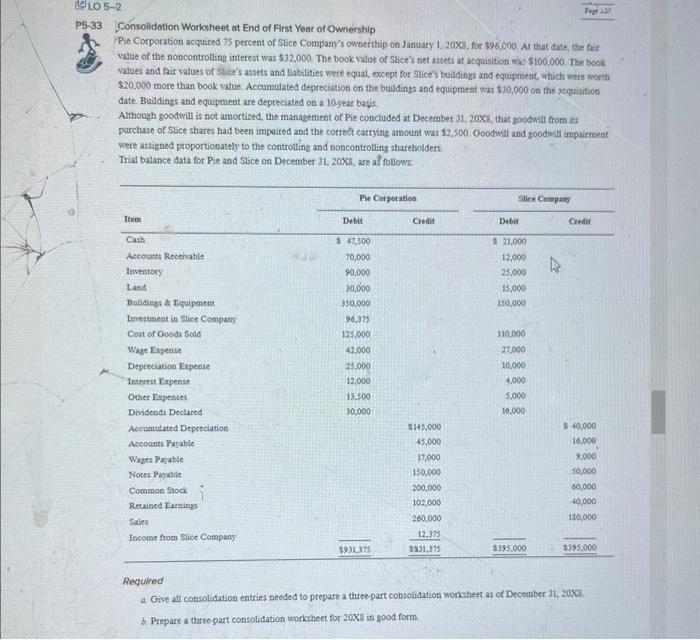

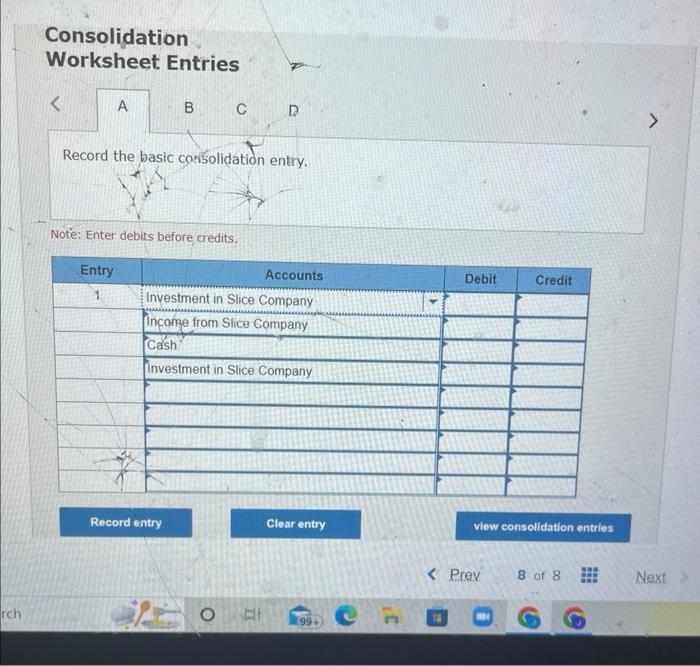

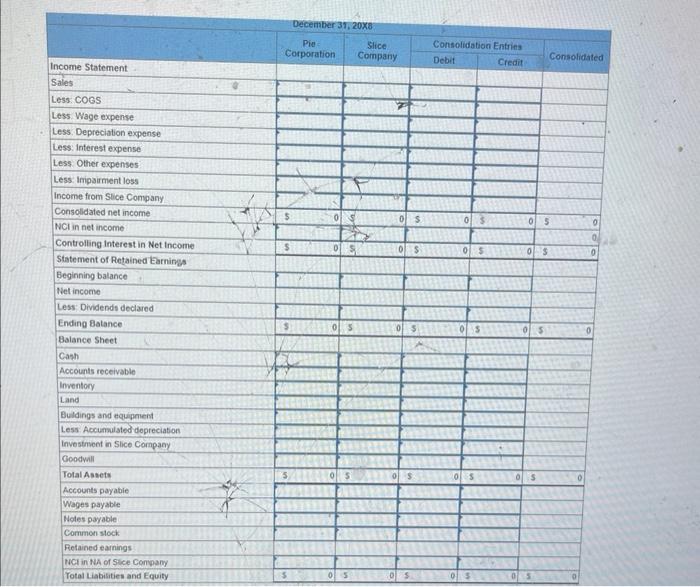

Cnsolidation Worksheet at End of First Year of Ownership Pie Corporation acquired 75 percent of Sice Complany's ownership on January 1, 20x3, for 396,000 . At that date, the fait vatue of the noncontrolling interest was $32,000. The book value of Slice's net assets at acquisition was $100,000. The book values anid fir values of shtce's assets and liabilities wert equal, except for Stices buildings and equipment, which were worth $20,000 more than book value. Accumulated depreciation on the buildings and equipmiest was $30,000 on the scquitition date. Bualdings and equipment are depreciated on a lojear bayis. Although goodvill is not amortized, the management of Pie concluded at December 31,20X, that goodwill from its purchase of Slice shares had beet impeired and the correct carrying amount was $2.500. 000 dwill and poodwill impairment were assigned proportionately to the controlling and noncontrolling sharelwhiders Trial balance data for Pie and Stice on December 31,208, are a? followa: Reguired a Give all consotidation entries needed to prepare a threepart cotsolidation workheet as of December 31,205 : 6. Prepare a threepart consoldation workheet for 20Ks in good form. Consolidation Worksheet Entries Record the basic cosisolidation entry. Note: Enter debits before credits. Cnsolidation Worksheet at End of First Year of Ownership Pie Corporation acquired 75 percent of Sice Complany's ownership on January 1, 20x3, for 396,000 . At that date, the fait vatue of the noncontrolling interest was $32,000. The book value of Slice's net assets at acquisition was $100,000. The book values anid fir values of shtce's assets and liabilities wert equal, except for Stices buildings and equipment, which were worth $20,000 more than book value. Accumulated depreciation on the buildings and equipmiest was $30,000 on the scquitition date. Bualdings and equipment are depreciated on a lojear bayis. Although goodvill is not amortized, the management of Pie concluded at December 31,20X, that goodwill from its purchase of Slice shares had beet impeired and the correct carrying amount was $2.500. 000 dwill and poodwill impairment were assigned proportionately to the controlling and noncontrolling sharelwhiders Trial balance data for Pie and Stice on December 31,208, are a? followa: Reguired a Give all consotidation entries needed to prepare a threepart cotsolidation workheet as of December 31,205 : 6. Prepare a threepart consoldation workheet for 20Ks in good form. Consolidation Worksheet Entries Record the basic cosisolidation entry. Note: Enter debits before credits