Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Coconut, an individual, is the sole shareholder of Tropical Fruit Corporation, a U.S. based corporation. Coconut also owns the office building that serves as

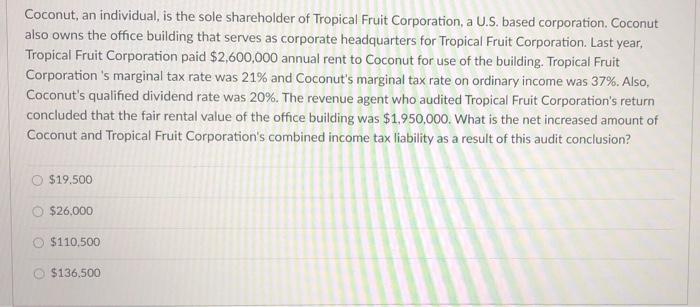

Coconut, an individual, is the sole shareholder of Tropical Fruit Corporation, a U.S. based corporation. Coconut also owns the office building that serves as corporate headquarters for Tropical Fruit Corporation. Last year, Tropical Fruit Corporation paid $2,600,000 annual rent to Coconut for use of the building. Tropical Fruit Corporation 's marginal tax rate was 21% and Coconut's marginal tax rate on ordinary income was 37%. Also, Coconut's qualified dividend rate was 20%. The revenue agent who audited Tropical Fruit Corporation's return concluded that the fair rental value of the office building was $1,950,000. What is the net increased amount of Coconut and Tropical Fruit Corporation's combined income tax liability as a result of this audit conclusion? $19,500 $26.000 $110,500 $136.500

Step by Step Solution

★★★★★

3.56 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Solution Correct option is B26500 Explanation In accounting books ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started