Answered step by step

Verified Expert Solution

Question

1 Approved Answer

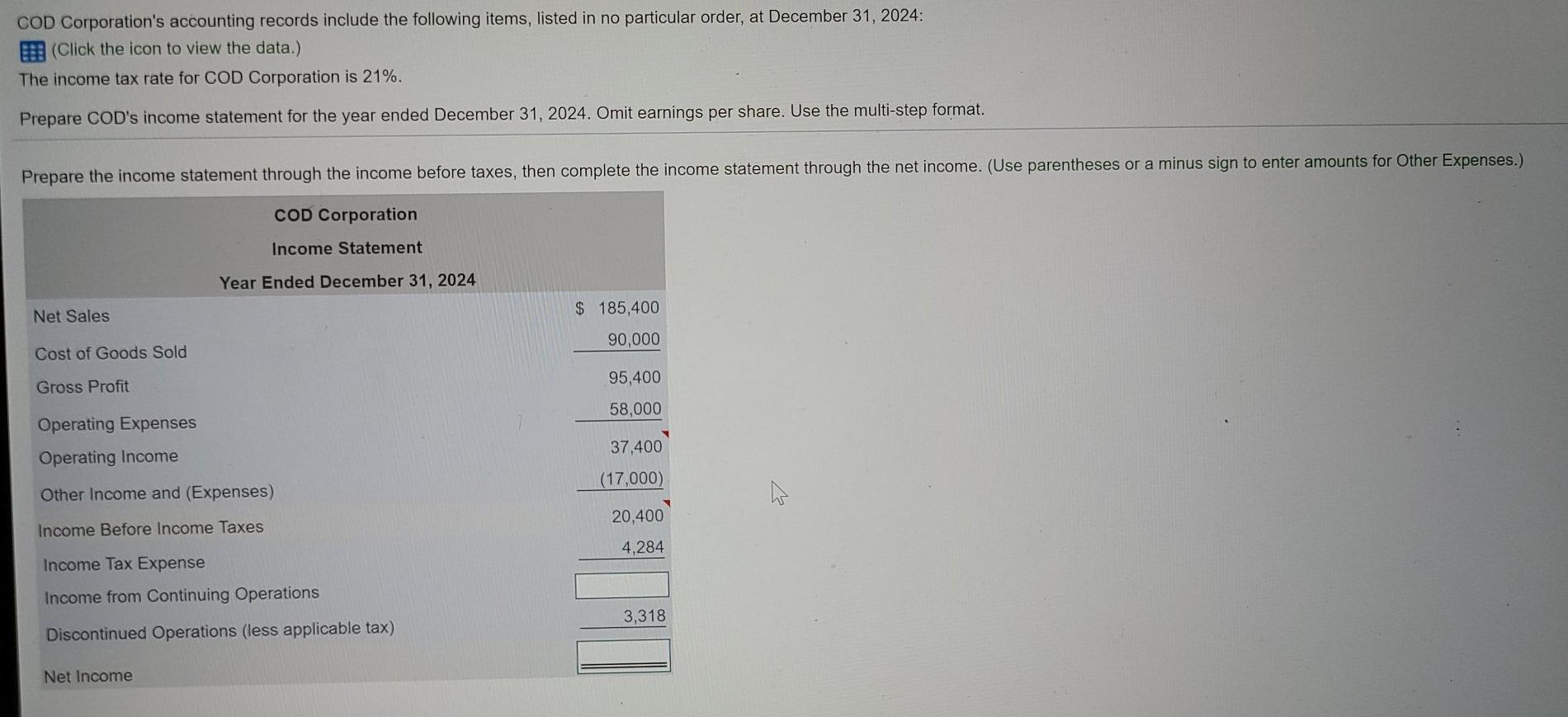

COD Corporation's accounting records include the following items, listed in no particular order, at December 31, 2024: (Click the icon to view the data.) The

