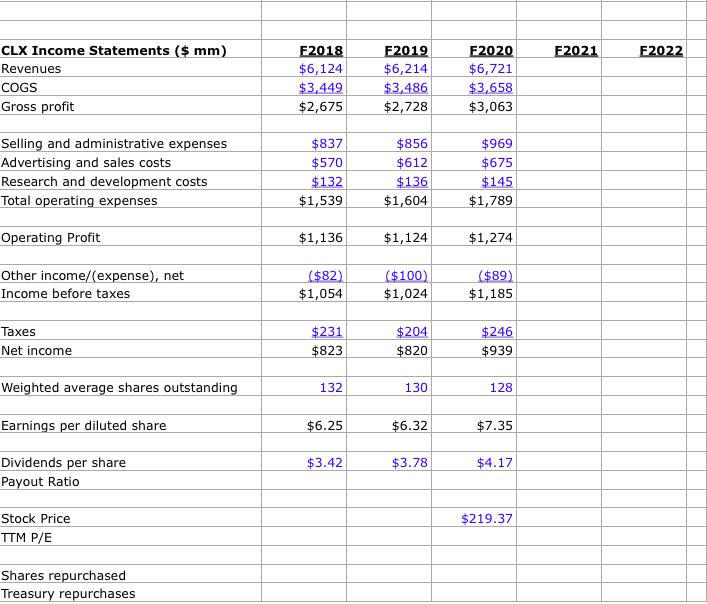

Use the 3-year financial statements provided separately on blackboard to complete proforma balance sheets and income statements for Clorox for FY2021 and 2022. Use an excel spreadsheet to develop your forecast. Actual non-GAAP income statements are provided for FY2018-2020 on blackboard. Use the guidance provided below in completing your forecast. Note you may need to make additional assumptions on your own to complete the forecast. If you do, please make sure you provide your rationale for your additional assumptions.

CLX Guidance for FY21 and FY22:

- Sales are expected to be flat to up low-single digits in both FY21 and FY22.

- GM’s are expected to expand by 10-15 bps per year.

- By year-end FY22 advertising and sales promotion spending is expected to increase to about 11% of sales and selling and administrative expenses are anticipated to decrease to about 14% of sales.

- The company’s effective tax rate is expected to be in the range of 22%-23% for both years.

- Share repurchases will continue at the historical pace. Use the price of CLX in the spreadsheet provided as the starting price ($219.37). For FY21 and FY22, assume the stock price grows in line with eps, or in other words at a constant trailing multiple. Use the fiscal year-end projected price as the cost basis for the shares repurchased during that year.

- Diluted eps are expected to be between a mid-single-digit decrease and a mid-single-digit increase.

After discussions with Clorox’s IR department you make the following additional assumptions:

Assumptions:

- Capex is expected to be $275m in FY21 and then decline to $250m in FY22.

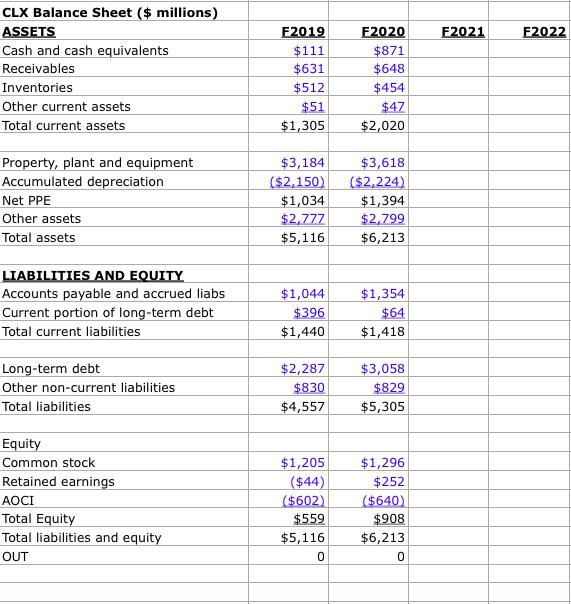

- Forecast A/R, Inventory and A/P based on historic ‘days’ trends. ACP will continue to decline modestly (1 day per year); IDH will remain stable; and DPO will decline 15 days in FY21 and then another 10 days in FY22.

- Assume D/A is $190m for FY21 and $200m in FY22.

