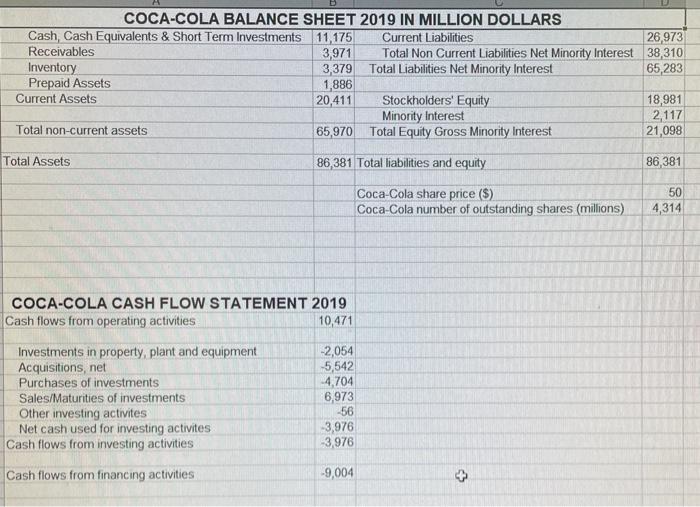

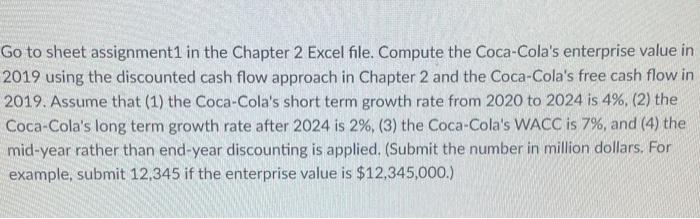

COCA-COLA BALANCE SHEET 2019 IN MILLION DOLLARS Cash Cash Equivalents & Short Term Investments 11,175 Current Liabilities 26,973 Receivables 3,971 Total Non Current Liabilities Net Minority Interest 38,310 Inventory 3,379 Total Liabilities Net Minority Interest 65,283 Prepaid Assets 1,886 Current Assets 20,411 Stockholders' Equity 18,981 Minority interest 2,117 Total non-current assets 65,970 Total Equity Gross Minority Interest 21,098 Total Assets 86,381 Total liabilities and equity 86,381 Coca-Cola share price ($) Coca-Cola number of outstanding shares (millions) 50 4,314 COCA-COLA CASH FLOW STATEMENT 2019 Cash flows from operating activities 10,471 Investments in property, plant and equipment -2,054 Acquisitions, net -5,542 Purchases of investments 4,704 Sales/Maturities of investments 6,973 Other investing activites -56 Net cash used for investing activites -3,976 Cash flows from investing activities -3.976 Cash flows from financing activities -9,004 Go to sheet assignment1 in the Chapter 2 Excel file. Compute the Coca-Cola's enterprise value in 2019 using the discounted cash flow approach in Chapter 2 and the Coca-Cola's free cash flow in 2019. Assume that (1) the Coca-Cola's short term growth rate from 2020 to 2024 is 4%, (2) the Coca-Cola's long term growth rate after 2024 is 2%, (3) the Coca-Cola's WACC is 7%, and (4) the mid-year rather than end-year discounting is applied. (Submit the number in million dollars. For example, submit 12.345 if the enterprise value is $12,345,000.) COCA-COLA BALANCE SHEET 2019 IN MILLION DOLLARS Cash Cash Equivalents & Short Term Investments 11,175 Current Liabilities 26,973 Receivables 3,971 Total Non Current Liabilities Net Minority Interest 38,310 Inventory 3,379 Total Liabilities Net Minority Interest 65,283 Prepaid Assets 1,886 Current Assets 20,411 Stockholders' Equity 18,981 Minority interest 2,117 Total non-current assets 65,970 Total Equity Gross Minority Interest 21,098 Total Assets 86,381 Total liabilities and equity 86,381 Coca-Cola share price ($) Coca-Cola number of outstanding shares (millions) 50 4,314 COCA-COLA CASH FLOW STATEMENT 2019 Cash flows from operating activities 10,471 Investments in property, plant and equipment -2,054 Acquisitions, net -5,542 Purchases of investments 4,704 Sales/Maturities of investments 6,973 Other investing activites -56 Net cash used for investing activites -3,976 Cash flows from investing activities -3.976 Cash flows from financing activities -9,004 Go to sheet assignment1 in the Chapter 2 Excel file. Compute the Coca-Cola's enterprise value in 2019 using the discounted cash flow approach in Chapter 2 and the Coca-Cola's free cash flow in 2019. Assume that (1) the Coca-Cola's short term growth rate from 2020 to 2024 is 4%, (2) the Coca-Cola's long term growth rate after 2024 is 2%, (3) the Coca-Cola's WACC is 7%, and (4) the mid-year rather than end-year discounting is applied. (Submit the number in million dollars. For example, submit 12.345 if the enterprise value is $12,345,000.)