Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CMS Energy Inc preferred stock pays an annual dividend of $11 per share. Assume the next dividend will be paid in one year. Investments

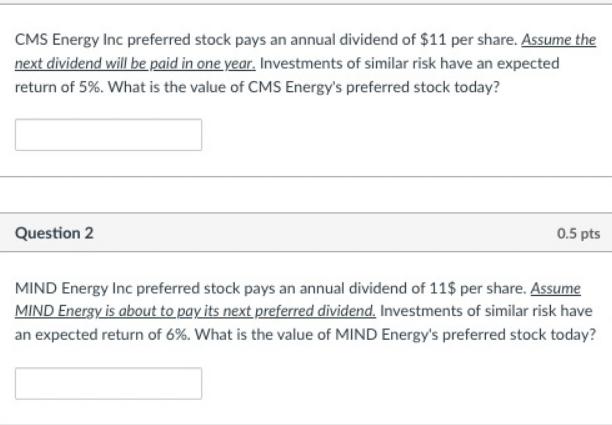

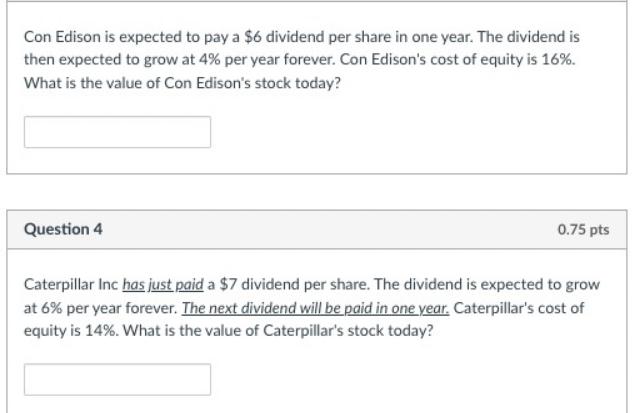

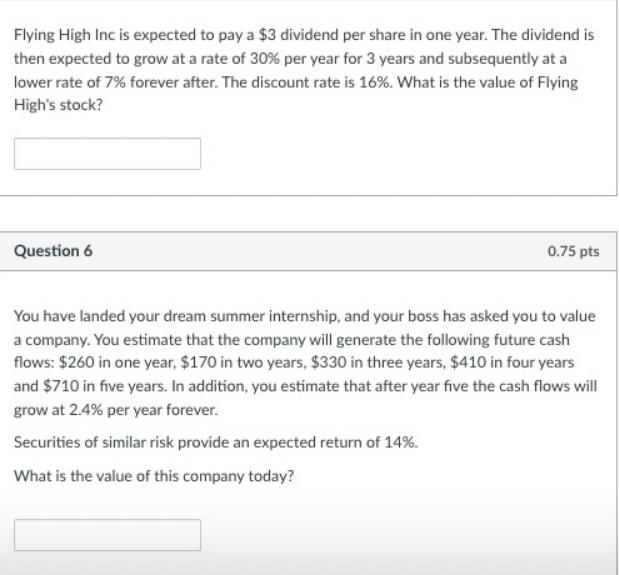

CMS Energy Inc preferred stock pays an annual dividend of $11 per share. Assume the next dividend will be paid in one year. Investments of similar risk have an expected return of 5%. What is the value of CMS Energy's preferred stock today? Question 2 0.5 pts MIND Energy Inc preferred stock pays an annual dividend of 11$ per share. Assume MIND Energy is about to pay its next preferred dividend. Investments of similar risk have an expected return of 6%. What is the value of MIND Energy's preferred stock today? Con Edison is expected to pay a $6 dividend per share in one year. The dividend is then expected to grow at 4% per year forever. Con Edison's cost of equity is 16%. What is the value of Con Edison's stock today? Question 4 0.75 pts Caterpillar Inc has just paid a $7 dividend per share. The dividend is expected to grow at 6% per year forever. The next dividend will be paid in one year. Caterpillar's cost of equity is 14%. What is the value of Caterpillar's stock today? Flying High Inc is expected to pay a $3 dividend per share in one year. The dividend is then expected to grow at a rate of 30% per year for 3 years and subsequently at a lower rate of 7% forever after. The discount rate is 16%. What is the value of Flying High's stock? Question 6 0.75 pts You have landed your dream summer internship, and your boss has asked you to value a company. You estimate that the company will generate the following future cash flows: $260 in one year, $170 in two years, $330 in three years, $410 in four years and $710 in five years. In addition, you estimate that after year five the cash flows will grow at 2.4% per year forever. Securities of similar risk provide an expected return of 14%. What is the value of this company today?

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Question 1 To calculate the value of CMS Energy Incs preferred stock today we need to use the dividend discount model DDM The DDM formula for valuing preferred stock is Value Dividend Require...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started