Question

Codebase: import numpy as np import math import cvxpy as cp import pandas as pd import seaborn as sns import matplotlib.pyplot as plt import scipy.cluster.hierarchy

Codebase:

import numpy as np

import math

import cvxpy as cp

import pandas as pd

import seaborn as sns

import matplotlib.pyplot as plt

import scipy.cluster.hierarchy as sch,random

import warnings

warnings.filterwarnings('ignore')

plt.style.use('ggplot')

dataset_log_returns = pd.read_csv('dataset.csv', index_col=0, parse_dates=True)

# The function you need to write.

# Input: cov: a dataframe containing the covariance matrix of stocks.

# sortIx: a list containing the stocks names, ordered by the stage 1&2.

# You can add any input argument if you need.

# Output: allocation weight. You can output any data type as long as you can use it properly in Q3.

def getRecBipart(cov,sortIx):

# A sub function for the satge 1 and 2, called in the hrp_s12()

def getQuasiDiag(link):

link=link.astype(int)

sortIx=pd.Series([link[-1,0],link[-1,1]])

numItems=link[-1,3]

while sortIx.max()>=numItems:

sortIx.index=range(0,sortIx.shape[0]*2,2)

df0=sortIx[sortIx>=numItems]

i=df0.index;j=df0.values-numItems

sortIx[i]=link[j,0]

df0=pd.Series(link[j,1],index=i+1)

sortIx=sortIx.append(df0)

sortIx=sortIx.sort_index()

sortIx.index=range(sortIx.shape[0])

return sortIx.tolist()

# Transform the correlation matrix to a distance matrix

def correlDist(corr, n_stock):

dist=((1-corr)/2.)**.5

for i in range(n_stock):

dist.iloc[i,i] = 0

return dist

# Plot the heatmap of the correlation matrix

def plotCorrMatrix(path,corr,labels=None):

#

if labels is None:labels=[]

plt.pcolor(corr)

plt.colorbar()

plt.yticks(np.arange(.5,corr.shape[0]+.5),labels)

plt.xticks(np.arange(.5,corr.shape[0]+.5),labels)

plt.savefig(path)

plt.clf();plt.close()

return

# Function for Stage 1 and 2

def hrp_s12(cov,stock_namelist, ifplot = False):

n_stock = len(stock_namelist)

#1) compute and plot correlation matrix

v = np.diag(np.sqrt(1p.diag(cov)))

corr = np.dot(np.dot(v,cov), v)

cov = pd.DataFrame(cov, columns = stock_namelist, index = stock_namelist)

corr = pd.DataFrame(corr, columns = stock_namelist, index = stock_namelist)

