Question

(CMA, adapted) The Frooty Company is a family-owned business that produces fruit jam. The company has a grinding machine that has been in use for

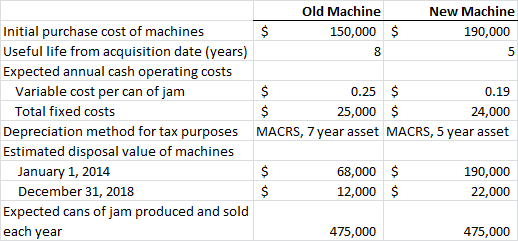

(CMA, adapted) The Frooty Company is a family-owned business that produces fruit jam. The company has a grinding machine that has been in use for 3 years. On January 1, 2014, Frooty is considering the purchase of a new grinding machine. Frooty has two options: (1) continue using the old machine or (2) sell the old machine and purchase a new machine. The seller of the new machine isnt offering a trade-in. The following information has been obtained:

Frooty is subject to a 34% income tax rate. Assume that any gain or loss on the sale of machines is treated as an ordinary tax item and will affect the taxes paid by Frooty in the year in which it occurs. Frootys after-tax required rate of return is 12%. Assume all cash flows occur at year-end except for initial investment amounts.

Can you explain how she got these answers?

1a. tax liability from gain = $4003;

1b. after tax variable costs, old machine = $78375; after tax fixed costs, old machine = $16500; after tax variable costs new machine $59565; after tax fixed costs, new machine $15840;

1c. the difference in depreciation tax shield (DTS) savings (undiscounted) between the old and new machine is 34,856 (new machine is higher).

1d. the difference in undiscounted cash from selling machines at end of useful life is $14,042 (new machine is higher).

2. NPV of keeping old machine is $(320,768); NPV of acquiring new machine is $(338,490);

3.Annual new machine operating costs need to be $4,916 lower.

Thank YOU! I need help bad and use MACRS Not straight line depreciation please

Old Machine New Machine Initial purchase cost of machines Useful life from acquisition date (years) Expected annual cash operating costs 150,000 $ 190,000 Variable cost per can of jam Total fixed costs 0.19 24,000 MACRS, 7 year asset MACRS, 5 year asset 0.25 $ 25,000 $ Depreciation method for tax purposes Estimated disposal value of machines January 1, 2014 December 31, 2018 68,000 12,000 $ 190,000 22,000 Expected cans of jam produced and sold each vear 475,000 475,000 Old Machine New Machine Initial purchase cost of machines Useful life from acquisition date (years) Expected annual cash operating costs 150,000 $ 190,000 Variable cost per can of jam Total fixed costs 0.19 24,000 MACRS, 7 year asset MACRS, 5 year asset 0.25 $ 25,000 $ Depreciation method for tax purposes Estimated disposal value of machines January 1, 2014 December 31, 2018 68,000 12,000 $ 190,000 22,000 Expected cans of jam produced and sold each vear 475,000 475,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started