- Current portion of LTD will follow the amortization schedule with $300m in FY21 and $600m in FY22. Long-term debt carries an interest of 2.9%.

- Assume CLX maintains a stable payout ratio of 60%.

- Assume common stock grows at 2% per year.

Assignment:

- Prepare proforma income statements and balance sheets for FY21 and FY22. You will need to make reasonable assumption for some line items. Use cash to plug the balance sheet.

- What is cash position of CLX at year-end FY22?

- What is the net debt position of CLX at year-end FY22?

- What is the FCF of CLX in FY22?

CLX Income Statements ($ mm) Revenues COGS Gross profit F2018 F2019 $6,214 $3,486 $2,728 F2020 F2021 F2022 $6,124 $3,449 $2,675 $6,721 $3,658 $3,063 Selling and administrative expenses Advertising and sales costs Research and development costs Total operating expenses $969 $837 $570 $132 $856 $612 $675 $145 $1,789 $136 $1,539 $1,604 Operating Profit $1,136 $1,124 $1,274 Other income/(expense), net Income before taxes ($82) $1,054 ($100) $1,024 ($89) $1,185 Taxes Net income $231 $204 $246 $939 $823 $820 Weighted average shares outstanding 132 130 128 Earnings per diluted share $6.25 $6.32 $7.35 $3.42 $4.17 Dividends per share Payout Ratio $3.78 Stock Price $219.37 TTM P/E Shares repurchased Treasury repurchases CLX Income Statements ($ mm) Revenues COGS Gross profit F2018 F2019 $6,214 $3,486 $2,728 F2020 F2021 F2022 $6,124 $3,449 $2,675 $6,721 $3,658 $3,063 Selling and administrative expenses Advertising and sales costs Research and development costs Total operating expenses $969 $837 $570 $132 $856 $612 $675 $145 $1,789 $136 $1,539 $1,604 Operating Profit $1,136 $1,124 $1,274 Other income/(expense), net Income before taxes ($82) $1,054 ($100) $1,024 ($89) $1,185 Taxes Net income $231 $204 $246 $939 $823 $820 Weighted average shares outstanding 132 130 128 Earnings per diluted share $6.25 $6.32 $7.35 $3.42 $4.17 Dividends per share Payout Ratio $3.78 Stock Price $219.37 TTM P/E Shares repurchased Treasury repurchases CLX Income Statements ($ mm) Revenues COGS Gross profit F2018 F2019 $6,214 $3,486 $2,728 F2020 F2021 F2022 $6,124 $3,449 $2,675 $6,721 $3,658 $3,063 Selling and administrative expenses Advertising and sales costs Research and development costs Total operating expenses $969 $837 $570 $132 $856 $612 $675 $145 $1,789 $136 $1,539 $1,604 Operating Profit $1,136 $1,124 $1,274 Other income/(expense), net Income before taxes ($82) $1,054 ($100) $1,024 ($89) $1,185 Taxes Net income $231 $204 $246 $939 $823 $820 Weighted average shares outstanding 132 130 128 Earnings per diluted share $6.25 $6.32 $7.35 $3.42 $4.17 Dividends per share Payout Ratio $3.78 Stock Price $219.37 TTM P/E Shares repurchased Treasury repurchases CLX Income Statements ($ mm) Revenues COGS Gross profit F2018 F2019 $6,214 $3,486 $2,728 F2020 F2021 F2022 $6,124 $3,449 $2,675 $6,721 $3,658 $3,063 Selling and administrative expenses Advertising and sales costs Research and development costs Total operating expenses $969 $837 $570 $132 $856 $612 $675 $145 $1,789 $136 $1,539 $1,604 Operating Profit $1,136 $1,124 $1,274 Other income/(expense), net Income before taxes ($82) $1,054 ($100) $1,024 ($89) $1,185 Taxes Net income $231 $204 $246 $939 $823 $820 Weighted average shares outstanding 132 130 128 Earnings per diluted share $6.25 $6.32 $7.35 $3.42 $4.17 Dividends per share Payout Ratio $3.78 Stock Price $219.37 TTM P/E Shares repurchased Treasury repurchases

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

CLX INCOME STATEMENT FY 18 FY 19 FY 20 FY 21 FY 22 Revenue 6124 6214 6721 6855 6993 COGS 3449 3486 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started