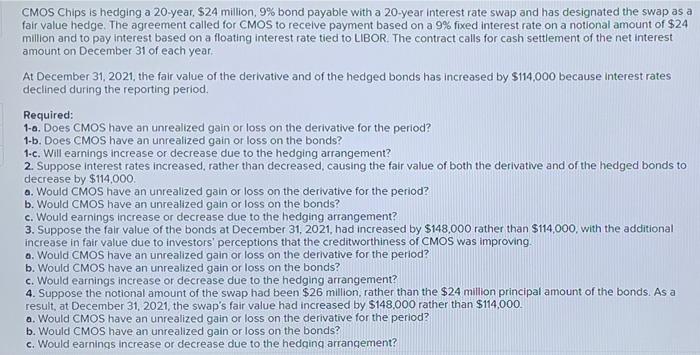

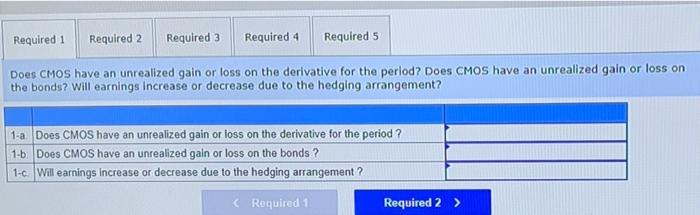

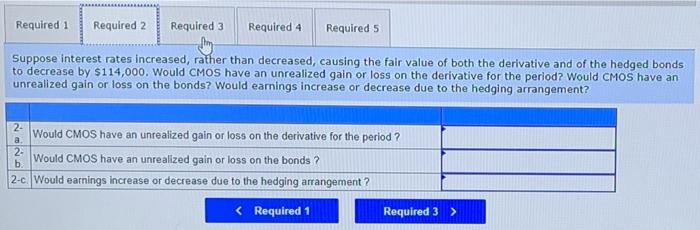

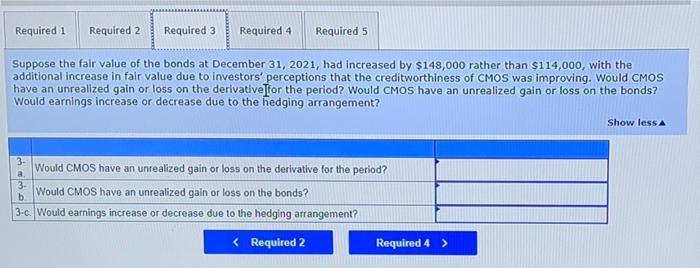

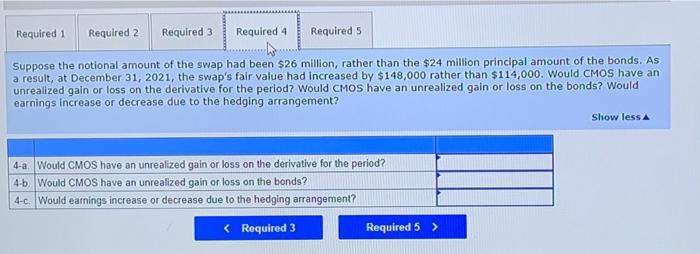

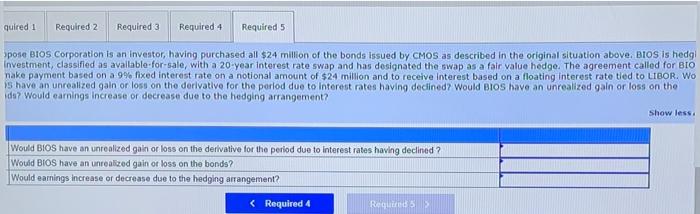

CMOS Chips is hedging a 20-year, $24 million, 9% bond payable with a 20-year Interest rate swap and has designated the swap as a fair value hedge. The agreement called for CMOS to receive payment based on a 9% fixed interest rate on a notional amount of $24 million and to pay Interest based on a floating interest rate tied to LIBOR. The contract calls for cash settlement of the net interest amount on December 31 of each year. At December 31, 2021, the falr value of the derivative and of the hedged bonds has increased by $114,000 because interest rates declined during the reporting period, Required: 1-a. Does CMOS have an unrealized gain or loss on the derivative for the period? 1-b. Does CMOS have an unrealized gain or loss on the bonds? 1-c. Will earnings increase or decrease due to the hedging arrangement? 2. Suppose Interest rates increased, rather than decreased, causing the fair value of both the derivative and of the hedged bonds to decrease by $114,000. a. Would CMOS have an unrealized gain or loss on the derivative for the period? b. Would CMOS have an unrealized gain or loss on the bonds? c. Would earnings increase or decrease due to the hedging arrangement? 3. Suppose the fair value of the bonds at December 31, 2021, had increased by $148,000 rather than $114,000, with the additional increase in fair value due to investors' perceptions that the creditworthiness of CMOS was improving a. Would CMOS have an unrealized gain or loss on the derivative for the period? b. Would CMOS have an unrealized gain or loss on the bonds? c. Would earnings increase or decrease due to the hedging arrangement? 4. Suppose the notional amount of the swap had been $26 million, rather than the $24 million principal amount of the bonds. As a result, at December 31, 2021, the swap's fair value had increased by $148,000 rather than $114,000. a. Would CMOS have an unrealized gain or loss on the derivative for the period? b. Would CMOS have an unrealized gain or loss on the bonds? c. Would earnings increase or decrease due to the hedging arrangement? Required 1 Required 2 Required 3 Required 4 Required 5 Does CMOs have an unrealized gain or loss on the derivative for the period? Does CMOS have an unrealized gain or loss on the bonds? Will earnings increase or decrease due to the hedging arrangement? 1-a Does CMOS have an unrealized gain or loss on the derivative for the period ? 1-6 Does CMOS have an unrealized gain or loss on the bonds ? 