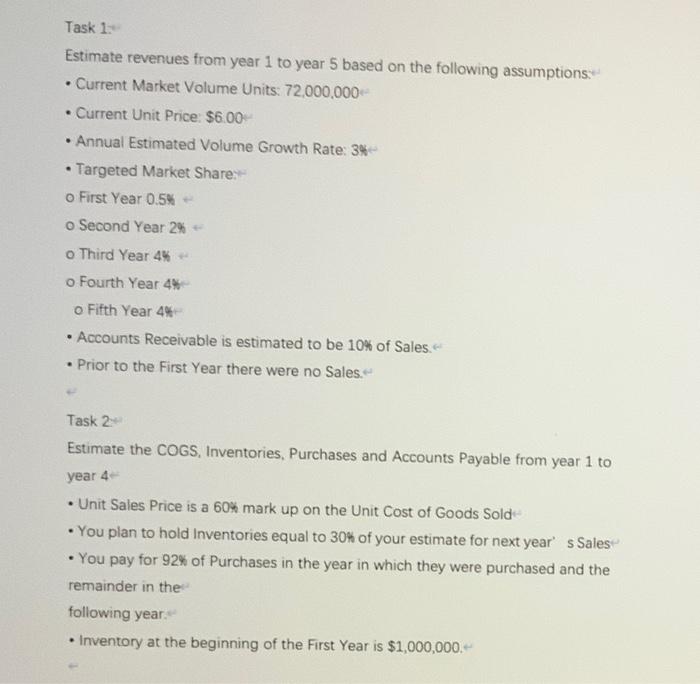

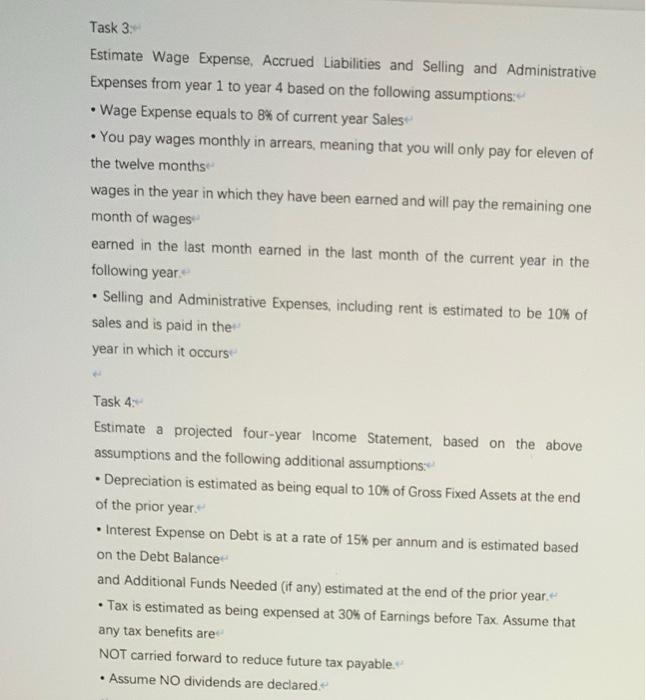

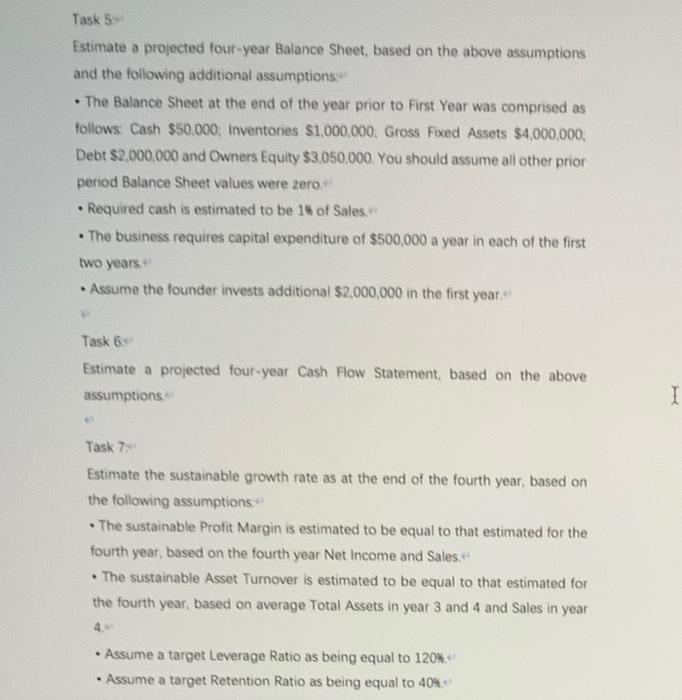

Task 1: Estimate revenues from year 1 to year 5 based on the following assumptions . Current Market Volume Units: 72,000,000 . Current Unit Price: $6.00 Annual Estimated Volume Growth Rate: 34 Targeted Market Share o First Year 0.5% o Second Year 2% o Third Year 4% o Fourth Year 4% o Fifth Year 44 Accounts Receivable is estimated to be 10% of Sales Prior to the First Year there were no Sales Task 2 Estimate the COGS, Inventories, Purchases and Accounts Payable from year 1 to year 4- Unit Sales Price is a 60% mark up on the Unit Cost of Goods Sold . You plan to hold Inventories equal to 30% of your estimate for next year's Sales You pay for 92% of Purchases in the year in which they were purchased and the remainder in the following year. Inventory at the beginning of the First Year is $1,000,000.- Task 3: Estimate Wage Expense, Accrued Liabilities and Selling and Administrative Expenses from year 1 to year 4 based on the following assumptions Wage Expense equals to 8% of current year Sales You pay wages monthly in arrears, meaning that you will only pay for eleven of the twelve months wages in the year in which they have been earned and will pay the remaining one month of wages earned in the last month eamed in the last month of the current year in the following year- Selling and Administrative Expenses, including rent is estimated to be 10% of sales and is paid in the year in which it occurs Task 4- Estimate a projected four-year Income Statement, based on the above assumptions and the following additional assumptions Depreciation is estimated as being equal to 10% of Gross Fixed Assets at the end of the prior years Interest Expense on Debt is at a rate of 15% per annum and is estimated based on the Debt Balance and Additional Funds Needed (if any) estimated at the end of the prior year Tax is estimated as being expensed at 30% of Earnings before Tax Assume that any tax benefits are NOT carried forward to reduce future tax payable Assume NO dividends are declarede . Task 5 Estimate a projected four-year Balance Sheet, based on the above assumptions and the following additional assumptions The Balance Sheet at the end of the year prior to First Year was comprised as follows: Cash $50.000: Inventories $1,000,000, Gross Fixed Assets $4,000,000 Debt $2,000,000 and Owners Equity $3,050,000. You should assume all other prior period Balance Sheet values were zero Required cash is estimated to be 18 of Sales The business requires capital expenditure of $500,000 a year in each of the first two years. Assume the founder invests additional $2,000,000 in the first year Task 6 Estimate a projected four-year Cash Flow Statement, based on the above assumptions I Task 7 Estimate the sustainable growth rate as at the end of the fourth year, based on the following assumptions The sustainable Profit Margin is estimated to be equal to that estimated for the fourth year, based on the fourth year Net Income and Sales The sustainable Asset Turnover is estimated to be equal to that estimated for the fourth year, based on average Total Assets in year 3 and 4 and Sales in year Assume a target Leverage Ratio as being equal to 120% Assume a target Retention Ratio as being equal to 40%