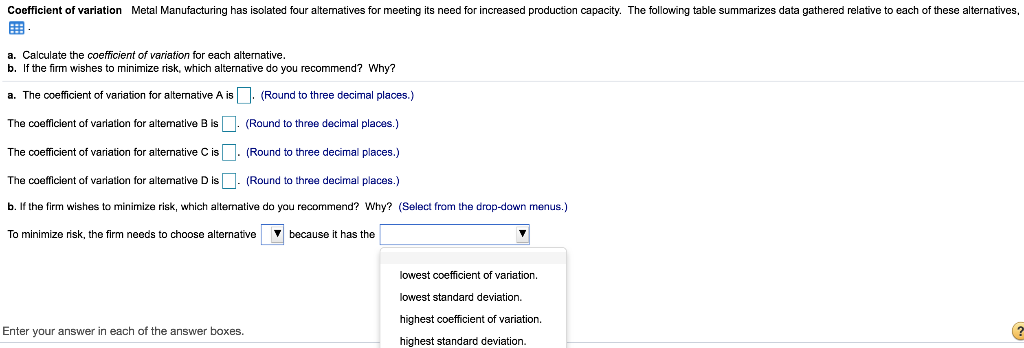

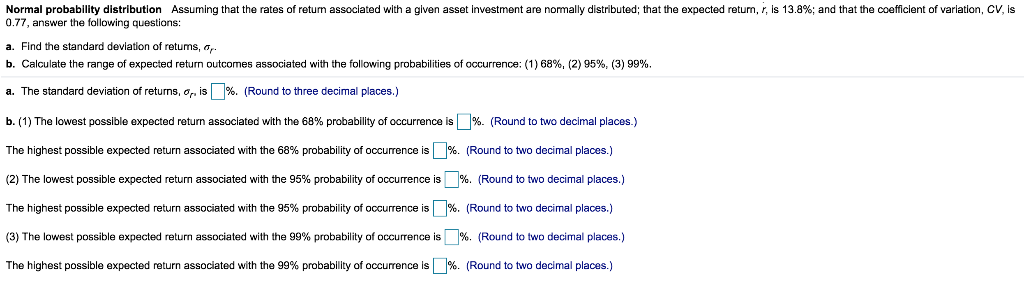

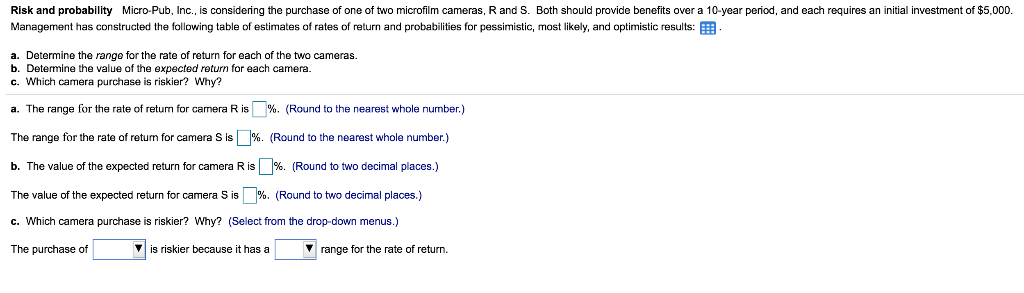

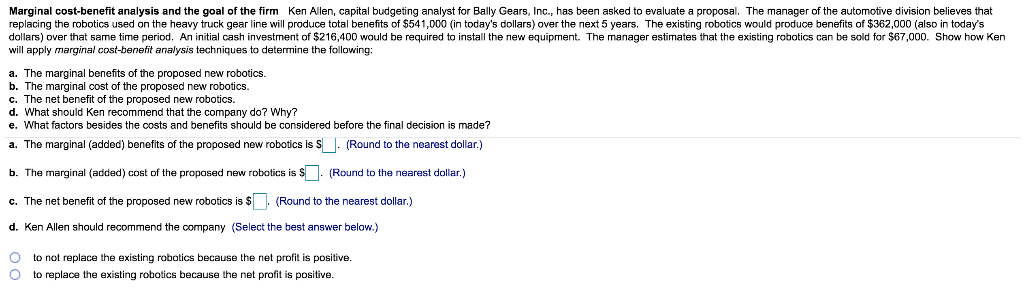

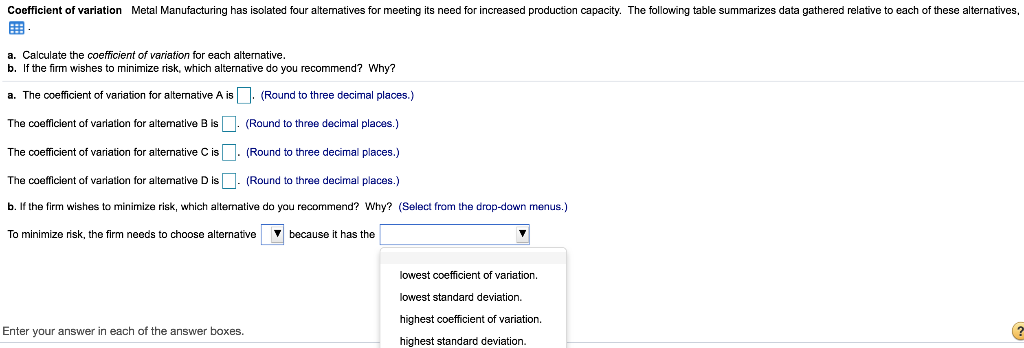

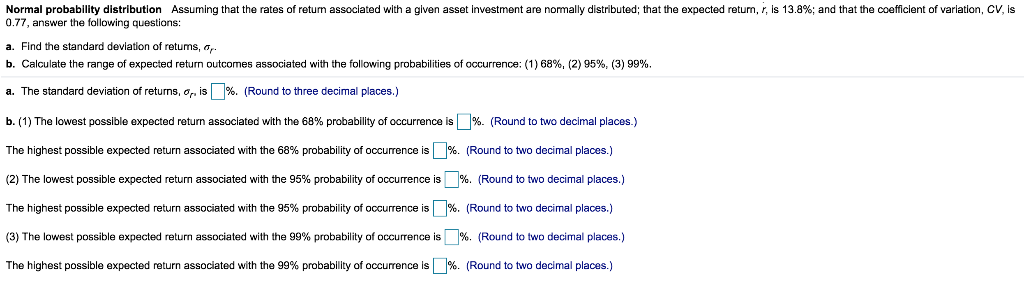

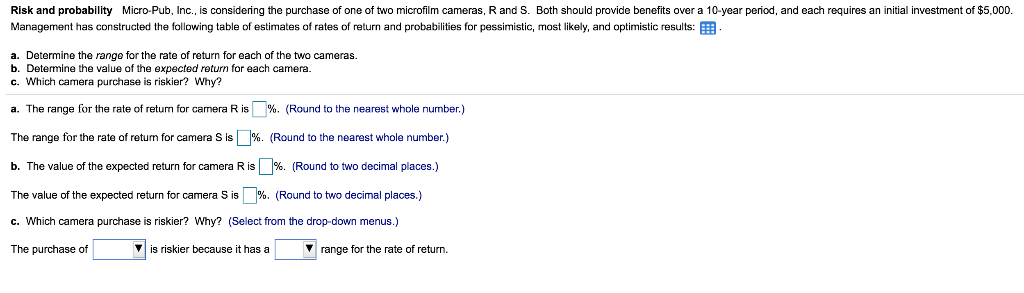

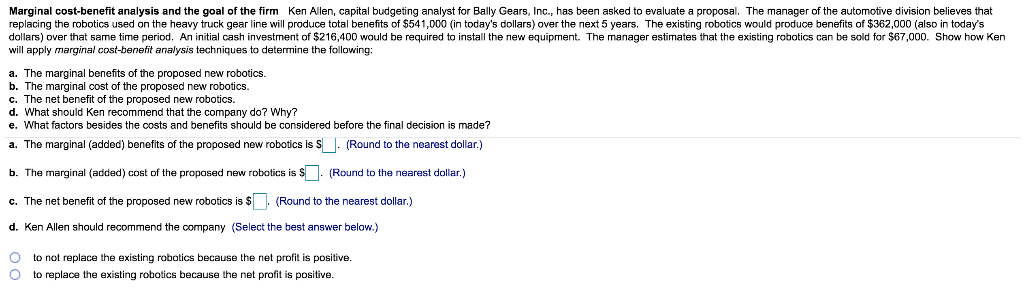

Coefficient of variation Metal Manufacturing has isolated four altematives for meeting its need for increased production capacity. The following table summarizes data gathered relative to each of these alternatives, a. Calculate the coefficient of variation for each alternative b. If the firm wishes to minimize risk, which alternative do you recommend? Why? a. The coefficient of variation for altemative AisD (Round to three decimal places.) The coefficiert of variation for altemative B is (Round to three decimal places.) The coefficient of variation for aitemative C is.(Round to three decimal places.) The coefficient of variation for altemative D is(Round to three decimal places.) b. If the firm wishes to minimize risk, which alternative do you recommend? Why? (Select from the drop-down menus.) To minimize risk, the firm needs to choose alternative because it has the lowest coefficient of variation. lowest standard deviation. highest coefficient of variation highest standard deviation. Enter your answer in each of the answer boxes. Normal probability distribution Assuming that the rates of return assoclated with a given asset investment are normally distributed; that the expected return, r, is 13.8%, and that the coefficient of variation, CV, is 0.77, answer the following questions: a. Find the standard deviation of retums, ,. b. Calculate the range of expected return outcomes associated with the following probabil tes of occurence: 1 68% 2 5 3 99%. a. The standard deviation of returns, r is | |26. (Round to three decimal places.) b 1 The lowest possible expected return associated with the 68% probability of occurrence is % Round to two decimal places The highest possible expected return associated with the 68% probability of occurrence is 2) The lowest possible expected return associated with the 95% probability of occurrence is % Round to two decimal places. The highest possible expected return associated with the 95% probability of occurrence is (3)The lowest possible expected return associated with the 99% probability of occurrence is % Round to two decimal places. The highest possible expected return associated with the 