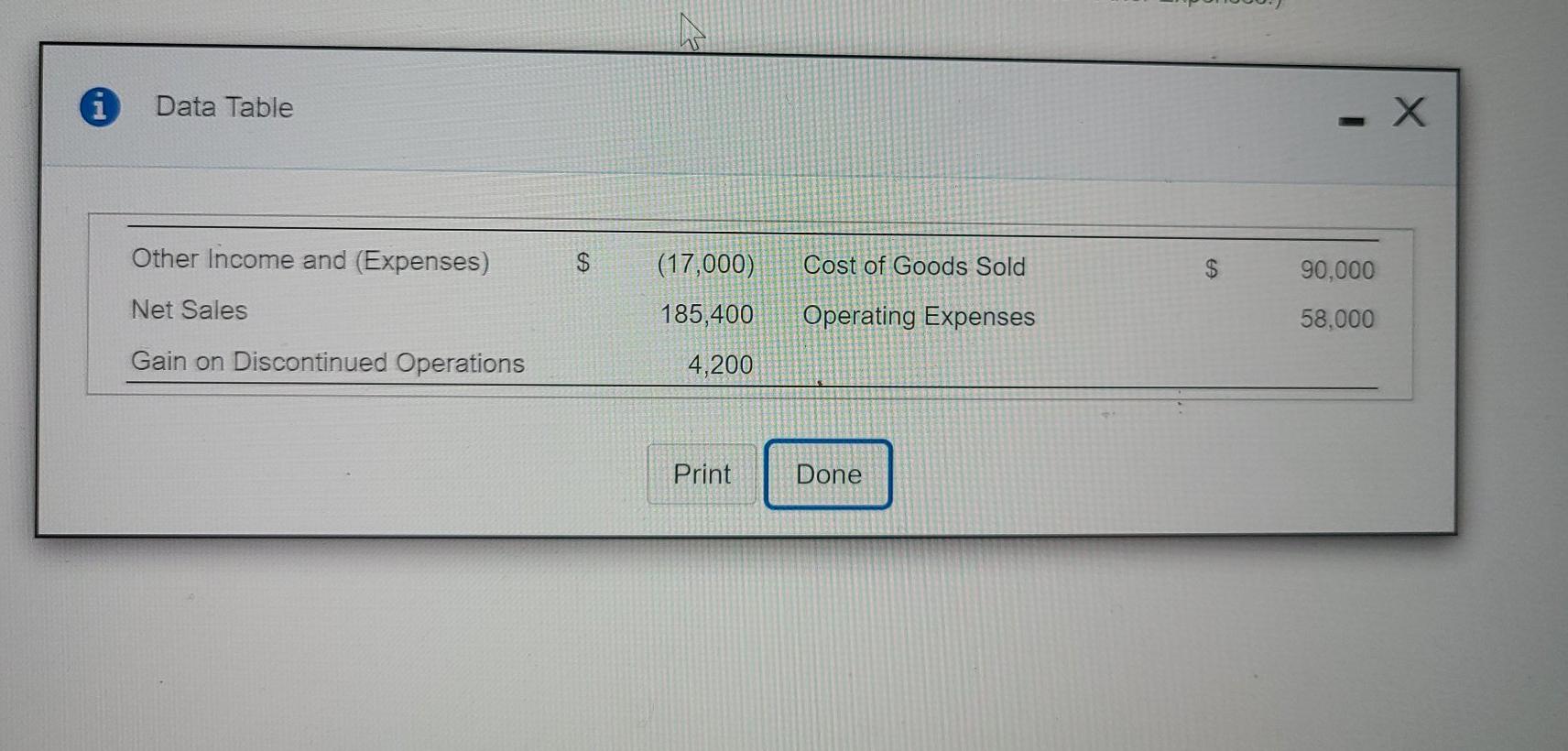

COD Corporation's accounting records include the following items, listed in no particular order, at December 31, 2024: (Click the icon to view the data.) The income tax rate for COD Corporation is 21%. Prepare COD's income statement for the year ended December 31, 2024. Omit earnings per share. Use the multi-step format. Prepare the income statement through the income before taxes, then complete the income statement through the net income. (Use parentheses or a minus sign to enter amounts for Other Expenses.) COD Corporation Income Statement Year Ended December 31, 2024 $ 185,400 Net Sales 90,000 Cost of Goods Sold Gross Profit 95,400 58,000 Operating Expenses Operating Income 37,400 (17,000) Other Income and (Expenses) 20,400 Income Before Income Taxes 4,284 Income Tax Expense Income from Continuing Operations 3,318 Discontinued Operations (less applicable tax) Net Income Data Table - X Other Income and (Expenses) $ (17,000) Cost of Goods Sold 90,000 Net Sales 185,400 Operating Expenses 58.000 Gain on Discontinued Operations 4,200 Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started