1-6 Will earnings Increase or decrease due to the hedging arrangement ? Required 1 Required 2 Required 3 Required 4 Required 5 Suppose interest rates increased, rather than decreased, causing the fair value of both the derivative and of the hedged bonds to decrease by $114,000. Would CMOS have an unrealized gain or loss on the derivative for the period? Would CMOS have an unrealized gain or loss on the bonds? Would earnings increase or decrease due to the hedging arrangement? 2. Would CMOS have an unrealized gain or loss on the derivative for the period ? Would CMOS have an unrealized gain or loss on the bonds ? 2-c Would earnings increase or decrease due to the hedging arrangement? a 2- b Required 1 Required 2 Required 3 Required 4 Required 5 Suppose the fair value of the bonds at December 31, 2021, had increased by $148,000 rather than $114,000, with the additional increase in fair value due to investors' perceptions that the creditworthiness of CMOS was improving. Would CMOS have an unrealized gain or loss on the derivativeIfor the period? Would CMOS have an unrealized gain or loss on the bonds? Would earnings increase or decrease due to the hedging arrangement? Show less Would CMOS have an unrealized gain or loss on the derivative for the period? Would CMOS have an unrealized gain or loss on the bonds? 3-c. Would earnings increase or decrease due to the hedging arrangement? 3- a 3 b Required 1 Required 2 Required 3 Required 4 Required 5 ho Suppose the notional amount of the swap had been $26 million, rather than the $24 million principal amount of the bonds. As a result, at December 31, 2021, the swap's fair value had Increased by $148,000 rather than $114,000. Would CMOS have an unrealized gain or loss on the derivative for the period? Would CMOS have an unrealized gain or loss on the bonds? Would earnings increase or decrease due to the hedging arrangement? Show less 4-a. Would CMOS have an unrealized gain or loss on the derivative for the period? 4-6. Would CMOS have an unrealized gain or loss on the bonds? 4-c Would earnings increase or decrease due to the hedging arrangement? quired 1 Required 2 Required 3 Required 4 Required 5 pose BIOS Corporation is an investor, having purchased all $24 million of the bonds issued by CMOS as described in the original situation above. BIOS is hedg Investment, classified as available-for-sale, with a 20-year interest rate swap and has designated the swap as a fair value hedge. The agreement called for BIO make payment based on a 9% fixed interest rate on a notional amount of $24 million and to receive Interest based on a floating Interest rate tied to LIBOR. WO Shave a coalized gain or loss on the darivalve for the period due to interest rates having declined? Would Bios have an unrealized galn or loss on the da? Would earnings increase or decrease due to the hedging arrangement? Show less Would BIOS have an unrealized gain or loss on the derivative for the period due to interest rates having declined ? Would BIOS have an unrealized gain or loss on the bonds? Would earnings increase or decrease due to the hedging arrangement?