99% probability of occurrence is Round to two decimal places.) Round to two decimal places.) Round to two decimal places.) Risk and probability Micro-Pub, Inc., is considering the purchase of one of two microfilm cameras, R and S. Both should provide benefits over a 10-year period, and each requires an initial investment of $5,000. Management has constructed the following table of estimates of rates of return and probabilities for pessimistic, most likely, and optimistic results: a. Determine the range for the rate of return for each of the two cameras. b. Determine the value of the expected return for each camera. c. Which camera purchase is riskier? Why? for the rate of retum for camera R is % (Round to the nearest whole number.) a. The range The range for the rate of return for camera s is % Round to the nearest whole number b. The value of the expected return for camera R is | %. (Round to two decimal places.) The value of the expected return for camera S is c. Which camera purchase is riskier? Why? (Select from the drop-down menus.) The purchase of (Round to two decimal places.) is riskier because it has a V range for the rate of return. Marginal cost-benefit analysis and the goal of the firm Ken Allen, capital budgeting analyst for Bally Gears, Inc., has been asked to evaluate a proposal. The manager of the automotive division believes that replacing the robotics used on the heavy truck gear line will produce total benefits of $541,000 (in today's dollars) over the next 5 years. The existing robotics would produce benefits of $362,000 (also in today's dollars) over that same time period. An initial cash investment of $216,400 would be required to install the new equipment. The manager estimates that the existing robotics can be sold for $67,000. Show how Ken will apply marginal cost-benefit analysis techniques to determine the following: a. The marginal benefits of the proposed new robotics. b. The marginal cost of the proposed new robotics c. The net benefit of the proposed new robotics d. What should Ken recommend that the company do? Why? e. What factors besides the costs and benefits should be considered before the final decision is made? a. The marginal (added) benefits of the proposed new robotics is s (Round to the nearest dollar.) b. The marginal (added) cost of the proposed new robotics is Round to the nearest dollar.) c. The net benefit of the proposed new robotics is Round to the nearest dollar.) d. Ken Allen should recommend the oompany (Select