Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Coffee Healthcare Associates (CHA) wants to expand its network of providers in the northwest section of the city to build its referral base for

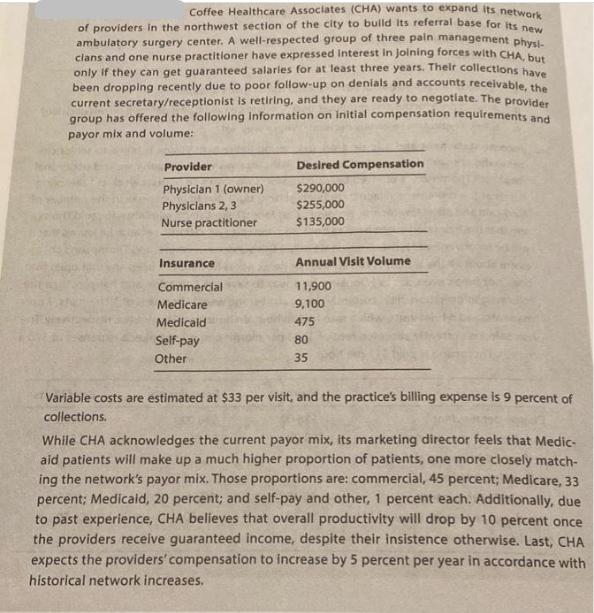

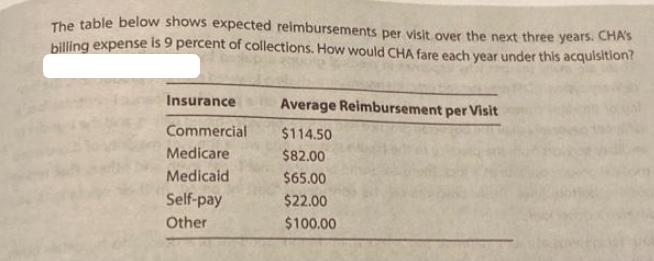

Coffee Healthcare Associates (CHA) wants to expand its network of providers in the northwest section of the city to build its referral base for its new ambulatory surgery center. A well-respected group of three pain management physi- clans and one nurse practitioner have expressed interest in joining forces with CHA, but only if they can get guaranteed salaries for at least three years. Their collections have been dropping recently due to poor follow-up on denials and accounts receivable, the current secretary/receptionist is retiring, and they are ready to negotiate. The provider group has offered the following information on initial compensation requirements and payor mix and volume: Provider Physician 1 (owner) Physicians 2, 3 Nurse practitioner Insurance Commercial Medicare Medicald Self-pay Other Desired Compensation $290,000 $255,000 $135,000 Annual Visit Volume 11,900 9,100 475 80 35 Variable costs are estimated at $33 per visit, and the practice's billing expense is 9 percent of collections. While CHA acknowledges the current payor mix, its marketing director feels that Medic- aid patients will make up a much higher proportion of patients, one more closely match- ing the network's payor mix. Those proportions are: commercial, 45 percent; Medicare, 33 percent; Medicald, 20 percent; and self-pay and other, 1 percent each. Additionally, due to past experience, CHA believes that overall productivity will drop by 10 percent once the providers receive guaranteed income, despite their insistence otherwise. Last, CHA expects the providers' compensation to increase by 5 percent per year in accordance with historical network increases. The table below shows expected reimbursements per visit over the next three years. CHA's billing expense is 9 percent of collections. How would CHA fare each year under this acquisition? Insurance Commercial Medicare Medicaid Self-pay Other Average Reimbursement per Visit $114.50 $82.00 $65.00 $22.00 $100.00

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To analyze CHAs financial performance each year under the acquisition we can calculate the expected revenue variable costs collections and billing exp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started