Answered step by step

Verified Expert Solution

Question

1 Approved Answer

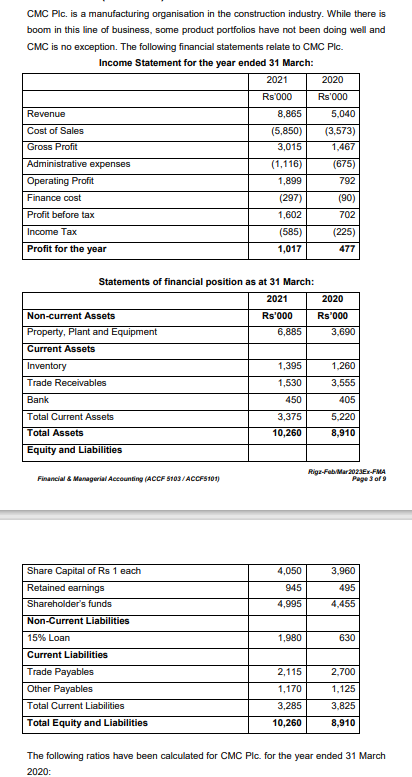

CMC Plc. is a manufacturing organisation in the construction industry. While there is boom in this line of business, some product portfolios have not

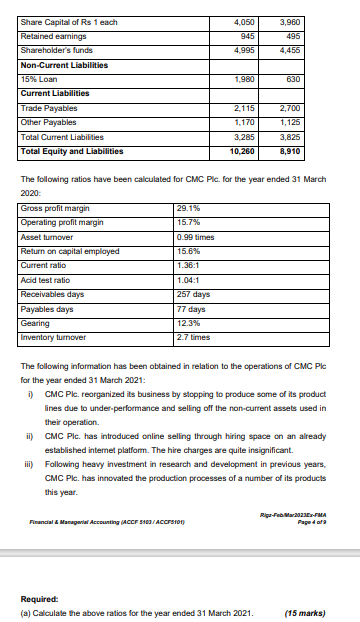

CMC Plc. is a manufacturing organisation in the construction industry. While there is boom in this line of business, some product portfolios have not been doing well and CMC is no exception. The following financial statements relate to CMC Plc. Income Statement for the year ended 31 March: 2021 Rs'000 Revenue Cost of Sales Gross Profit Administrative expenses Operating Profit Finance cost Profit before tax Income Tax Profit for the year Non-current Assets Property, Plant and Equipment Current Assets Inventory Trade Receivables Bank Total Current Assets Total Assets Equity and Liabilities Financial & Managerial Accounting (ACCF 5103/ACCF5101) Statements of financial position as at 31 March: 2021 Rs'000 Share Capital of Rs 1 each Retained earnings Shareholder's funds Non-Current Liabilities 15% Loan 8,865 (5,850) 3,015 Current Liabilities Trade Payables Other Payables Total Current Liabilities Total Equity and Liabilities (1,116) 1,899 (297) 1,602 (585) 1,017 6,885 1,395 1,530 450 3,375 10,260 4,050 945 4,995 1,980 2,115 1,170 3,285 10,260 2020 Rs'000 5,040 (3,573) 1,467 (675) 792 (90) 702 (225) 477 2020 Rs'000 3,690 1,260 3,555 405 5,220 8,910 Rigz-Feb/Mar2023Ex-FMA Page 3 of 9 3,960 495 4,455 630 2,700 1,125 3,825 8,910 The following ratios have been calculated for CMC Plc. for the year ended 31 March 2020: Share Capital of Rs 1 each Retained earnings Shareholder's funds Non-Current Liabilities 15% Loan Current Liabilities Trade Payables Other Payables Total Current Liabilities Total Equity and Liabilities Asset turnover Return on capital employed Current ratio Acid test ratio Receivables days Payables days Gearing Inventory turnover 29.1% 15.7% 0.99 times 15.6% 1.36:1 1.04:1 257 days 77 days 12.3% 2.7 times 4,050 945 4,995 1,980 The following ratios have been calculated for CMC Plc. for the year ended 31 March 2020: Gross profit margin Operating profit margin Financial & Managerial Accounting (ACCF 5103/ACCFS101) 2,115 1,170 3,285 10,260 3,960 495 4,455 630 Required: (a) Calculate the above ratios for the year ended 31 March 2021. 2,700 1,125 3,825 8,910 The following information has been obtained in relation to the operations of CMC Plc for the year ended 31 March 2021: i) CMC Plc. reorganized its business by stopping to produce some of its product lines due to under-performance and selling off the non-current assets used in their operation. ii) CMC Plc. has introduced online selling through hiring space on an already established internet platform. The hire charges are quite insignificant. iii) Following heavy investment in research and development in previous years, CMC Plc. has innovated the production processes of a number of its products this year. Riga-Feb Mar2023Ex-FMA Page of (15 marks)

Step by Step Solution

★★★★★

3.26 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Here are the calculations for the ratios for the year ended 31 March 2021 1 Gross profit margin Gros...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started