the best answer below.) O O to not replace the existing robotics because the net profit is positive. to replace the existing robatics because the net profit is positive Coefficient of variation Metal Manufacturing has isolated four altematives for meeting its need for increased production capacity. The following table summarizes data gathered relative to each of these alternatives, a. Calculate the coefficient of variation for each alternative b. If the firm wishes to minimize risk, which alternative do you recommend? Why? a. The coefficient of variation for altemative AisD (Round to three decimal places.) The coefficiert of variation for altemative B is (Round to three decimal places.) The coefficient of variation for aitemative C is.(Round to three decimal places.) The coefficient of variation for altemative D is(Round to three decimal places.) b. If the firm wishes to minimize risk, which alternative do you recommend? Why? (Select from the drop-down menus.) To minimize risk, the firm needs to choose alternative because it has the lowest coefficient of variation. lowest standard deviation. highest coefficient of variation highest standard deviation. Enter your answer in each of the answer boxes. Normal probability distribution Assuming that the rates of return assoclated with a given asset investment are normally distributed; that the expected return, r, is 13.8%, and that the coefficient of variation, CV, is 0.77, answer the following questions: a. Find the standard deviation of retums, ,. b. Calculate the range of expected return outcomes associated with the following probabil tes of occurence: 1 68% 2 5 3 99%. a. The standard deviation of returns, r is | |26. (Round to three decimal places.) b 1 The lowest possible expected return associated with the 68% probability of occurrence is % Round to two decimal places The highest possible expected return associated with the 68% probability of occurrence is 2) The lowest possible expected return associated with the 95% probability of occurrence is % Round to two decimal places. The highest possible expected return associated with the 95% probability of occurrence is (3)The lowest possible expected return associated with the 99% probability of occurrence is % Round to two decimal places. The highest possible expected return associated with the 99% probability of occurrence is Round to two decimal places.) Round to two decimal places.) Round to two decimal places.) Risk and probability Micro-Pub, Inc., is considering