Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cobra Corp. issued 2,000 convertible bonds on January 1, 2020, which mature on December 31, 2024. Each $1,000 bond is convertible into 2 common

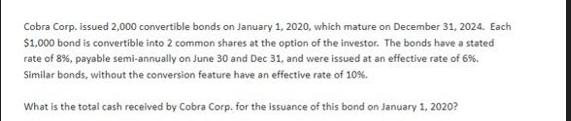

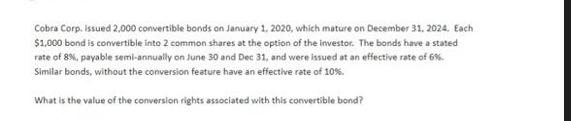

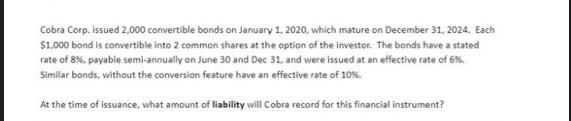

Cobra Corp. issued 2,000 convertible bonds on January 1, 2020, which mature on December 31, 2024. Each $1,000 bond is convertible into 2 common shares at the option of the investor. The bonds have a stated rate of 8%, payable semi-annually on June 30 and Dec 31, and were issued at an effective rate of 6%. Similar bonds, without the conversion feature have an effective rate of 10%. What is the total cash received by Cobra Corp. for the issuance of this bond on January 1, 2020? Cobra Corp.issued 2,000 convertible bonds on January 1, 2020, which mature on December 31, 2024. Each $1,000 bond is convertible into 2 common shares at the option of the investor. The bonds have a stated rate of 8%, payable semi-annually on June 30 and Dec 31, and were issued at an effective rate of 6%. Similar bonds, without the conversion feature have an effective rate of 10%. What is the value of the conversion rights associated with this convertible bond? Cobra Corp. issued 2,000 convertible bonds on January 1, 2020, which mature on December 31, 2024. Each $1,000 bond is convertible into 2 common shares at the option of the investor. The bonds have a stated rate of 8%, payable semi-annually on June 30 and Dec 31, and were issued at an effective rate of 6%. Similar bonds, without the conversion feature have an effective rate of 10%. At the time of issuance, what amount of liability will Cobra record for this financial instrument?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started