Answered step by step

Verified Expert Solution

Question

1 Approved Answer

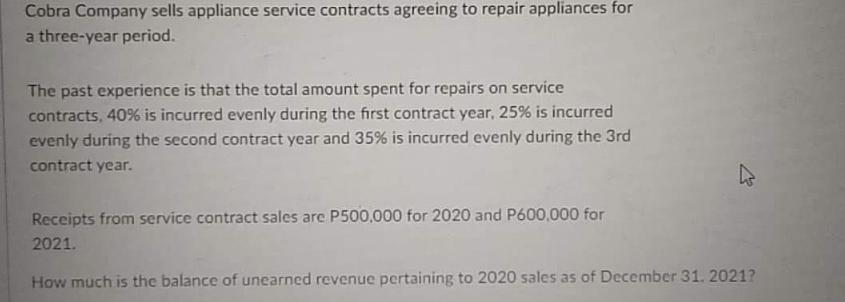

Cobra Company sells appliance service contracts agreeing to repair appliances for a three-year period. The past experience is that the total amount spent for

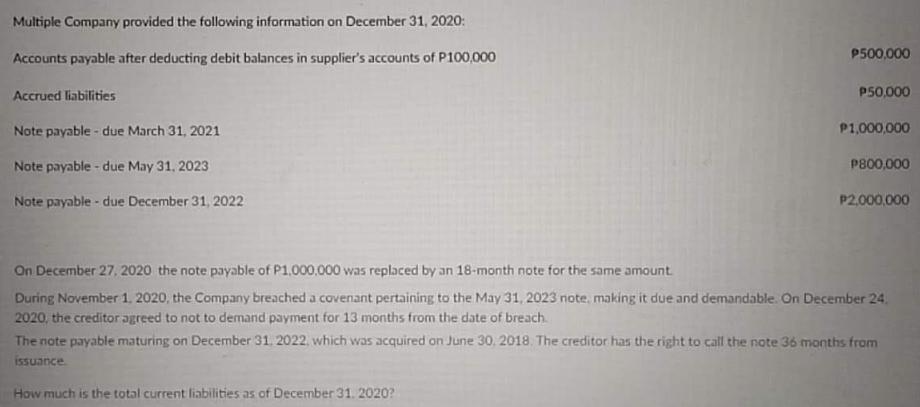

Cobra Company sells appliance service contracts agreeing to repair appliances for a three-year period. The past experience is that the total amount spent for repairs on service contracts, 40% is incurred evenly during the first contract year, 25% is incurred evenly during the second contract year and 35% is incurred evenly during the 3rd contract year. Receipts from service contract sales are P500,000 for 2020 and P600,000 for 2021. How much is the balance of unearned revenue pertaining to 2020 sales as of December 31, 2021? Multiple Company provided the following information on December 31, 2020: Accounts payable after deducting debit balances in supplier's accounts of P100,000 Accrued liabilities Note payable - due March 31, 2021 Note payable - due May 31, 2023 Note payable - due December 31, 2022 P500,000 How much is the total current liabilities as of December 31, 2020? 950,000 P1,000,000 P800,000 P2,000,000 On December 27, 2020 the note payable of P1,000,000 was replaced by an 18-month note for the same amount. During November 1, 2020, the Company breached a covenant pertaining to the May 31, 2023 note, making it due and demandable. On December 24. 2020, the creditor agreed to not to demand payment for 13 months from the date of breach. The note payable maturing on December 31, 2022, which was acquired on June 30, 2018. The creditor has the right to call the note 36 months from issuance

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 Determine the balance of unearned revenue pertaining to 2020 sales as of December 31 2021 In 2020 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started