the purchase of one of two microfilm cameras, R and S. Both should provide benefits over a 10-year period, and each requires an initial investment of $5,000. Management has constructed the following table of estimates of rates of return and probabilities for pessimistic, most likely, and optimistic results: a. Determine the range for the rate of return for each of the two cameras. b. Determine the value of the expected return for each camera. c. Which camera purchase is riskier? Why? for the rate of retum for camera R is % (Round to the nearest whole number.) a. The range The range for the rate of return for camera s is % Round to the nearest whole number b. The value of the expected return for camera R is | %. (Round to two decimal places.) The value of the expected return for camera S is c. Which camera purchase is riskier? Why? (Select from the drop-down menus.) The purchase of (Round to two decimal places.) is riskier because it has a V range for the rate of return. Marginal cost-benefit analysis and the goal of the firm Ken Allen, capital budgeting analyst for Bally Gears, Inc., has been asked to evaluate a proposal. The manager of the automotive division believes that replacing the robotics used on the heavy truck gear line will produce total benefits of $541,000 (in today's dollars) over the next 5 years. The existing robotics would produce benefits of $362,000 (also in today's dollars) over that same time period. An initial cash investment of $216,400 would be required to install the new equipment. The manager estimates that the existing robotics can be sold for $67,000. Show how Ken will apply marginal cost-benefit analysis techniques to determine the following: a. The marginal benefits of the proposed new robotics. b. The marginal cost of the proposed new robotics c. The net benefit of the proposed new robotics d. What should Ken recommend that the company do? Why? e. What factors besides the costs and benefits should be considered before the final decision is made? a. The marginal (added) benefits of the proposed new robotics is s (Round to the nearest dollar.) b. The marginal (added) cost of the proposed new robotics is Round to the nearest dollar.) c. The net benefit of the proposed new robotics is Round to the nearest dollar.) d. Ken Allen should recommend the oompany (Select the best answer below.) O O to not replace the existing robotics because the net profit is positive. to replace the existing robatics because the net profit is positive