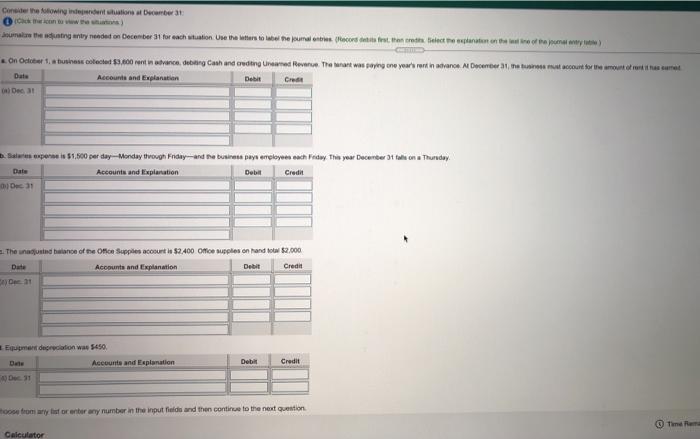

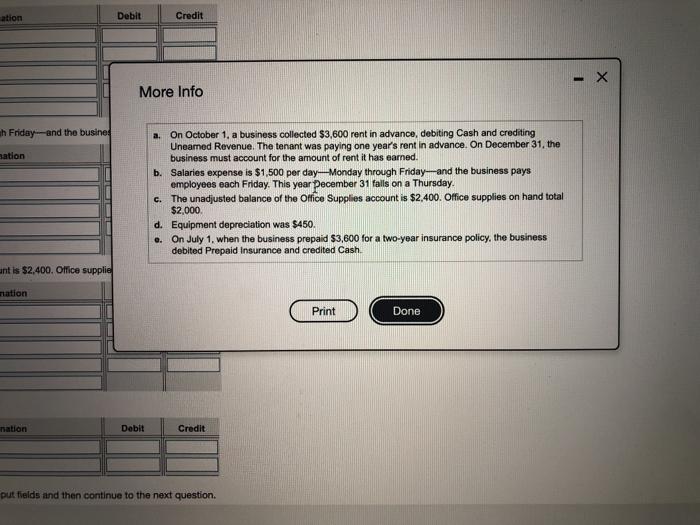

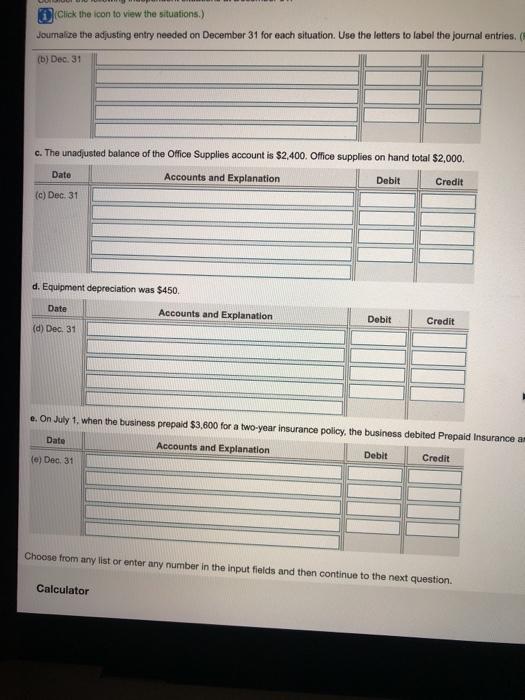

Code The following independent stations December Saturate the counting any needed on December 31 for each unten. Use the waters to the found the locors de tren rette Select the planten en het voort te pune www on the collected 3.600 tance, debiting Cash and creding Unearned ever. The work was sony one year rastin trane. Docenter, et muut account mount and the current Date Accounts and Explanation Det Dec 31 Suspensei 51.500 per day Monday through Friday and the business pays employees each Friday This year December 31 tale on a Thunday Date Accounts and Explanation Credit Dec 31 Debit The unajusid of the Onion Supplies acourts $2,400 Office supplies on hand $2.000 Date Accounts and Explanation Debit Credit 21 Eerderadion was 5450 Account and Explanation Dec 31 Det Credit ostronny for enter any number in the input fields and then continue to the next Question Tine Calculator ation Debit Debit Credit - X More Info ah Friday and the busine sation a. On October 1, a business collected $3,600 rent in advance, debiting Cash and crediting Uneamed Revenue. The tenant was paying one year's rent in advance. On December 31, the business must account for the amount of rent it has earned. b. Salaries expense is $1,500 per day Monday through Friday and the business pays employees each Friday. This year December 31 falls on a Thursday C. The unadjusted balance of the Office Supplies account is $2,400. Office supplies on hand total $2,000 d. Equipment depreciation was $450. Q. On July 1, when the business prepaid $3,600 for a two-year insurance policy, the business debited Prepaid Insurance and credited Cash unt is $2,400. Office supplie nation Print Done nation Debit Credit put fields and then continue to the next question. (Click the icon to view the situations.) Joumalize the adjusting entry needed on December 31 for each situation. Use the letters to label the journal entries. (b) Dec. 31 c. The unadjusted balance of the Office Supplies account is $2,400. Office supplies on hand total $2,000. Date Accounts and Explanation Debit Credit (c) Dec. 31 d. Equipment depreciation was $450 Date Accounts and Explanation Debit Credit (d) Dec 31 e. On July 1, when the business prepaid $3,600 for a two-year insurance policy, the business debited Prepal Date Insurance a Accounts and Explanation Debit (0) Dec 31 Credit Choose from any list or enter any number in the input fields and then continue to the next question. Calculator