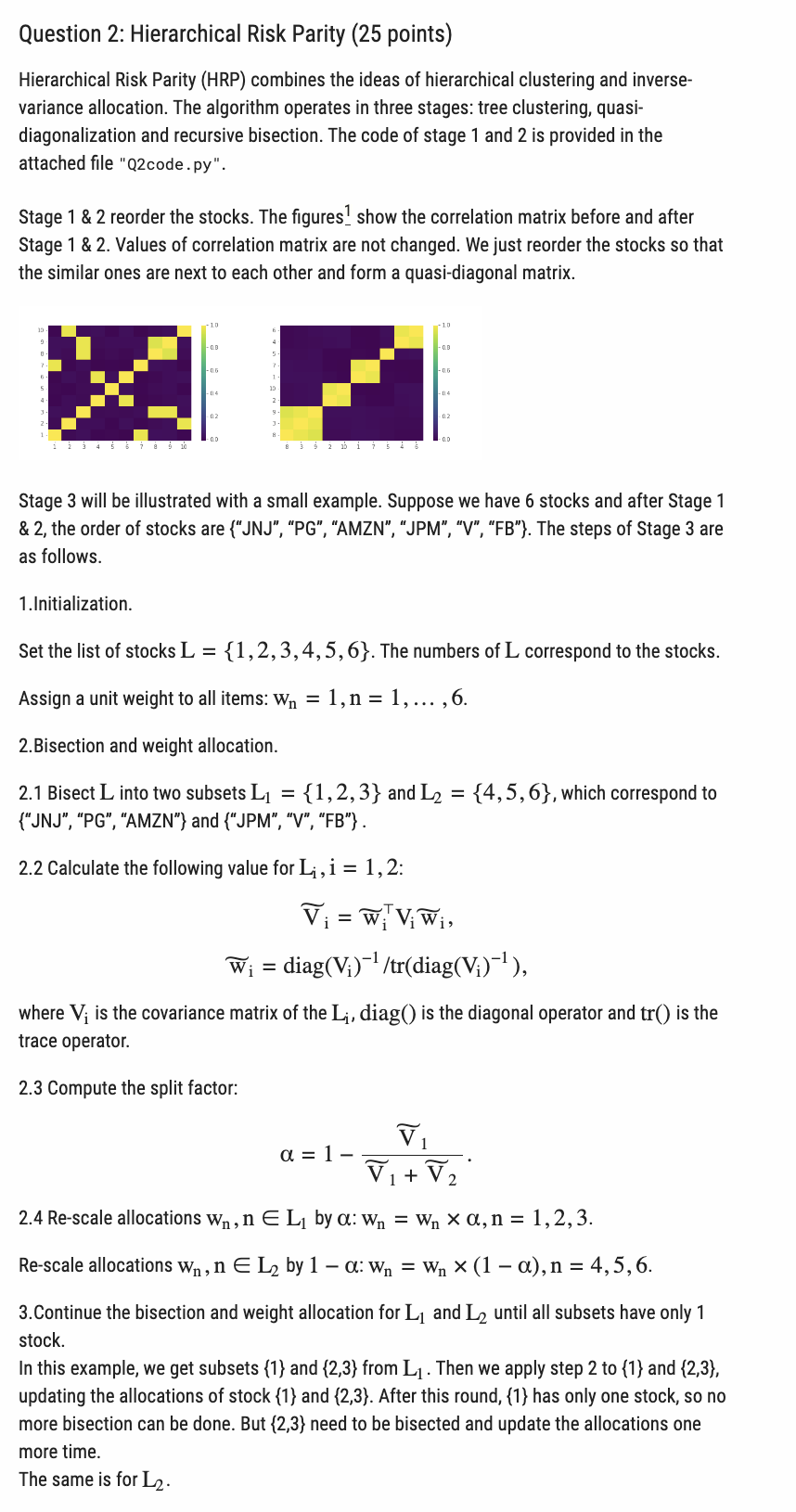

if (ifplot): plotCorrMatrix('HRP_corr0.png',corr,labels=corr.columns)

#2) cluster

dist=correlDist(corr,n_stock)

link=sch.linkage(dist,'single')

sortIx=getQuasiDiag(link)

sortIx=corr.index[sortIx].tolist() # recover labels

df0=corr.loc[sortIx,sortIx] # reorder

if (ifplot): plotCorrMatrix('HRP_corr1.png',df0,labels=df0.columns)

return sortIx

def hrp_s3(cov,stock_namelist,sortIx):

cov = pd.DataFrame(cov, columns = stock_namelist, index = stock_namelist)

# Finish this function getRecBipart(cov,sortIx).

hrp = getRecBipart(cov,sortIx)

# Please print and check the "hrp" returned by the "getRecBipart(cov,sortIx)".

# The order of stocks in "hrp" maybe follow the "sortIx", which is different from the "stock_namelist".

# I suggest you to restore the order of "hrp" to "stock_namelist" here,

# in order to avoid mistakes in Q3.

# My "hrp" is a pandas.series, so this is what I do:

hrp = hrp[stock_namelist]

# It's OK if you want to finish this step in "getRecBipart()".

# It's also Ok if you want to skip this step here and deal with this small order problem in Q3.

return hrp

if __name__ == '__main__':

stock_namelist = dataset_log_returns.columns.values.tolist()

log_returns_1 = dataset_log_returns.loc['2015-01-06':'2015-05-29']

Sigma = np.cov(log_returns_1.T)

# Fill in the right argument to get the plots and new order of stocks:

sortIx = hrp_s12(Sigma, stock_namelist, ifplot= )

# After finish the function of stage 3, call it and print the final weight:

w_hrp = hrp_s3(Sigma, stock_namelist, sortIx)

print(w_hrp)

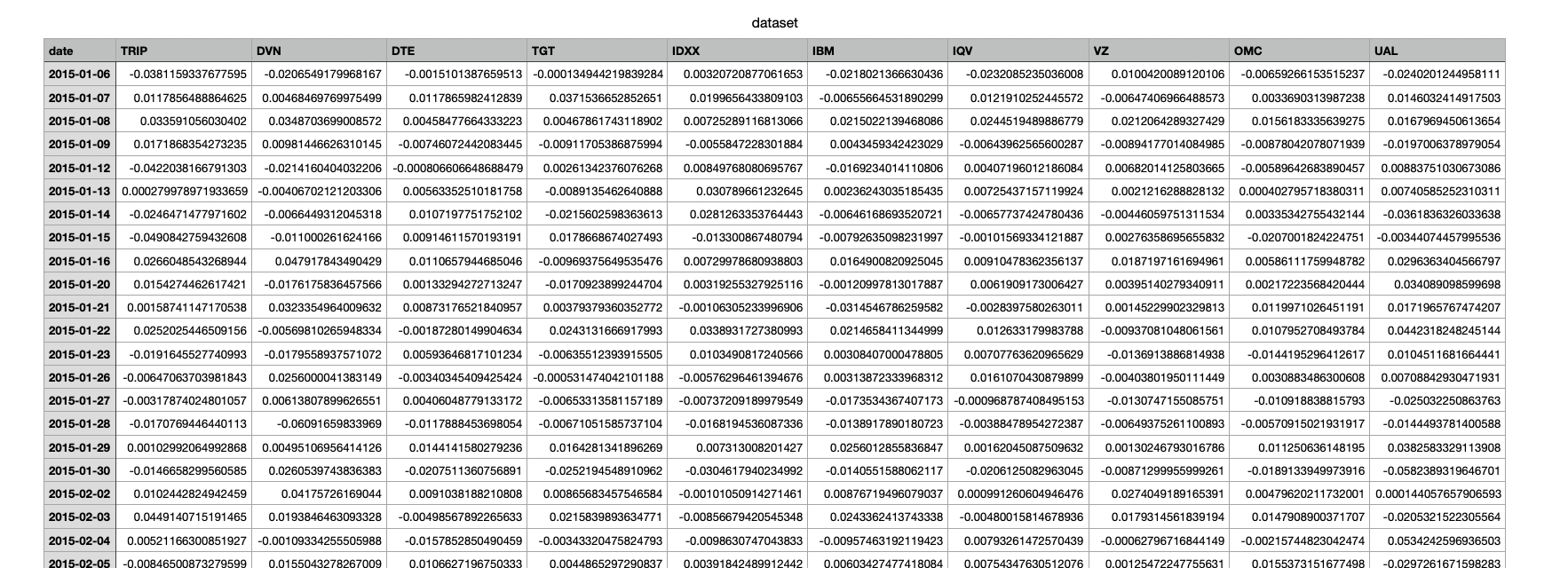

dataset.csv

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started